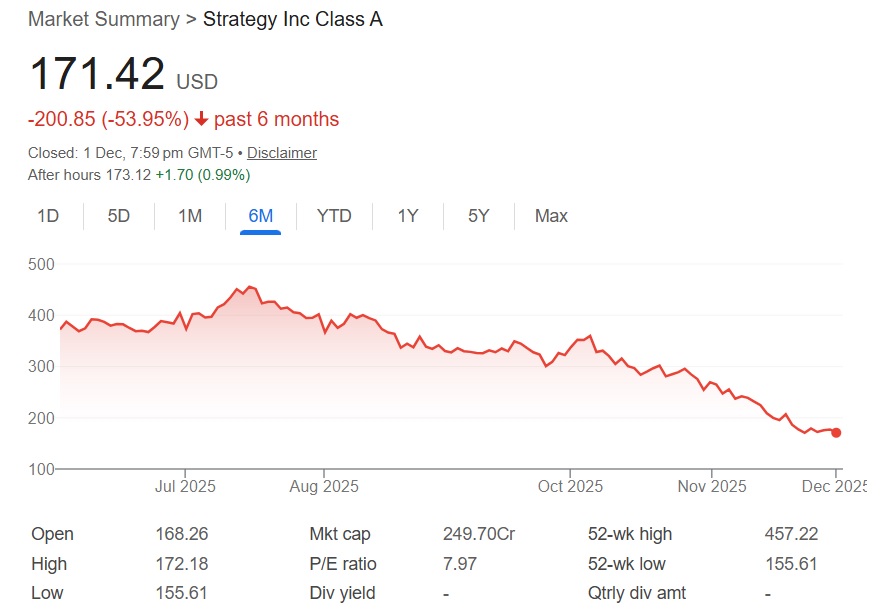

Strategy Stock Plunges 54% in 6 Months After Bitcoin Falls To $86,000

When Bitcoin stumbles, some stocks don't just trip—they faceplant. A 54% plunge in six months tells a brutal story of correlation, where a single digital asset's price action can gut a company's valuation. Welcome to the new era of finance, where traditional equities wear crypto's volatility like a lead vest.

The Domino Effect: When Digital Gold Loses Its Shine

Bitcoin's retreat from its highs didn't just spook crypto traders. It triggered a sell-off cascade in equities tied to its ecosystem. The data is stark: a 54% drop directly shadows Bitcoin's own descent. This isn't mere coincidence—it's a direct tether, proving that for some 'strategic' plays, the strategy is simply to ride crypto's coattails. When those coattails get cut, the fall is precipitous.

Six Months of Erosion: A Timeline of Unraveling Confidence

The half-year chart isn't a gentle slope—it's a cliff. Each percentage point of Bitcoin's decline seemed to amplify the stock's losses, erasing investor confidence faster than a blockchain transaction confirms. The narrative shifted from 'growth potential' to 'risk exposure,' and the market voted with its sell orders. It's a masterclass in how quickly sentiment can reverse when the foundational asset wobbles.

Rethinking the 'Crypto-Correlated' Playbook

This plunge forces a harsh question: what's the actual business model here? If a stock's value is so intimately tied to Bitcoin's price—more than doubling its downside over six months—then it's not a stock. It's a leveraged, unhedged bet on crypto, dressed in a quarterly earnings report. It's the financial equivalent of putting a spoiler on a golf cart and calling it a sports car.

The market has delivered its verdict with brutal efficiency. In the end, some 'strategies' are just hopes wearing a suit, and when the tide of easy money goes out, everyone sees who's been swimming without trunks.

Source: Google

Source: Google

Strategy currently holds 650,000 BTC, and the $75 billion worth of reserves have now fallen to $56 billion. The company recorded a decline of $19 billion in just five months as Bitcoin dipped to the $86,000 range. On average, Strategy’s holdings stand at $73,000 per BTC while its profits are up only 18%. Another round of bearish market could erase this, leading to its holdings trading in the red.

To keep things afloat and diversify their bitcoin reserves, Strategy announced on Monday that the company will establish $1.44 billion in USD reserves.said Saylor.

Bitcoin Dip Leads To Strategy (MSTR) Stock Decline

Strategy (NASDAQ: MSTR) is experiencing a bloodbath as Bitcoin fell to the $86,000 level. MSTR is down nearly 54% in six months and has erased all the gains it generated this year. Traders’ wallets that took an entry position in the stock in 2025 have all turned red. MSTR entered 2025 at $300 per share and is now trading at $171 in December.

In a month alone, Strategy stock has moved in tandem with Bitcoin, sinking 36% in the indices. BTC is down 22% in a month, and both assets are flashing bearish sentiments. If BTC begins to decline in 2026, falling below $70,000, the charts could be merciless for MSTR. Though it is standing at a close point of break-even, a tip-down from here could add immense pressure on Saylor.