Crypto Market Structure Bill Drops in 2 Weeks: Here’s What You Need to Know

The regulatory hammer is about to swing. In just fourteen days, a landmark piece of legislation targeting the very architecture of digital asset markets is expected to land in Congress. This isn't just another hearing—it's a potential rewrite of the rulebook.

What's in the Bill?

While the exact text remains under wraps, the bill's intent is clear: to carve out a definitive regulatory path for cryptocurrencies. It aims to settle the long-running turf war between agencies, clarify what constitutes a security versus a commodity, and establish ground rules for trading platforms and custody. Think of it as a foundational framework—the plumbing and wiring for a multi-trillion-dollar industry.

Why It Matters Now

The timing is no accident. With institutional capital flooding in and traditional finance building its own on-ramps, the pressure for legal certainty has hit a boiling point. Markets hate ambiguity, and this bill promises to cut through the fog. It could unlock a new wave of institutional investment or, if it gets the balance wrong, stifle innovation for years.

The industry's reaction will be immediate and volatile. Lobbying efforts have been in overdrive for months, with every major player trying to bend the arc of the policy. The final language will reveal who won—and who got left holding the bag.

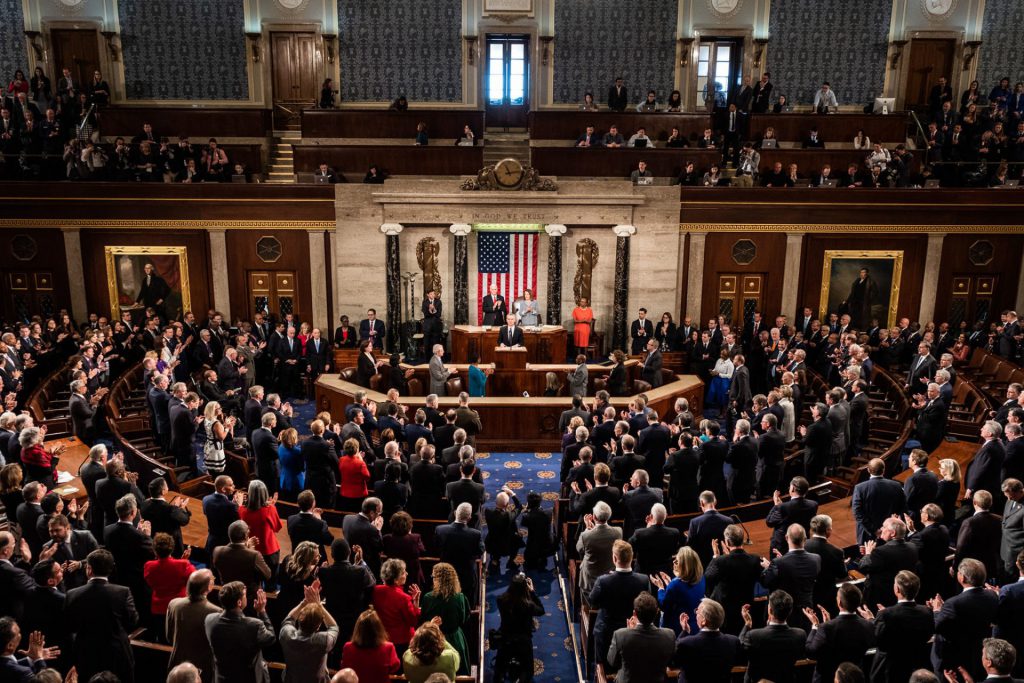

Get ready. In two weeks, the conversation shifts from speculative whispers to concrete text. The era of "wait and see" is ending. The fight for crypto's future is moving from Twitter threads to the congressional record—where the real money has always been made, usually by the people writing the rules.

How Will The Crypto Market Structure Bill Affect The Cryptocurrency Market?

The upcoming legislation aims to build on the Digital Asset Market Clarity Act (CLARITY Act). The US does not have any clear legislation on how to define digital assets. Some could be “securities” and others could be “non-securities.” The SEC has had substantial trouble over the last few years with these definitions. The most popular was the SEC vs. Ripple lawsuit, which lasted for nearly four years.

Secondly, the crypto market structure bill will bring more clarity as to who will oversee the crypto industry. Currently, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have clashes over which cases should fall under their jurisdiction. The upcoming bill will make the process smoother. The CFTC will oversee cryptocurrencies that fall under the “commodities” tab, and the SEC will oversee cryptocurrencies that qualify as “securities.”

The lack of proper legislation and regulation has also added to the widespread of scandals, frauds, and collapses. The FTX collapse of 2022 was a wake-up call for the crypto market. Lawmakers want to make sure such a debacle never happens again.

The bill will also likely set clear rules for crypto taxation, anti-money laundering practices, and standards for exchanges.

The crypto market structure bill will likely have a positive impact on the market. The legislation could build investor confidence, and more people may enter the crypto market. The number of frauds and scams may also go down as a result of the legislation.