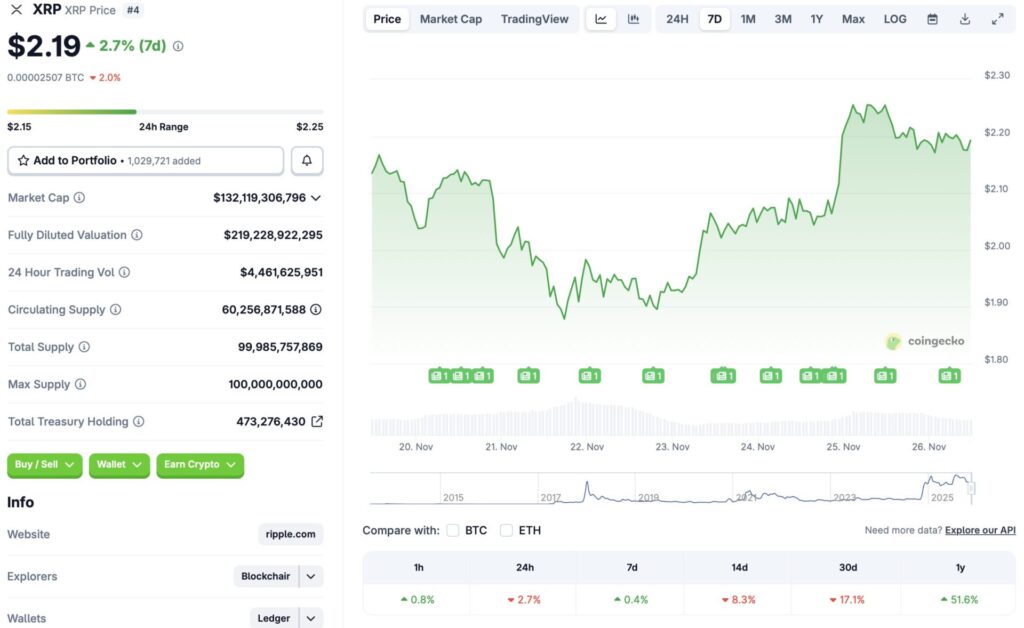

XRP Battles Critical $2.25 Resistance: What’s Next for the Digital Asset?

XRP faces its moment of truth at the $2.25 barrier—a level that could determine its trajectory for weeks to come.

Technical Analysis Breakdown

The digital asset's struggle at this resistance level reveals deeper market dynamics. Trading volumes suggest institutional interest remains strong despite the price stall. Market sentiment indicators show cautious optimism among traders—because nothing says 'confidence' like watching your portfolio swing 20% before breakfast.

Market Forces at Play

Regulatory developments continue to influence XRP's movement more than traditional technical patterns. The ongoing legal clarity provides both support and uncertainty—typical finance sector efficiency at work. Meanwhile, adoption metrics show steady growth in cross-border payment implementations.

Next Price Targets

A clean break above $2.25 could trigger rapid movement toward the $2.50 psychological level. However, rejection here might see the asset retest support around $1.90. The coming days will reveal whether XRP has the momentum to overcome this critical juncture or if traders will need to endure another round of 'building character' through sideways movement.

Source: CoinGecko

Source: CoinGecko

Will XRP Rally Further, Or Face a Correction?

The crypto market seems to be entering a consolidation phase in general. Bitcoin (BTC) seems to be slowing down after it reclaimed the $87,000 price level, after its recent dip to the $82,000 mark. XRP is also showing signs of consolidating around the $2.20-$2.25 mark.

Ripple’s XRP token was one of the best-performing cryptocurrencies earlier this year. XRP breached the $3 mark for the first time in seven years, and even hit a new all-time high. The incredible performance was most likely due to the SEC vs. Ripple lawsuit coming to an end. The lawsuit clouded XRP’s legal status and presented substantial challenges to its price. With the lawsuit gone, the asset has a clear legal status.

XRP could be gearing up for a major rally over the coming months, fuelled by ETF inflows. The asset finally has a spot ETF that could lead to a spike in institutional money. However, macroeconomic conditions need to improve for the crypto market to rally. Slow economic growth, rising inflation, and high jobs data have led to a substantial dip in the chances of another interest rate cut in 2025. XRP will likely not enter a bullish phase unless the larger economy improves.