BNB’s December Charge: Can Binance Coin Actually Hit $1000?

All eyes are on Binance Coin as the year winds down. The question isn't just about growth—it's about a moonshot to a four-figure valuation.

The $1000 Psychological Barrier

Hitting a thousand dollars isn't just another milestone; it's a massive psychological and technical feat. It would signal a vote of confidence that cuts through the typical market noise, proving resilience beyond exchange-specific headlines. For a token so deeply tied to the world's largest crypto ecosystem, that price point bypasses mere utility—it enters the realm of legacy asset.

The Ecosystem Engine

BNB's fate isn't written on a standalone chart. It's fueled by the relentless expansion of the BNB Chain, its burn mechanism actively destroying supply, and its entrenched role as the lifeblood of Binance's sprawling universe. Every new project launched, every transaction settled, adds another log to the fire. The network effect isn't just real—it's compounding.

Market Forces at Play

December brings its own brand of volatility—a mix of tax-harvesting sell-offs and bullish, new-year positioning. Reaching that elusive target requires more than just organic growth; it needs a perfect storm of broad crypto momentum and a decisive break above key resistance levels. It's a high-stakes game where sentiment often trumps spreadsheet models, much to the chagrin of traditional analysts clutching their discounted cash flow calculations.

The climb to $1000 is a steep one, packed with both promise and peril. Will December deliver the festive rally or just another lesson in crypto's thrilling unpredictability? Watch the charts—they're writing the headline now.

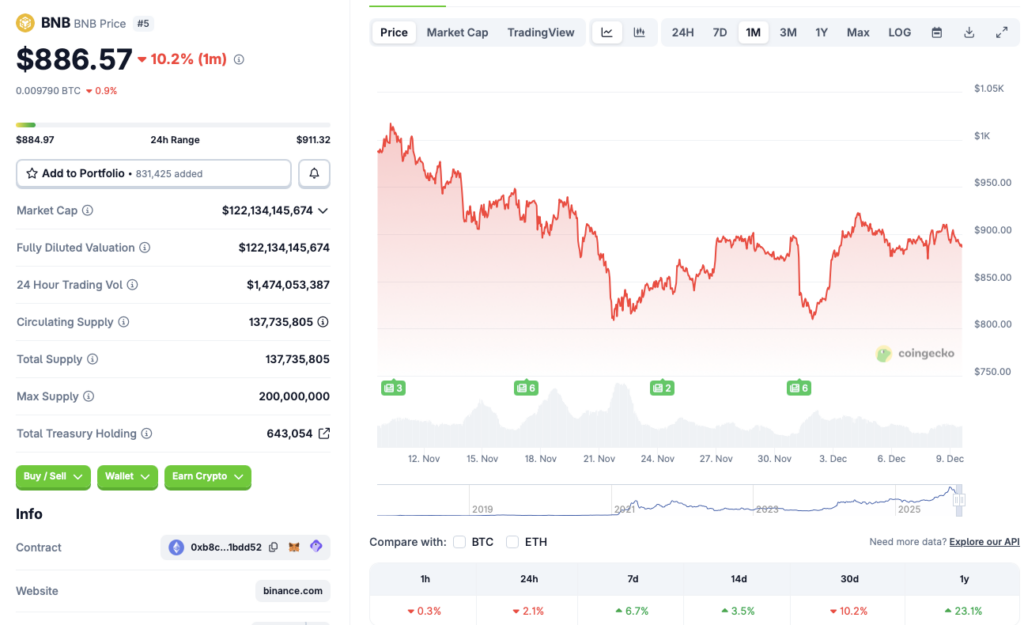

Source: CoinGecko

Source: CoinGecko

BNB Price Prediction: Is $1000 In The Cards This December?

BNB last traded above the $1000 mark on Nov. 11. The asset has since struggled to gain momentum. However, the tide may change for the crypto market over the coming weeks. There is a high chance that the Federal Reserve will roll out another interest rate cut after Wednesday’s Federal Open Market Committee (FOMC) meeting. Another rate cut could trigger a market-wide rally. BNB could hit the $1000 mark once again if rates are reduced.

Many financial institutions, such as Grayscale and Bernstein, anticipate Bitcoin (BTC) to hit a new all-time high in 2026. Analysts claim that BTC may have broken away from its 4-year cycle and may be following a 5-year cycle instead. This could mean that the original crypto will climb to a new peak next year. BTC hitting a new all-time high could lead to BNB following a similar trajectory.

Additionally, ETF inflows are expected to rise over the coming months. BNB’s price could benefit from high ETF inflows.