Bitcoin Dips Despite Interest Rate Cut: The Market’s Defiant Signal

Bitcoin just threw a curveball. Central banks slash rates, traditional markets cheer—and crypto's flagship asset tanks. What gives?

The Contrarian Move

Conventional wisdom says cheap money floods into risk assets. Stocks love it, real estate drinks it up. Yet Bitcoin, the digital bellwether, just shrugged and headed south. It's a stark reminder that crypto doesn't dance to the old masters' tune. The usual catalysts—liquidity, inflation fears—sometimes just don't stick here.

Decoding the Dip

Look beyond the headline rate. The market's sniffing out something else. Maybe it's whale profit-taking after a long run-up. Could be leverage unwinding across derivatives platforms. Or perhaps it's a classic 'sell the news' play, where the anticipated event—the rate cut—was already baked into the price. The dip isn't a failure; it's a complexity check.

A Separate Reality

This move underscores crypto's emerging, and often frustrating, independence. Its drivers are a tangled web of on-chain flows, miner behavior, and a sentiment gauge that swings from euphoria to despair faster than a Wall Street analyst can say 'overbought.' It operates on internet time, where narratives shift hourly and global liquidity is just one factor among dozens.

So, while the old guard celebrates its monetary policy victory, Bitcoin offers a cynical jab: sometimes, the smartest money is the money that ignores the party altogether and charts its own course. The dip isn't an anomaly—it's a feature.

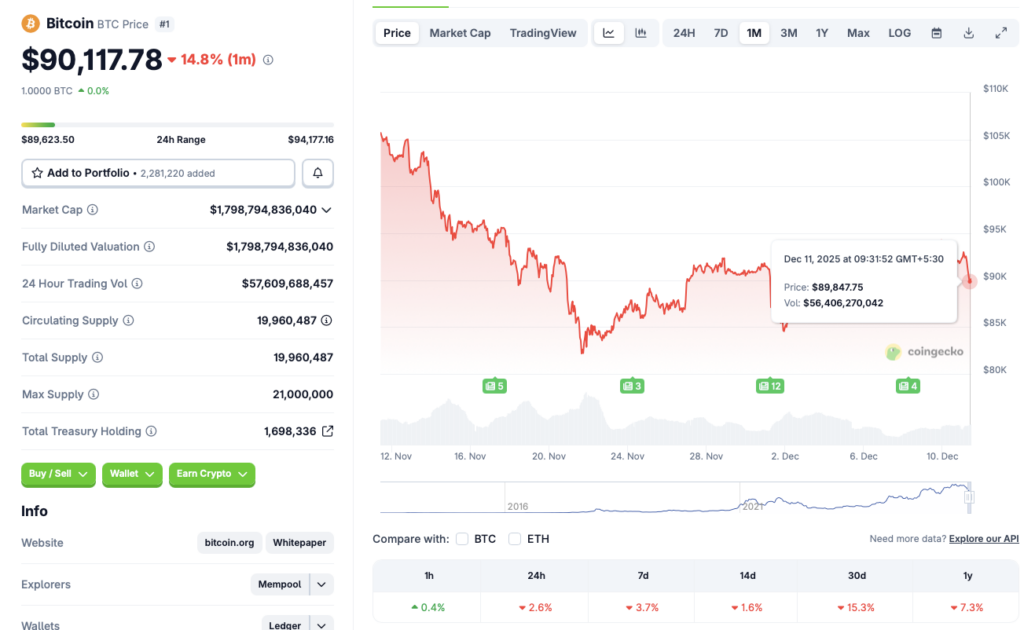

Source: CoinGecko

Source: CoinGecko

Why Is Bitcoin Facing a Correction? Will It Rebound?

Bitcoin’s (BTC) latest price correction is similar to what happened earlier this year in October. October is historically a bullish month for the crypto market. Moreover, the Federal Reserve rolled out a 25 basis point interest rate cut in October. However, bitcoin (BTC) saw a price dip despite the bullish developments. The October price correction was likely due to macroeconomic uncertainties and the low chances of another interest rate cut this year. The ongoing dip could be due to a similar reason.

Many anticipated Bitcoin (BTC) to rally after the interest rate cut. However, fresh volatility seems to have thwarted the plans of many investors. Bitcoin’s (BTC) recovery may depend on macroeconomic factors, such as jobs data. The job market concerns may be keeping investors from making risky investments. Market participants are likely continuing their risk-averse strategy for the time being.

Bitcoin (BTC) may see some positive movements next year. Many experts predict Bitcoin (BTC) will climb to a new all-time high in 2026. Bernstein and Grayscale claim that BTC is no longer following a 4-year cycle. This means that the original crypto could climb to a new high next year. Bernstein predicts BTC will hit $150,000 in 2026 and breach the $200,000 mark in 2027.