Tom Lee Predicts Crypto Bottom Imminent: V-Shaped Rebound Just Days Away

Crypto markets brace for the final shakeout.

Fundstrat's Tom Lee—the analyst who called Bitcoin's 2018 bottom within weeks—just dropped another bombshell prediction. He says the crypto market bottom could hit within days, not months. And when it comes? Expect a V-shaped recovery that leaves slow-moving institutional money scrambling to catch up.

The Anatomy of a V-Shaped Bounce

Forget the slow, grinding recoveries of traditional finance. Crypto moves at light speed. Lee's model suggests capitulation selling is nearing exhaustion. Once that last wave of weak hands folds, the rebound could be violent and vertical. Liquidity gets sucked back into the market faster than a Wall Street banker can say 'risk-off.'

Why This Time Is Different

Market structures have evolved. The derivatives complex is more mature, on-chain data is transparent, and institutional plumbing is in place. This doesn't prevent panic—it just means the recovery mechanism is more efficient. The bounce won't be a question of 'if,' but 'how fast.'

The Professional's Dilemma

Here's the cynical finance jab: Traditional portfolio managers, trained on quarterly rebalancing and committee approvals, will likely miss the first leg up. By the time their risk models give the all-clear, retail traders who bought the blood will already be booking profits. A perfect reminder that in crypto, timing isn't everything—it's the only thing.

Lee's track record gives this forecast weight. The countdown to the bottom has started. The only question left is who's positioned to ride the V.

ETH and BTC V-Shaped Formation: Details

Despite the ongoing crypto market volatility, Tom Lee, CEO of Fundstrat, shared how Bitcoin and ethereum are on the verge of bottoming out. But this bottoming stance will give birth to a new rally, as Lee shared in the video later. He later clarified how both the tokens project a V-shaped recovery driven by liquidity.

TOM LEE SEES A V-SHAPED RECOVERY AHEAD

Tom Lee just said he believes we’re days away from a bottom — for both Bitcoin and Ethereum.

He expects a V-shaped recovery driven by returning liquidity, a dovish shift at the Fed, and the resolution of the U.S. government shutdown.

His… https://t.co/uweyxkaEiu pic.twitter.com/RcyzJ5YF0p

The Bullish Predictions

Tom Lee later shared how bitcoin is now entering into a supply shock, with halving cuts of new issuance as demands keep rising. He later shared how BTC is already charting its own path, climbing as high as $150K by year-end.

![]() TOM LEE JUST WENT FULL BULL ON CNBC

TOM LEE JUST WENT FULL BULL ON CNBC

Fundstrat’s Tom Lee warned that #Bitcoin is entering a historic supply shock — halving cuts new issuance while demand keeps climbing. That imbalance is exactly what ignites parabolic moves.

Lee says $BTC could break $100K–$150K by… pic.twitter.com/UcSRaqqIg0

The Future Market Outlook

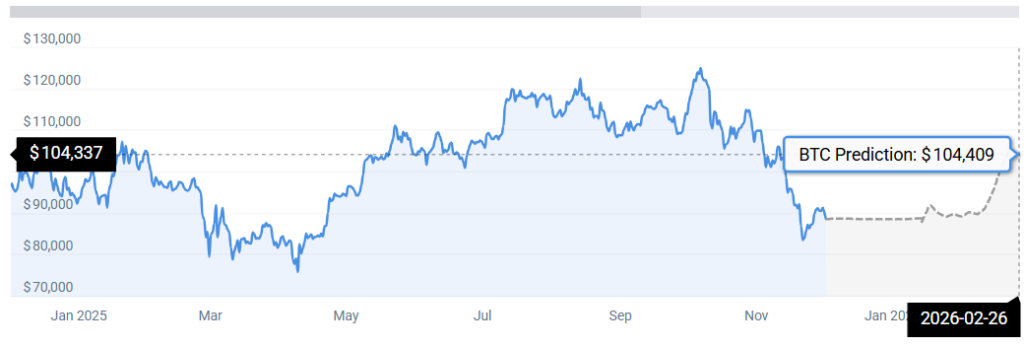

According to CoinCodex BTC stats, Bitcoin is now aiming to sit at $104K.

For ETH stats, CC predicts the token to sit at $4,780.03, revamping the crypto market trajectory.