XRP ETFs Smash $1 Billion Milestone - So Why Is the Price Still Stuck?

XRP exchange-traded funds just crossed a major threshold, yet the underlying asset refuses to follow the script. A billion dollars in assets under management signals institutional interest, but the market's reaction has been a collective shrug.

The ETF Paradox

Conventional wisdom says massive fund inflows should lift all boats. Not this time. The $1 billion parked in XRP ETFs hasn't translated into bullish momentum for the token itself, creating a puzzling disconnect between product success and price action.

Market Mechanics vs. Narrative

It turns out that wrapping an asset in a regulatory-friendly package for traditional finance doesn't automatically juice its spot price—a nuance often lost in the hype cycle. The ETFs are doing their job, providing exposure. The market, however, is doing its own thing, weighing a laundry list of other factors from regulatory overhangs to broader crypto sentiment.

So, What Gives?

This divergence highlights a classic crypto tension: financial engineering versus organic utility and demand. You can build the slickest on-ramp for Wall Street, but if the destination isn't compelling enough, the traffic just won't come. It's a sobering reminder that in crypto, sometimes the product succeeds while the story stalls—a truth that tends to get expensive for those betting on narratives over numbers.

Why Is XRP Struggling Despite Large ETF Inflows?

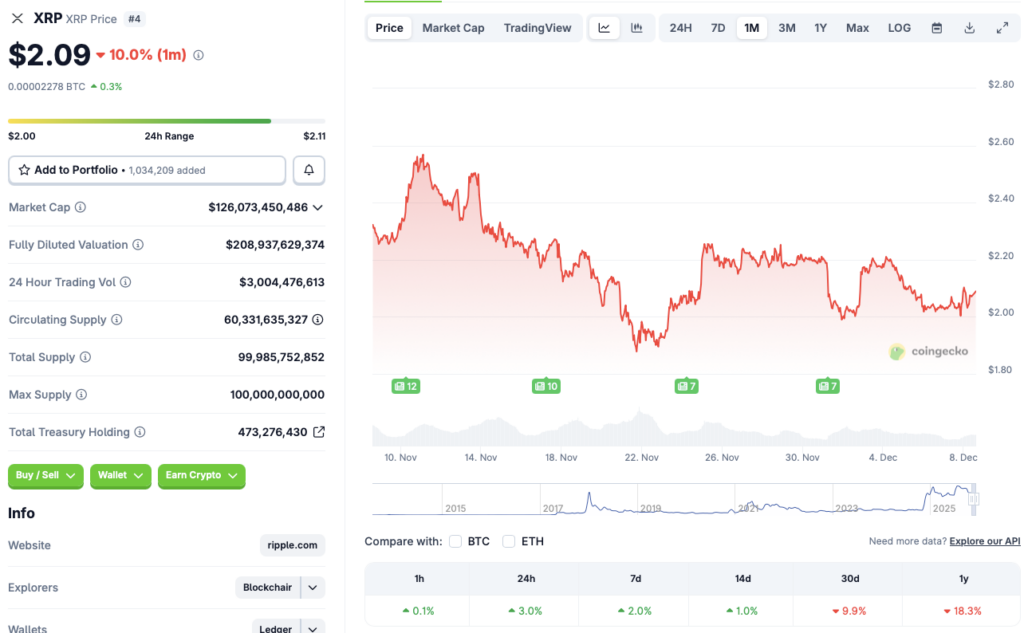

XRP started the year with a bang. The asset breached the $3 mark in January of this year for the first time in nearly seven years. The rally was likely due to the SEC vs. Ripple lawsuit coming to an end. XRP’s celebrations did not stop with the lawsuit settlement. The launch of 5 spot ETFs led to a substantial rise in investor sentiment. However, the asset’s price has taken a hit over the last two months. According to CoinGecko data, XRP is down 9.9% over the last month and 18.3% since December 2024. However, XRP is green in the other time frames, rallying 3% in the last 24 hours, 2% in the last week, and 1% in the 14-day charts. The asset’s price seems to be consolidating around the $2.10 mark.

The current market scenario could be due to macroeconomic uncertainties. The Federal Reserve announced an interest rate cut in October, but the chances of a third rate cut in 2025 significantly fell due to rising inflation and slow economic growth. XRP and other crypto assets faced massive liquidations after the development. However, the chances of another interest rate cut in 2025 have substantially increased over the last few weeks. Another rate cut could trigger a market-wide rally for the crypto sector. The uncertainties in the market could be keeping XRP’s price at bay for the moment.