Bitcoin’s $90,000 Reclamation Bid: Is This the Final Push?

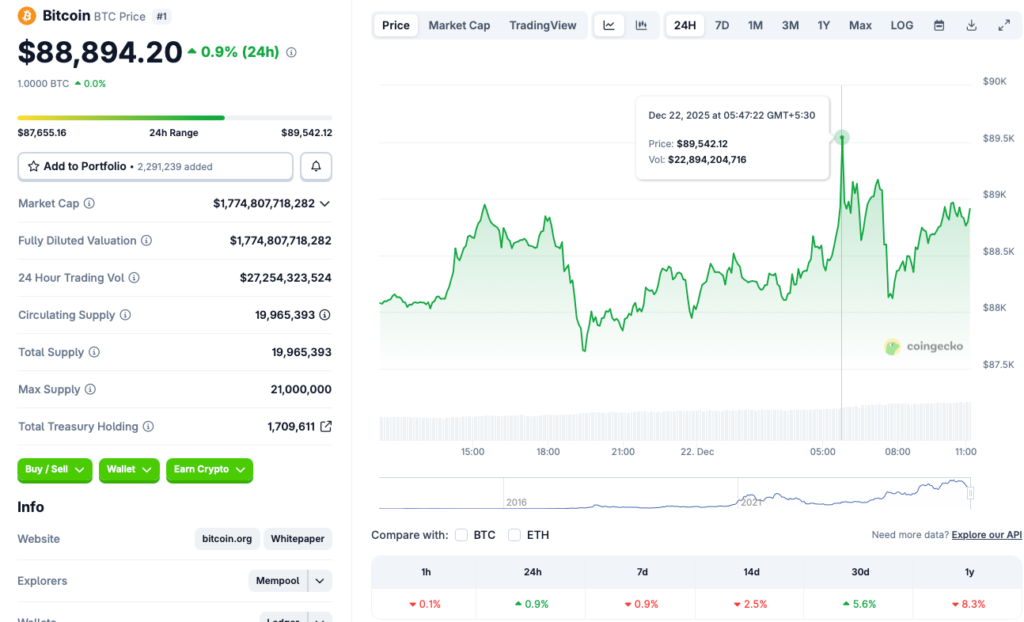

Bitcoin is knocking on the door of a major psychological threshold. The $90,000 level isn't just another number—it's a battleground where market sentiment and technical resistance collide.

The Setup: A Technical Crucible

After a period of consolidation, the king of crypto is making another run. The charts show a clear pattern of higher lows, but that formidable $90,000 ceiling has proven stubborn. Each attempt paints a clearer picture of where institutional buy walls meet retail profit-taking.

Market Mechanics in Play

Forget the hopium. This move hinges on real factors: spot ETF flows, on-chain accumulation by long-term holders, and a macro environment that still treats digital gold as a risk asset—when it's convenient for traditional portfolio managers, of course. Liquidity above this level is thin, meaning a successful breakout could trigger a swift move higher as shorts get squeezed.

The Verdict: Momentum vs. Gravity

Will it reclaim the level? The momentum is there, but so is the weight of expectation. A clean break and hold above $90,000 opens the path toward six figures. A rejection here, however, sets the stage for another frustrating range—proving once again that crypto markets love to maximize pain for the greatest number of participants, especially those watching from their Bloomberg terminals.

Source: CoinGecko

Source: CoinGecko

Can Bitcoin (BTC) Reclaim $90,000 Before 2026 Starts?

BTC has been on a bearish path since hitting an all-time high of $126,000 in October. October is historically a bullish month, but 2025 seems to have taken a different path. The downtrend started after the Federal Reserve rolled out an interest rate cut in October, another bullish development. However, the market responded bearishly as investors did not anticipate another rate cut in 2025. Things turned around in December, as the Federal Reserve announced yet another interest rate cut. Bitcoin (BTC) and the larger crypto market remained bearish even after the December rate cut. The current lackluster performance is likely due to macroeconomic uncertainties.

It is unclear if bitcoin (BTC) will enter a rally anytime soon. Market participants seem to be diverting their funds into safe havens such as gold and silver, both of which have hit new peaks. Gold and silver hitting new all-time highs could be a signal that investors are not interested in risky assets, such as cryptocurrencies, at the moment.

However, things could change very soon. The crypto market could see increased inflows, and Bitcoin (BTC) could reclaim the $90,000 price level by early 2026.