Mega Bitcoin Strategy Stuns Market with $962.7 Million Purchase

A single, staggering move just rewired the market's nervous system.

The Whale That Roared

Forget nibbling at the edges—this was a full-blown feast. An institutional-grade strategy bypassed cautious accumulation and executed a headline-grabbing, near-billion-dollar Bitcoin buy. The sheer scale of the purchase cuts through the usual market noise, sending a shockwave from trading desks to crypto Twitter.

Decoding the Signal

What drives a player to deploy capital of this magnitude in one go? It's a statement piece, a massive vote of confidence that looks past short-term volatility and targets long-term infrastructure. This isn't day-trading; it's digital asset acquisition on an industrial scale—the kind of move that makes traditional finance's "dollar-cost averaging" look like a timid savings plan.

The Ripple Effect

Markets react to conviction. A purchase this large soaks up available supply, tightens liquidity, and forces every other major holder to reassess their position. It creates a new floor, a psychological price anchor that shifts the terrain for everyone else. Suddenly, the question isn't "if" big money is here, but "who's next?" and "how much higher?"

The New Calculus

The playbook is changing. While some funds still tip-toe in with cautious allocations, others are now making sovereign-grade bets. It highlights a growing divide: those who see Bitcoin as a speculative asset, and those treating it as a foundational, non-correlated pillar of a modern portfolio. One cynical take? It's the ultimate flex—making your average hedge fund's "bold move" look like rearranging deck chairs on the Titanic.

This isn't just a trade; it's a tectonic shift. When one strategy commits nearly a billion dollars in a single stroke, it doesn't just move the market—it redefines the game.

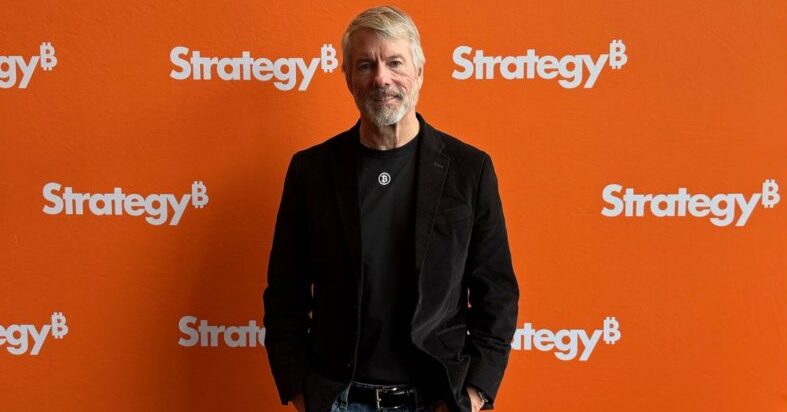

Mega Bitcoin Purchase: Michael Saylor’s Strategy Goes Bullish on BTC

Strategy is on an unending bitcoin accumulation spree, making it the top company that holds so much BTC in its reserves. The bullishness has kept the markets hooked as his laser-eyed enthusiasm is powering investors’ confidence.

How much Bitcoin does Michael Saylor’s Strategy currently hold? As of December 9, 2025, they hold over 660,624 BTC in their reserves.

What about Strategy’s overall Bitcoin holdings? How much do they hold? The company has accumulated around $49.35 billion worth of BTC, and the number increases when the digital asset moves up.

The company has seen a yield of 24.7% on Bitcoin in 2025 alone. The average purchasing price has come down to $74,696 through dollar cost averaging (DCA).

What Next For The Leading Cryptocurrency?

Bitcoin is struggling to reclaim the $100,000 mark and is falling to the $86,000 range every time it touches $95,000. The market is yet to stabilize, but the dip is acting as a buying opportunity to investors. Accumulating BTC during the fall has proven beneficial as the cryptocurrency has rebounded in value. Swing traders can make the most money out of the volatility in cryptocurrency. Another dip to the $85,000 level could be a prime buying opportunity.