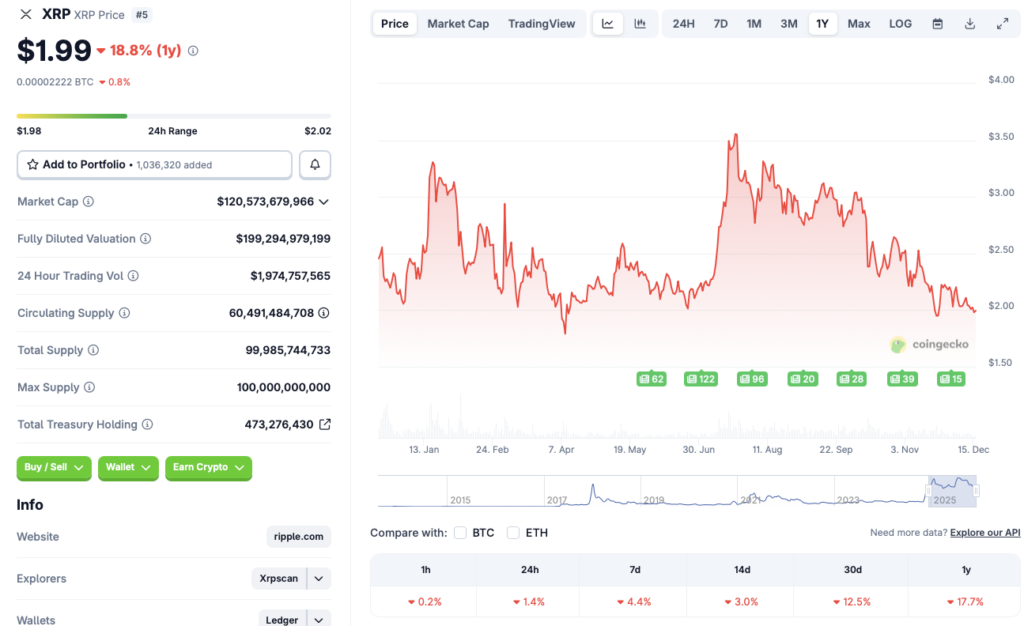

XRP Plunges Below $2 Despite Massive ETF Inflows—Is a Rebound Imminent?

XRP just crashed through the $2 floor—and the timing couldn't be more ironic. Billions are pouring into crypto ETFs, but the digital asset is taking a nosedive. What gives?

ETF Inflows Can't Stop the Bleed

Strong ETF inflows usually signal institutional confidence. Yet here we are, watching XRP tumble while the money faucet stays wide open. It's a classic case of Wall Street throwing cash at a problem and hoping it sticks—sometimes the market just does its own thing.

The Technical Breakdown

Breaking below $2 isn't just a psychological blow; it's a technical red flag. Support levels are crumbling, and the charts are flashing warning signs. This isn't a gentle dip—it's a full-scale retreat.

Catalysts for a Comeback

History shows crypto loves a dramatic rebound. With ETF money still flooding in and volatility being the industry's middle name, a sharp reversal wouldn't surprise anyone. The real question is timing—and whether traders have the stomach to buy the dip.

Bottom Line: Watch the Flow

ETF inflows are the tide, but not every boat rises. If the institutional money starts targeting XRP specifically, we could see fireworks. Until then? It's another day in crypto—where fundamentals sometimes take a backseat to pure, unadulterated speculation.

Source: CoinGecko

Source: CoinGecko

XRP’s Price Fall Below $2 Could Be The Last Straw

While XRP’s price is struggling to gain momentum, the ETF products based on the asset have seen consistent inflows. XRP ETFs have seen inflows for 30 consecutive days. The funds have seen about $990 million in net inflows, with more than $1 billion in assets. Bitcoin (BTC) and ethereum (ETH) ETFs, on the other hand, are seeing quite the opposite.

![]() XRP ETF INFLOWS HIT 30 DAYS STRAIGHT!

XRP ETF INFLOWS HIT 30 DAYS STRAIGHT!

U.S. spot $XRP ETFs have logged 30 straight days of inflows since launch, while $BTC and $ETH struggle with outflows.

XRP ETFs now have accumulated about $990.9M in net inflows, with total net assets at $1.18B. pic.twitter.com/oZebpr3TzF

ETF inflows have been a key driver in the 2025 market cycle. BTC and ETH have hit new all-time highs, thanks to consistent ETF inflows. XRP may see a similar pattern over the coming weeks.

Moreover, many anticipate Bitcoin (BTC) to hit a new all-time high in 2026. Bernstein predicts BTC to hit the $150,000 mark next year and breach the $200,000 mark in 2027. Grayscale also anticipates BTC to hit a new high in 2026. Both financial institutions claim BTC has pivoted from its 4-year cycle, and it now follows a 5-year trajectory. BTC hitting a new peak will likely lead to a price surge for XRP as well.

While Bernstein and Grayscale present bullish outlooks for the crypto market, Barclays is quite pessimistic. Barclays’ analysts say that the crypto market could face challenges in 2026. The firm cites low trading volume and weak demand for its claims. Such a scenario could lead to XRP’s price falling further.