XRP ETF Holdings Explode to $1.71 Billion in January—So Why Isn’t the Price Reacting?

Institutional money is piling into XRP exchange-traded funds at a staggering clip—$1.71 billion worth in January alone. The inflows are massive, undeniable, and yet the token's price action remains curiously muted. It's a classic crypto conundrum: the smart money shows up, but the party hasn't started.

The Institutional Stampede

Forget retail FOMO. This is a whale-sized move. That $1.71 billion figure represents a wall of institutional capital voting with its wallet, betting on XRP's long-term utility beyond the courtroom drama. These aren't day traders; they're funds building positions, often a precursor to major price discovery.

The Price Disconnect

Here's where it gets interesting—and a bit frustrating for holders. Traditional finance logic says this much buying pressure should lift the asset. In crypto? Sometimes the tape lags. The market might be digesting the supply, or waiting for a clearer regulatory catalyst. Or maybe the traditional finance playbook just doesn't apply here—a thought that would make any Wall Street quant shudder.

The Waiting Game

All that dry powder sitting in ETFs is potential energy. It represents future buying that isn't hitting spot exchanges yet. When—or if—that capital gets deployed into the underlying asset, the mechanics could trigger a significant revaluation. Until then, it's a bullish bet sitting on the sidelines.

The Cynical Take

Let's be real for a second. This is the same industry that charges you 2% a year to hold a digital asset that was designed to bypass… well, them. The irony of traditional finance packaging a decentralized asset into a fee-generating wrapper isn't lost on anyone paying attention.

The bottom line? The institutional vote of confidence is in. The money is on the books. Now we see if the market finally decides to read the memo.

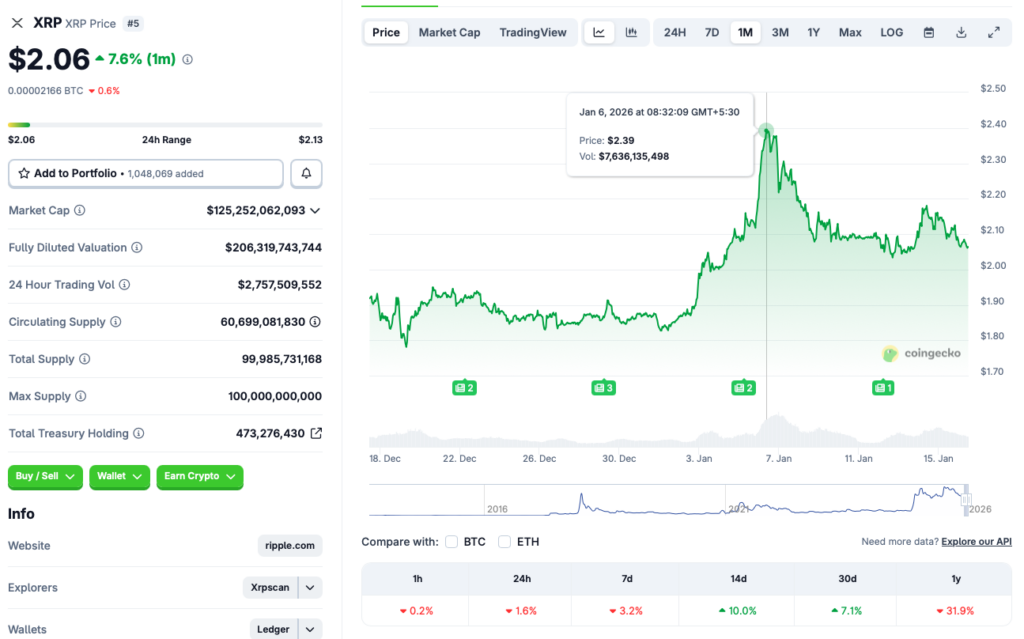

Source: CoinGecko

Source: CoinGecko

Can Increased ETF Inflows Push XRP’s Price To $3 in January 2026?

ETF inflows played a key role in the 2025 market cycle. Bitcoin (BTC) and ethereum (ETH) climbed to new peaks last year thanks to a surge in ETF purchases. XRP could see a similar trend this year. However, whether the asset breaches the $3 mark in January or not, is unclear. XRP last traded above the $3 mark in July 2025, when it climbed to a new all-time high of $3.65. Since July, XRP’s price has seen a gradual decline.

While ETF inflows play a role in the underlying asset’s price, some assets may take longer than others to rally. Ethereum (ETH), for example, did not see any positive price movements arising from its ETF launch in 2024 until a year later. There is a possibility XRP could also see a delayed reaction to its ETF products.

Nonetheless, XRP has been named the “hottest crypto trade of 2026” by CNBC. Many experts anticipate the asset to see record inflows over the coming months. While the larger bearish market tone may be presenting challenges to the asset, we could see a trend reversal once the larger economy cools down.