ChatGPT Predicts: One Single Asset Will Dominate US Markets by 2026 - What Is It?

Forget the noise. One digital asset is poised to swallow the market whole by 2026, according to AI analysis. The prediction cuts through the clutter of thousands of tokens, pointing to a singular winner.

The AI's Pick

ChatGPT's forecast bypasses traditional equity analysis, focusing instead on network effects, adoption velocity, and regulatory moats. It's not about a stock or a bond—it's a digital protocol eating the world.

Why This One?

Mass institutional onboarding, clearer regulatory frameworks, and a developer ecosystem that dwarfs the competition create an unstoppable flywheel. The asset doesn't just grow—it consolidates entire sectors under its banner.

Market Implications

This dominance reshapes portfolio construction. Financial advisors, who once scoffed, now scramble to allocate—a classic case of chasing performance after the real gains are made. The prediction suggests a winner-take-most outcome that leaves other assets fighting for scraps.

The final analysis is blunt: by 2026, one asset won't just lead the market—it will define it. Everything else is just a speculative bet on second place.

GPT Predicts: The Leading Asset Of 2026

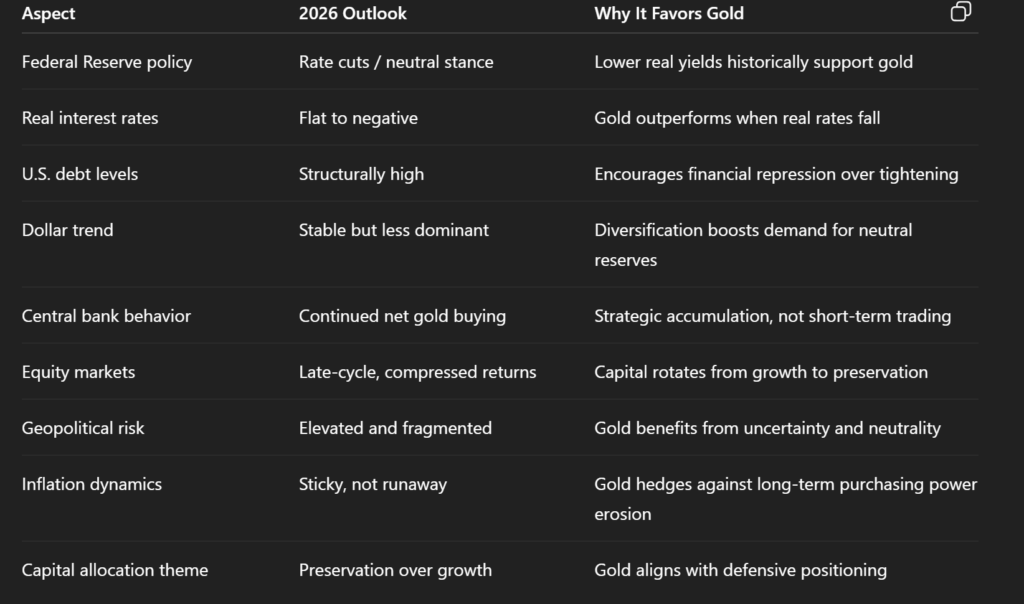

With crypto, stocks, and metals stealing the limelight in 2025, GPT believes 2026 could be the year when Gold trends dominate the US markets extensively. Gold is currently sitting at a high mark of $4350, eyeing $4500 in a new price surge.

Per GPT, the Fed may continue to cut rates in 2026, which may help gold rise higher on the radar. In addition to this, US debt structuring costs are now becoming heavy, which again benefits gold in its entirety. The platform also shared how central bank gold accumulation sprees may play an elemental role in popularizing the asset, with stock frenzy eventually subsiding and shifting attention towards gold.

Silver Is Also Gaining Widespread Momentum

With gold projected as the ultimate leading asset of 2026, silver prices are also up for a haul, as commercial demand for the asset keeps on rising steadily.

If this is indeed the unraveling of the decades-long silver paper price suppression…

then the silver price will NOT behave like in previous cycles and collapse, but will stay at elevated price levels to be determined by a truly free market based on real physical supply and… pic.twitter.com/RaMxViegZV