Tether’s Gold Gambit: USDT Issuer Now World’s Largest Independent Gold Holder

Tether just rewrote the rulebook on crypto collateralization—by going medieval.

The Gold Standard 2.0

While bitcoin maximalists debate digital scarcity, Tether's stacking physical bullion like it's 1923. The stablecoin giant now holds more gold than most central banks—transforming from crypto pioneer to precious metals behemoth overnight.

Physical Backing in Digital Age

Forget algorithmic stablecoins. Tether's betting that institutional confidence comes not from code, but from vaults filled with shiny yellow metal. Their gold reserves now eclipse entire national stockpiles—proving that in finance, everything old is new again.

Wall Street's worst nightmare: a crypto company that actually believes in tangible assets. Who needs fractional reserve banking when you can literally count your collateral in gold bars?

Is Tether Going All In On Gold?

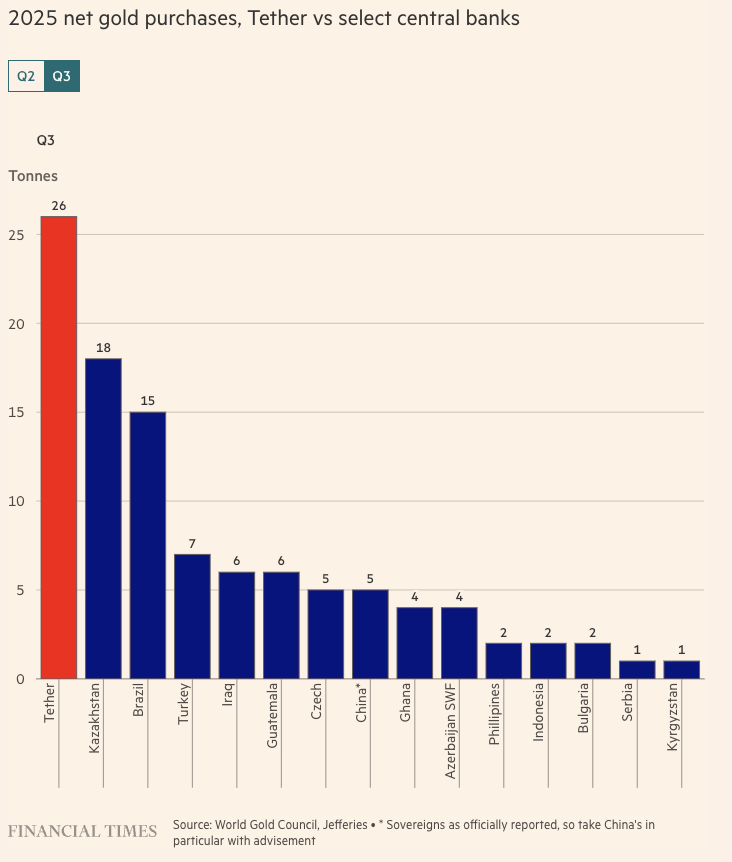

The bullish outlook for gold could be a signal that Tether views the metal as the best store of value. The company’s gold holding currently equals that of countries such as South Korea, Hungary, or Greece. According to a Financial Times report, Tether’s purchases have outshone those of Kazakhstan, Brazil, Turkey, China, etc.

According to some analysts, Tether’s recent aggressive purchases may have influenced the yellow metal’s price over the last few months. Gold has hit an all-time high of $4,379 in October 2025. The rise in gold’s price may have been due to investors taking a risk-averse strategy amid uncertain macroeconomic conditions.

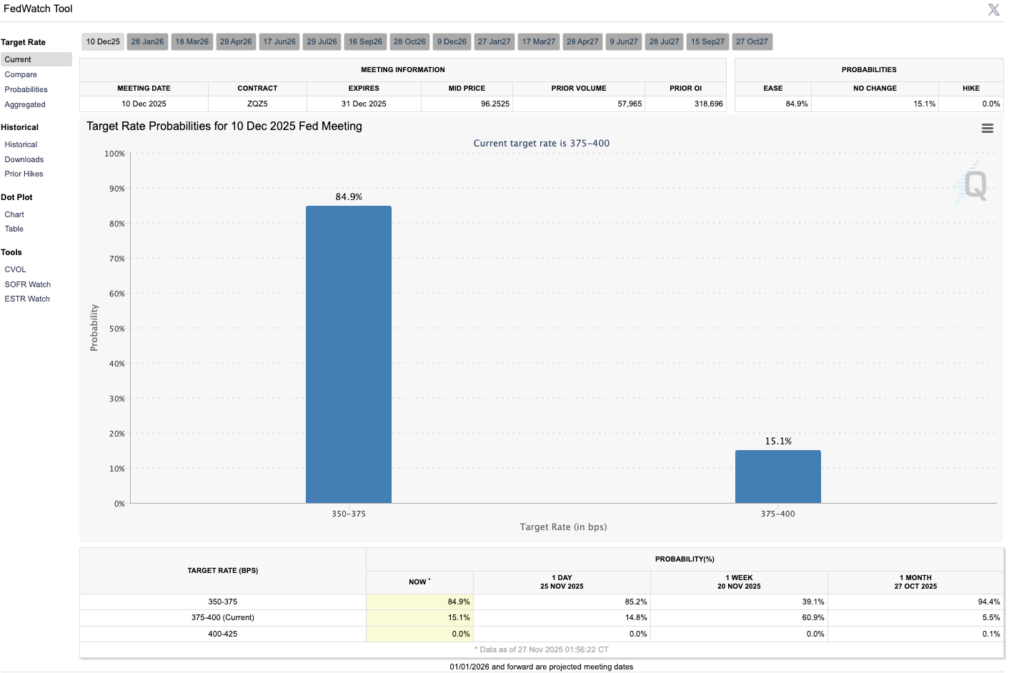

We may see a shift in investor strategy in the coming weeks as the chances of another interest rate cut in December increase. According to the CME FedWatch tool, there is an 84.9% chance of a 25 basis point interest rate cut in December 2025. Another rate cut could lead to investors moving out of safe-haven assets, such as gold, and redirect their capital into riskier assets, such as cryptocurrencies.

According to Marex analyst Edward Meir, ““

Meir believes that the rise in interest rate cut chances is helping gold’s price. He further spoke about the possibility of a new chair at the Federal Reserve. He stated, ““