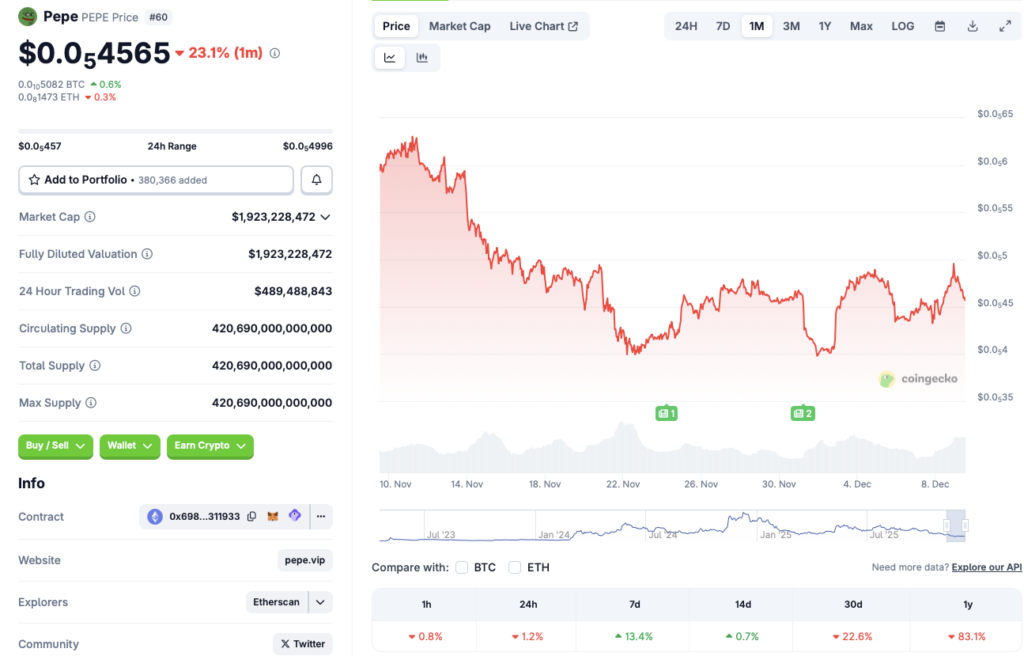

Pepe Plunges to 60th Spot: Can the Memecoin Stage a Comeback?

Pepe the frog just got croaked—the once-dominant memecoin has tumbled down the rankings, landing at a humble 60th place. The question on every trader's mind: is this a dip or a death spiral?

The Anatomy of a Memecoin Slump

Memecoins live and die by sentiment. When the hype train derails, the fall can be brutal and fast. Pepe's descent isn't just a bad day—it's a stark reminder that in crypto, today's top dog can be tomorrow's forgotten meme. The market cap tells the story of capital fleeing for greener, or at least more serious, pastures.

Catalysts and Cliff Edges

So what triggers a slide like this? Look at trading volume drying up, developer activity stalling, or a shiny new memecoin stealing the narrative. Sometimes, it's just the collective attention span of crypto Twitter moving on to the next animal-themed token—a classic case of 'what have you done for me lately?'

The Path to Recovery—or Obscurity

A comeback isn't impossible, but it's an uphill battle. It would require a fresh wave of viral marketing, a major exchange listing, or perhaps an unlikely utility pivot. History shows some memecoins claw back, while most fade into the graveyard of forgotten internet jokes. It's the high-stakes gamble of digital asset investing, where fundamentals are often just a frog-shaped mascot and a dream.

In the end, Pepe's fate rests where it always has: in the hands of traders who treat the market like a casino, armed with charts, memes, and the unwavering belief that this time, it's different. After all, what's finance if not a serious business occasionally interrupted by pictures of cartoon amphibians?

Source: CoinGecko

Source: CoinGecko

Will Pepe Recover From Its Price Crash?

The crypto market started with t a bullish swing in 2025. However, the market turned red in October, experiencing its biggest single-day liquidation ever. Pepe (PEPE) was among the most affected cryptocurrencies in the market. The October crash was surprising, especially because the Federal Reserve lowered interest rates by 25 basis points. The crash was likely due to macroeconomic uncertainties.

PEPE could see a price rebound over the coming days. There is a high chance that the Federal Reserve will roll out another interest rate cut after Wednesday’s Federal Open Market Committee (FOMC) meeting. Another rate cut could lead to a market-wide rally. PEPE and other risky assets could see a surge in inflows.

Furthermore, Bernstein and Grayscale anticipate Bitcoin (BTC) to climb to a new all-time high in 2026. Both financial institutions predict Bitcoin (BTC) to break out of its 4-year cycle. BTC hitting a new all-time high could lead to a massive surge in investor sentiment. Such a development could push PEPE to new heights as well.

Nonetheless, there is also a possibility that the market will not react to a potential interest rate cut, as seen in October. Such a development could lead to another price correction for PEPE.