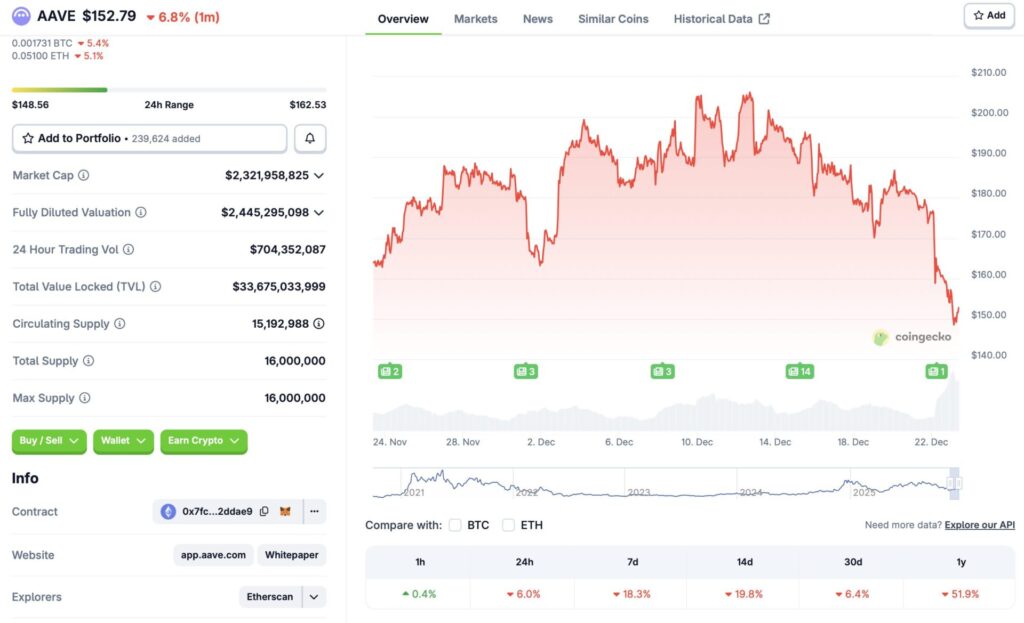

AAVE Plunges 10% Following $38 Million Whale Exodus

Whale-sized selling pressure just sent shockwaves through the DeFi sector.

A single massive transaction—dumping $38 million worth of AAVE tokens—triggered a rapid 10% price collapse. The move highlights the outsized influence large holders still wield in crypto markets, where one wallet can still move the needle for an entire protocol.

The Anatomy of a Flash Crash

This wasn't a slow bleed. Charts show a near-vertical drop as the sell order hit the books, liquidating leveraged positions and sparking a classic fear cascade. It's a stark reminder that in DeFi, liquidity can vanish faster than a trader's confidence when a whale decides to swim elsewhere.

DeFi's Double-Edged Sword

The very permissionless nature that makes DeFi revolutionary also makes it vulnerable to these sudden, concentrated sell-offs. There's no circuit breaker, no centralized authority to halt trading—just pure, unadulterated market mechanics. For believers, it's a feature. For everyone else watching their portfolio flash red, it feels a lot like a bug.

While the long-term thesis for decentralized lending remains intact, episodes like this serve as a cold splash of reality. It's the financial market equivalent of a stress test, revealing both resilience and fragility in real-time. Sometimes, the market doesn't need a macroeconomic catalyst—just one person with a very large bag and an even larger sell button.

Remember: in crypto, 'whale watching' isn't a hobby; it's a survival skill. And today, one whale just reminded the entire pond who's biggest.

Source: CoinGecko

Source: CoinGecko

Will AAVE Recover From Its Price Crash?

AAVE’s ongoing downtrend comes amid a larger bear market. Bitcoin (BTC) has fallen below the $88,000 mark, and most other assets are following BTC’s trajectory. Macroeconomic uncertainties most likely led to the market-wide correction. Although the Federal Reserve has rolled out two interest rate cuts since October, investors continue to take a risk-averse approach. The development is strange, given that investors usually take on more risks after interest rate cuts.

AAVE is also going through a power struggle, which may have further added to its woes. The Aave Dao is protesting against Aave Labs for diverting revenue without its permission. The rift between the two groups has led to substantial worry among investors. DeFi protocols should follow a fixed set of rules. Pivoting from the norm could spell disaster for the project.

AAVE’s recovery will most likely depend on the larger crypto market. Market participants are staying away from risky assets, and the crypto market will likely not rally unless that sentiment changes. Macroeconomic uncertainties also have to cool down before the crypto market can make a move. Many anticipate the market to rebound in 2026, with many anticipating Bitcoin (BTC) to hit a new all-time high. BTC hitting a new peak could trigger another market-wide rally.