Bitcoin’s Final Move of 2025: How High or How Low Can BTC Go?

Bitcoin's 2025 endgame is here—and the stakes couldn't be higher. Will the king of crypto surge to new heights or face a brutal correction? The market holds its breath.

The Bull Case: Scaling the Summit

Institutional adoption isn't just a buzzword anymore—it's a tidal wave. Spot ETFs have opened the floodgates for traditional capital, while whispers of central bank digital currency integration grow louder. The supply shock narrative is back with a vengeance, fueled by the ever-tightening halving mechanics. Technically, breaking past key resistance levels could trigger a parabolic move that leaves even the most optimistic forecasts in the dust. Forget predicting the top; the question becomes how fast the market can absorb the incoming liquidity.

The Bear Trap: Navigating the Chasm

But let's not ignore the cliff's edge. Macroeconomic headwinds—stubborn inflation, hawkish central banks—threaten to suck risk capital out of the system. Regulatory overhang remains a sword of Damocles, with global watchdogs still figuring out how to handle this digital beast. And then there's the market's own psychology: extreme greed indicators flashing, leverage piling up in the derivatives markets. A single black swan event could unravel months of gains in a classic 'sell the news' frenzy that would make even seasoned traders wince.

The Final Verdict: Volatility is the Only Guarantee

One thing's certain: Bitcoin doesn't do quiet exits. Its final 2025 move will be a masterclass in volatility, likely swinging between euphoric breakout attempts and gut-wrenching liquidations. The narrative will shift daily—from digital gold to risky tech stock, sometimes within the same trading session. For all the sophisticated models and analyst predictions, price discovery in an unregulated, global, 24/7 market remains gloriously chaotic. In the end, Bitcoin's final move may simply remind everyone that in crypto, the only free lunch is the adrenaline rush—and the occasional cynical jab at traditional finance's sluggish, fee-heavy machinery.

Bitcoin: New Insights Emerging

Bitcoin’s latest price plunge has taken the market by surprise. The asset is currently being heavily battered by a series of US macro developments, weighing down the domain. However, many experts have long been calling dips temporary gifts, perhaps small opportunistic windows for smart money to hodl more.

TOM LEE SAYS $ETH AND $BTC BEST YEARS OF GROWTH ARE AHEAD

Lee believes that the current dip is engineered liquidation— not a problem with fundamentals.

He also says it WOULD be ideal if prices bleed a little lower.

Smart money keeps buying the blood. pic.twitter.com/MoYi8pf6Xl

The experts like Tom Lee are quite bullish on Bitcoin, stating how its momentum ought to change soon. Lee predicted a massive high for Bitcoin, sharing how the asset is primed to hit $180K by the end of January 2026.

NEW: Tom Lee says he is optimistic that Bitcoin can double in price to $180,000 before the end of January and that if Bitcoin breaks $125,000 the 4 year cycle is broken. pic.twitter.com/yMRgrpWMEy

— The ₿itcoin Therapist (@TheBTCTherapist) December 16, 2025The Real Price: Technical Insights

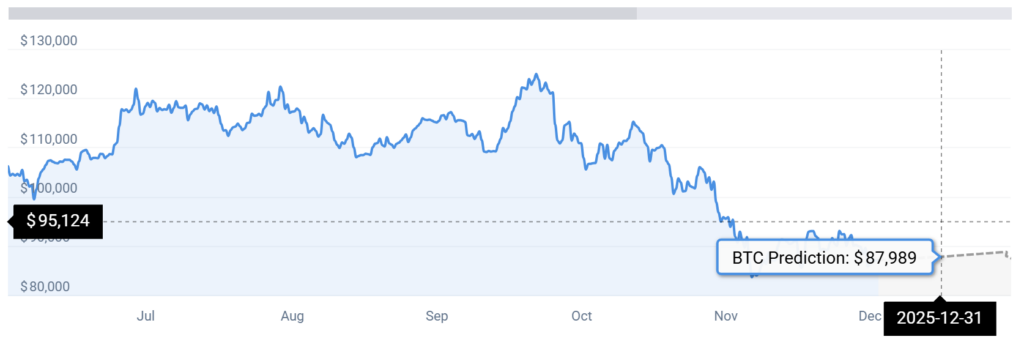

According to CoinCodex BTC stats, bitcoin may surge to sit at $88K before the year’s end.

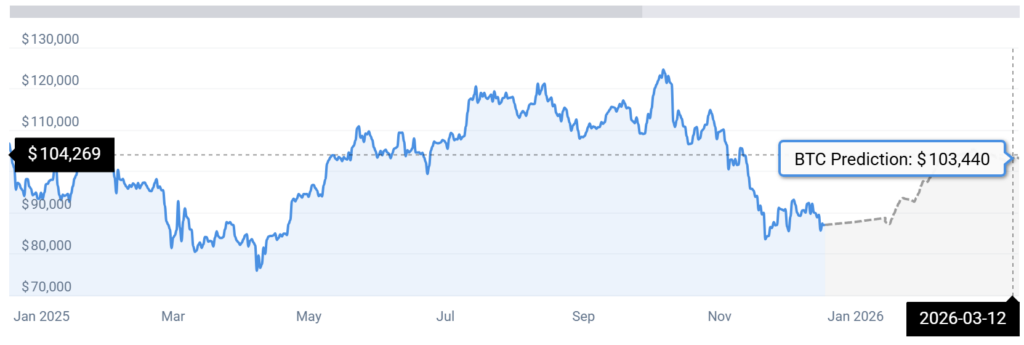

Moreover, CC adds how the token may ultimately hit the $103K mark by March 2025.