Interest Rate Cut Odds Soar, Yet Markets Stay Stuck: What’s Holding Them Back?

Markets are pricing in a dovish pivot, but the charts aren't buying it. Why the disconnect?

The Waiting Game

Traders have loaded up on bets for lower rates. The data's clear, the sentiment's shifted. Yet, major indices and crypto alike are stuck in a frustratingly tight range—consolidating when logic screams for a breakout.

Digging Beneath the Headline

The smart money is looking past the initial cut. They're asking: How fast will they come? How deep will they go? One cut might just be a policy correction, not a full-blown stimulus party. The market hates uncertainty more than it loves cheap money.

Liquidity's Ghost

Remember all that liquidity that vanished? It doesn't just magically reappear with a 25-basis-point trim. Banks are still licking their wounds, and the plumbing of the financial system has some rust. A rate cut is a signal, not a solution.

The Cynical Take

Maybe the market's just wise to the old game. Central banks talk dovish to avoid panic, then deliver the bare minimum—a classic 'dovish talk, hawkish walk' routine that keeps Wall Street's bonuses safe and Main Street's hopes just alive enough.

So, we wait. The odds are up, but conviction is down. The real move starts when the first cut is in the rearview and the path ahead is finally, painfully clear.

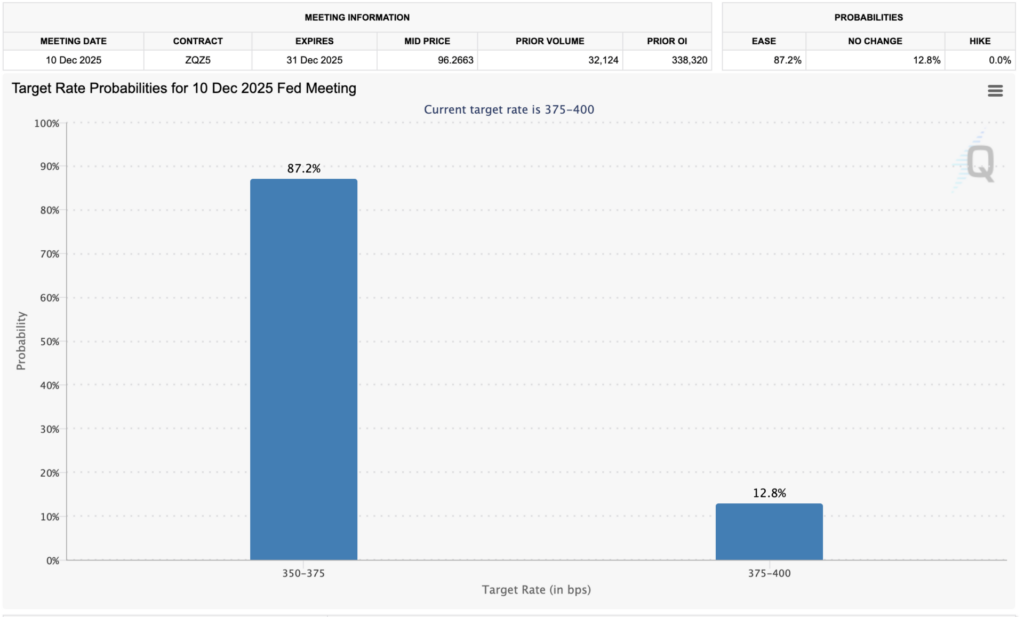

Source: CME FedWatch

Source: CME FedWatch

Why Is The Crypto Market Stagnant, Despite High Interest Rate Cut Chances?

The lack of any movement in the cryptocurrency market could be due to macroeconomic uncertainties. Investor sentiment has not fully recovered after the market crash in October-November. According to Alternative, investor sentiment is still in the “extreme fear” region.

Cryptocurrency ETF inflows have also slowed down significantly over the last few months. Low ETF inflows could signal a bearish outlook from financial institutions. Investors could be looking at low ETF inflows as a sign that the worst is not yet over.

Despite the lackluster performance over the last few weeks, the cryptocurrency market may build up steam over the coming days. If the Federal Reserve cuts rates by another 25 basis points, Bitcoin (BTC) could see a massive surge in inflows. Other assets will likely follow suit.

Additionally, Grayscale believes Bitcoin (BTC) will climb to a new all-time high sometime next year, based on its thesis that the original cryptocurrency follows a 5-year cycle, and not a 4-year cycle. BTC hitting a new peak next year could trigger a market-wide bull run.

However, there is also a possibility that the cryptocurrency market will not react to a potential interest rate cut. October saw a 25 basis point rate reduction, but the crypto market did not budge.