Bitcoin Whales Gobble Up $23 Billion Dip in 30 Days—Here’s Why It Matters

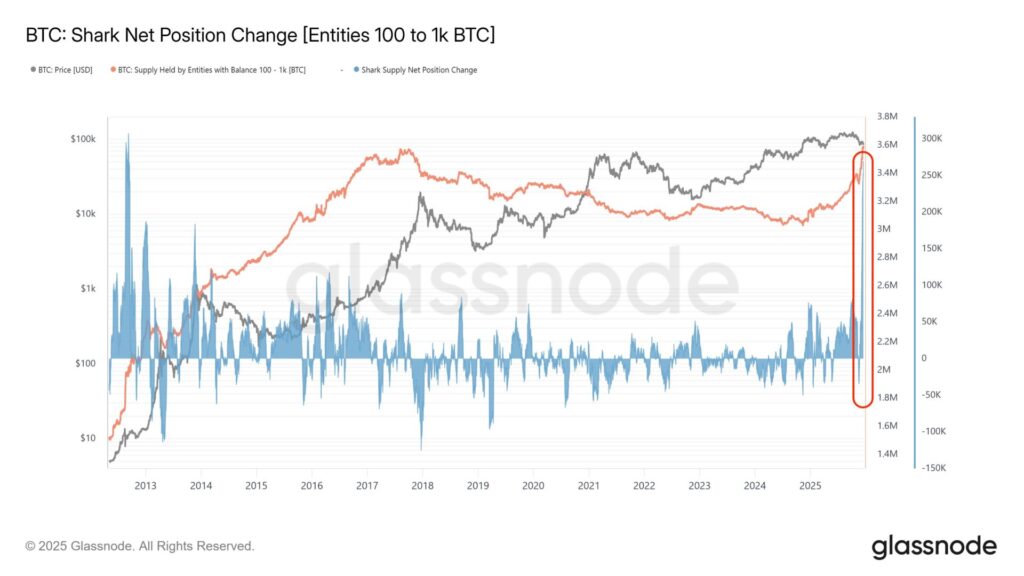

When Bitcoin stumbles, the giants don't panic—they pounce. A seismic $23 billion has flowed from sidelines to wallets in just one month, signaling a colossal vote of confidence from crypto's most powerful players.

The Whale Watch Is On

Forget retail FOMO. This is institutional accumulation on a scale that rattles traditional finance desks. These aren't speculative day traders; they're entities moving capital with the subtlety of a freight train, buying assets others fear to touch. It's the ultimate contrarian play—backing up the truck when headlines scream caution.

Decoding the $23 Billion Signal

That number isn't just a statistic; it's a market-moving event. It represents a foundational shift in ownership, concentrating Bitcoin in hands that rarely sell on whim. This kind of accumulation historically precedes significant price inflection points, creating a supply squeeze that leaves latecomers scrambling. While pundits debate the 'why,' the 'what' is clear: deep-pocketed conviction is building.

A Cynical Nod to Wall Street

Meanwhile, traditional fund managers are still drafting their third round of 'crypto feasibility studies'—a classic case of over-analysis paralysis while the digital future gets bought out from under them.

The takeaway? The smart money isn't waiting for permission or perfect conditions. It's executing. This whale activity cuts through the noise, bypasses short-term sentiment, and lays a billion-dollar bet on Bitcoin's next chapter. Watch where the capital flows, not where the headlines point.

Source: Glassnode

Source: Glassnode

Will Whale Purchases Push Bitcoin’s Price?

Whale movements are a key driver for Bitcoin’s (BTC) price. Large wallets seem to be buying the dip, which could signal an incoming trend reversal. Many industry experts anticipate BTC’s price to take off in 2026. Grayscale believes BTC has diverged from its 4-year cycle and now follows a 5-year path. This means that BTC could climb to a new peak in 2026. Other factors that could push BTC’s price include lower interest rates and pro-crypto legislation in the US.

Bernstein also presents a similar outlook for bitcoin (BTC). According to the financial institution, BTC will breach the $150,000 mark in 2026 and eventually hit $200,000 in 2027. Berntein also believes BTC is currently following a 5-year cycle.

While Grayscale and Bernstein are optimistic in their 2026 outlook, Barclays presents a rather bearish prediction. Barclays believes the crypto market will face further challenges in 2026. The firm cites decreased spot trading volumes and low demand for its bearish outlook.

It is unclear how the crypto market will behave in the coming months. Macroeconomic factors, such as slow economic growth and high jobs figures, may lead to prolonged market bearishness. However, if inflation numbers go down, the crypto market may see renewed interest. Currently, investors are pouring funds into risk-free assets, such as gold and silver. This trend could change over the coming months.