VanEck Predicts Bitcoin Is Near Its Bottom: Is a Major Reversal Incoming?

Bitcoin's brutal sell-off might finally be running out of steam. Investment giant VanEck just flashed a signal that's got the crypto world buzzing: the bottom could be in sight.

Reading the Charts: More Than Just Hope?

VanEck's analysis isn't based on gut feeling. Their team is digging into on-chain metrics and historical patterns that have signaled major turning points before. They're seeing capitulation—that final wave of panic selling from weak hands—which often cleanses the market and sets the stage for the next leg up. It's the classic 'blood in the streets' moment that veteran traders watch for.

The Mechanics of a Market Floor

So what makes a bottom? It's when selling pressure evaporates because everyone who wanted out has finally left. Liquidity dries up, volatility can spike on low volume, and the price action gets messy. That's when the real accumulation begins, quietly, under the radar. The big players start scooping up assets while the mainstream narrative is still stuck on fear—a timeless dance in finance, whether you're trading tulips or tokens.

What Comes After the Bounce?

A reversal isn't just a dead-cat bounce. For it to stick, Bitcoin needs to reclaim key technical levels and, more importantly, see sustained buying from both institutions and retail. The macro environment will play its part too. Will inflation data cooperate? Will the Fed's next move be a tailwind or a headwind? Crypto never trades in a vacuum, no matter how much its maxis wish it would.

The Bigger Picture: A Test of Conviction

This potential inflection point is more than a trading opportunity. It's a stress test for the entire 'digital gold' thesis. If Bitcoin finds its footing here and rallies, it reinforces its resilience as a non-correlated asset. If it fails, the bears will have a field day. One cynical take? The traditional finance giants calling the bottom probably already have their orders in—nothing like talking your book while sounding like an oracle.

The countdown is on. Either VanEck has spotted the turning point, or we're in for another lesson in humility. In crypto, the only certainty is volatility.

Is Bitcoin Entering a Price Reversal Phase?

VanEck is not the only institution with an optimistic outlook for bitcoin (BTC). Grayscale and Bernstein also anticipate BTC to break out in 2026. Both Grayscale and Bernstein claim that BTC may be following a 5-year cycle, instead of its regular 4-year path. This means that Bitcoin (BTC) could climb to a new all-time high in 2026, five years after its 2021 peak. Bernstein anticipates BTC to hit $150,000 in 2026 and $200,000 in 2027.

While VanEck, Grayscale, and Bernstein present bullish outlooks for Bitcoin (BTC), Barclays, on the other hand, is quite pessimistic about the 2026 crypto market. Barclays anticipates the crypto sector to face additional struggles next year. The financial institution cites low spot trading volumes and low demand for its bearish outlook.

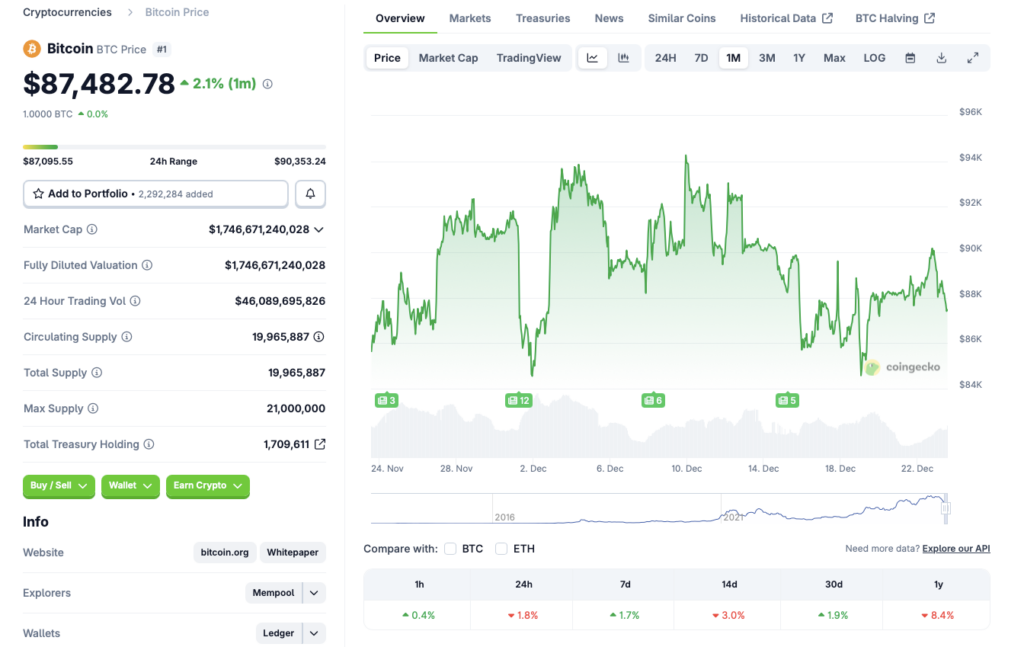

The crypto market has struggled to gain momentum over the last few months, despite two interest rate cuts since October. Bitcoin (BTC) is currently facing substantial resistance at the $90,000 level. The current market scenario is attributed to macroeconomic uncertainties. Market participants seem to be taking a risk-off approach. The development is further strengthened by growing gold and silver prices. Bitcoin (BTC) may continue its lackluster path until economic conditions improve. According to CoinGecko’s BTC data, the original crypto has seen a 1.7% rally in the weekly charts and a 1.9% rally over the previous month. However, BTC is still down by 1.8% in the daily charts, 3% in the 14-day charts, and 8.4% sicne December 2024.