Shiba Inu’s 66% Crash In 1 Year: Should You Worry?

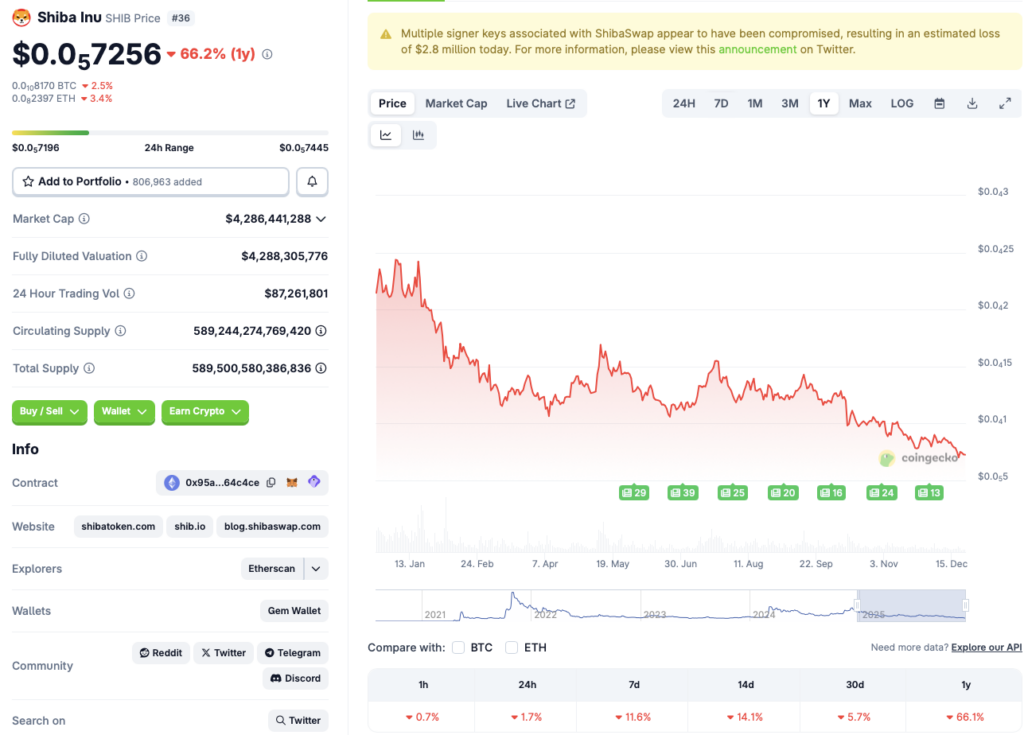

Memecoins bleed while the crypto winter deepens. Shiba Inu's staggering 66% plunge over the past year has investors scrambling—is this the end of the dog-themed rally, or just another brutal correction in a notoriously volatile asset class?

The Anatomy of a Memecoin Meltdown

Forget the "to the moon" hype. A 66% haircut in twelve months cuts through the noise, exposing the raw mechanics of speculative mania. This isn't a gentle dip; it's a full-scale retreat from peak euphoria. The numbers tell a story of momentum shattered and paper gains vaporized.

Decoding the Dog Days

What drives a token to shed two-thirds of its value? Look beyond the cute mascot. It's a cocktail of macroeconomic headwinds, shifting risk appetite, and the inevitable gravity that follows any parabolic run-up. When liquidity tightens, the most speculative bets are always first on the chopping block—a lesson traditional finance loves to ignore until the next bubble pops.

To Hold or To Fold?

The real question isn't about the past drop, but the future path. Is this a buying opportunity for the brave, or a warning siren to exit stage left? Every crash plants seeds for the next rally, but only for assets with staying power beyond social media trends. Separating signal from noise requires looking past the fear, and maybe past the asset altogether.

Volatility isn't a bug in crypto; it's the main feature. A 66% crash is just another Tuesday for veterans, but a brutal wake-up call for those who confused a meme-fueled rocket ship with a stable store of value. In the end, only your risk tolerance and conviction can decide if this is a disaster or a discount—just remember, in this market, the only guarantee is more drama.

Source: CoinGecko

Source: CoinGecko

How Soon Can Shiba Inu Recover From Its Price Crash?

Shiba Inu’s (SHIB) price trajectory most likely depends on Bitcoin (BTC). Bitcoin (BTC) is the market leader, and other assets will likely not rally unless BTC makes a move. BTC’s path, on the other hand, is dependent on macroeconomic factors. Economic uncertainties have had detrimental effects on the crypto market. Investors are most probably moving their funds to safe havens, such as gold and silver. Gold and silver climbing to new all-time highs is a signal that market participants are taking a risk-averse approach.

Shiba Inu (SHIB) is a memecoin and carries some of the highest risks among financial assets. Given that investors are moving away from risky assets, SHIB’s price may continue to struggle over the coming months. However, things could get better when macroeconomic conditions improve. Many anticipate Bitcoin (BTC) to climb to a new all-time high in 2026. BTC hitting a new peak could lead to Shiba Inu (SHIB) generating significant steam.