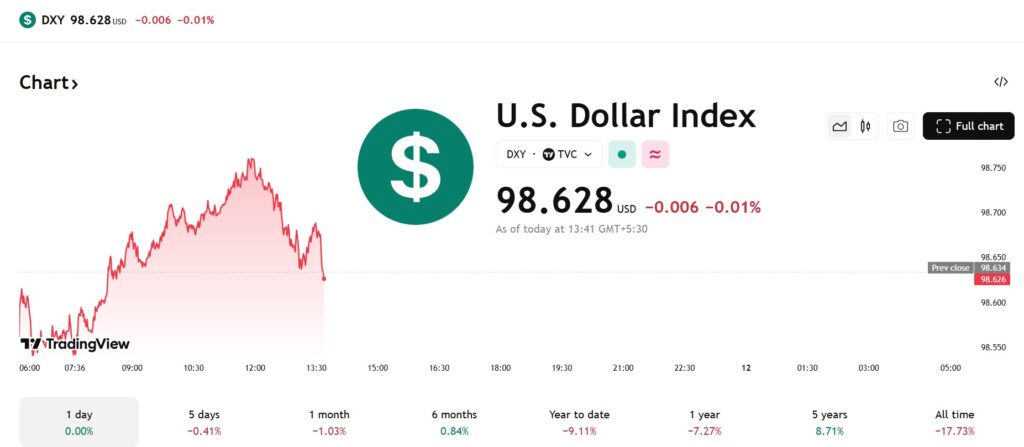

Dollar Dives: Traders Pivot to Asian Currencies as USD Weakens

The greenback's grip is slipping. Money is moving east.

### The Great Rotation Out of Dollars

Forget the safe-haven playbook. A wave of capital is washing out of US dollar positions, seeking higher ground across Asian markets. It's a direct bet against American monetary dominance—a quiet rebellion playing out in forex terminals from Singapore to Seoul.

### Why Asia's Looking Like the Smart Bet

It's not just about a weak dollar; it's about relative strength. While the Fed dances with inflation data, several Asian economies are posting growth that makes Wall Street look sluggish. Their central banks aren't just reacting—they're leading. The carry trade is back, but with a modern, regional twist.

### The Cynical Take

Let's be real: this is the same herd that piled into tech stocks last quarter and commodities the quarter before. Today's 'strategic allocation' is often just tomorrow's crowded trade, dressed up with fancy charts and economic jargon. But for now, the momentum is undeniable—and it's flowing into yuan, won, and other regional currencies.

The dollar's reign isn't over, but its monopoly on investor attention certainly is. The East is offering more than just cheap manufacturing; it's offering yield, stability, and a compelling alternative narrative. The financial world's center of gravity just took a noticeable shift.

Source: TradingView

Source: TradingView

Forex Traders Betting on Asian Currencies & Not the US Dollar

Reuters polled data showing that traders have taken long bets on Asian currencies, sidelining the US dollar. Local currencies are showing stronger growth prospects, especially the Singapore dollar, Thai baht, and Malaysian ringgit. Investments in these currencies are at their highest since mid-June as traders open long positions. Thesaid Lloyd Chan, Senior Currency Analyst at MUFG.

In addition, long positions in the Chinese yuan also ROSE to their highest level since January 2023. The Chinese yuan grew for four months straight till November, its longest gains in four years. The development indicates growing confidence in Asian currencies among forex traders as the US dollar weakens in the charts. China also has a record trade surplus of $1 trillion for the first time ever through non-US growth.

However, the only loser in the Asian currency market against the US dollar is the Indian rupee. Traders are shorting the rupee for profits as it’s the worst-performing currency in Asia in 2025. The rupee plummeted to a lifetime low of 90.47 on Thursday, and the Reserve Bank of India (RBI) failed to stop its decline. Analysts predict the INR could fall to the 92 level next and ring in new lows. Investors who have shorted the rupee could make bigger profits as the currency dips.