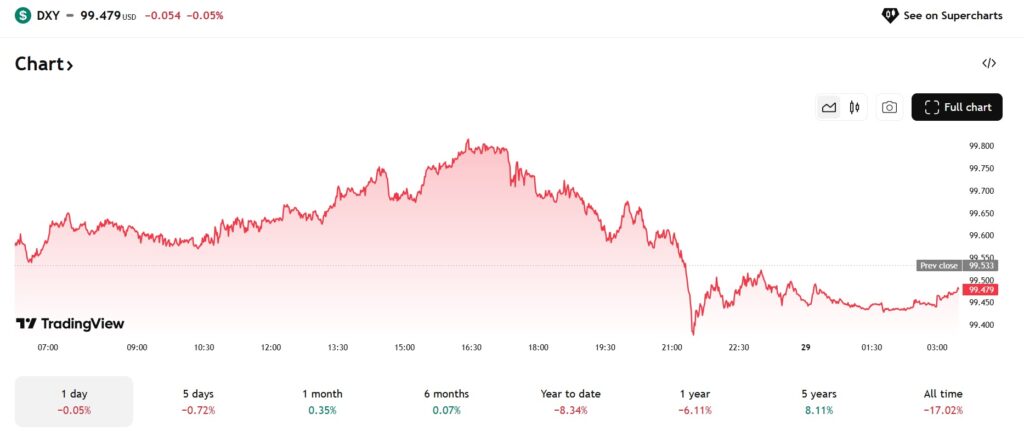

US Dollar Drops Out of the Top 7 Strongest Currency List in 2025 - A Crypto Bull’s Perspective

The greenback just got knocked off its pedestal. For the first time in living memory, the US dollar has tumbled out of the top seven strongest global currencies. The rankings, once a predictable list of traditional safe havens, have been reshuffled. It's the kind of shift that makes central bankers sweat and crypto advocates nod knowingly.

The New World Order of Value

Forget the old guard. The currencies now leading the pack represent a fundamental rethink of what 'strength' means in a digital age. It's no longer just about a nation's GDP or military might. Stability, digital adoption, and monetary policy innovation are the new benchmarks. The dollar's slip signals a loss of confidence—the very bedrock of fiat currency.

Digital Gold Rushes In

While traditional finance scrambles to explain the dip, the crypto market sees a clear narrative. When faith in legacy systems erodes, capital seeks alternatives. Bitcoin's 'digital gold' thesis gets a massive, real-world validation. Stablecoins pegged to these newly ascendant currencies could see explosive demand, creating on-ramps that bypass the dollar entirely. Decentralized finance (DeFi) protocols are already built for this multi-currency reality—no permission needed.

A Self-Inflicted Wound

Let's be cynical for a second: decades of printing money to fund everything from wars to tax cuts tends to have consequences. The dollar's decline isn't an accident; it's arithmetic. Meanwhile, crypto assets operate on a globally transparent ledger. Their monetary policy is coded in stone, not changed on a central banker's whim. The contrast couldn't be starker.

The dollar's fall from grace isn't just a headline—it's a flashing buy signal for a financial system in transition. The future of money is being written on the blockchain, not by the Federal Reserve.

Source: TradingView

Source: TradingView

Top 7 Strongest Currency List of 2025: US Dollar Fails To Make It

Below is the list of the seven strongest currencies of 2025, which the US dollar failed to enter.

The dinar and riyal, along with the GBP and Franc, made it to the top 7 list of 2025 and elbowed the US dollar out.

However, to keep things in perspective, the US dollar has taken the 8th spot in the 2025’s list. The euro (EUR) comes at the 9th spot, while the last 10th spot is taken by the Singapore dollar (SGD). Factors like inflation and the meager jobs sector have made the greenback weaker this year.

However, despite all the rough terrains, the US dollar is at the 8th spot of the 2025’s strongest currency list. The development indicates that the economic headwinds could not dim the lights on the USD. America is still the world’s biggest economy and has maintained its stability. While there’s dissatisfaction with trade agreements and foreign policies, developing countries are still dependent on the USD for their economic survival.