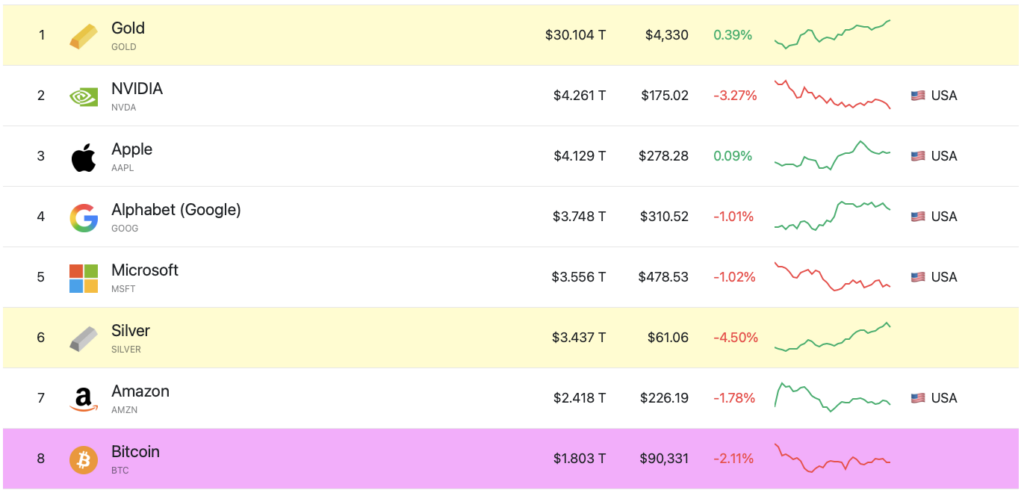

Silver Surges Past Bitcoin and Amazon in Market Cap Showdown

Silver just pulled off a market cap coup—leaving both Bitcoin and Amazon in the dust. The precious metal's valuation has officially eclipsed two of the modern era's most iconic assets, flipping the script on what constitutes 'value' in today's markets.

The New Heavyweight

Forget digital gold versus physical gold—this is about an age-old commodity staging a comeback so fierce it's outrunning the tech and crypto giants. Silver's market cap leap isn't just a blip; it's a statement. While Bitcoin bulls tout digital scarcity and Amazon dominates commerce, silver's surge whispers a reminder: sometimes the old guards still have the heaviest fists.

What's Driving the Shine?

The move highlights a tectonic shift in capital flows—one that often gets lost in the daily crypto charts and earnings reports. It's a classic, almost cynical, finance play: when uncertainty bites, the shiny, physical stuff still gets the nod. While algorithms trade digital tokens and e-commerce empires expand, a chunk of big money is parking itself in something you can literally hold. Go figure.

A Wake-Up Call for Asset Narratives

This isn't just about silver. It's a reality check for every asset class clinging to a single narrative. Bitcoin's store-of-value thesis? Amazon's growth-at-all-costs model? Both just got visually benchmarked against a metal used in coins and solar panels. The market has a brutal way of humbling even the most compelling stories.

So, while crypto Twitter debates the next altseason and Wall Street obsesses over retail earnings, remember: sometimes capital moves to the beat of a much older, simpler drum. The real question now is who—or what—gets overtaken next.

Source: CompaniesMarketCap

Source: CompaniesMarketCap

Will Silver Outshine Bitcoin?

Silver and gold have seen incredible growth in 2025, hitting multiple new peaks. Silver’s latest upswing is likely due to investors hedging their investments amid slow economic growth. Market participants are moving away from risky assets such as Bitcoin (BTC) and other cryptocurrencies. The development is reflected in the crypto market entering a consolidation phase. Silver overtaking Bitcoin’s market cap is a sign of the movement away from risky assets.

The Federal Reserve rolled out an additional 25 basis point interest rate cut earlier this week. However, the rate cut did not push Bitcoin’s (BTC) price. The lack of movement in the crypto market could be due to macroeconomic uncertainties. The same reason could be why investors are moving their funds into gold and silver.

However, the trend may change in 2026, as many anticipate Bitcoin (BTC) to climb to a new all-time high next year. Grayscale and Bernstein claim BTC has pivoted from its 4-year cycle and now follows a 5-year cycle. Bernstein predicts BTC to hit the $150,000 mark in 2026 and the $200,000 mark in 2027. Bitcoin (BTC) hitting a new all-time high could see funds exiting silver and gold markets. However, there is no telling with the crypto market. Fresh volatility could present unforeseen challenges.