TSLA Billionaire’s Unshakable Bet: Why Tesla Stock Is a ’Hold Forever’ Asset

Elon Musk's electric darling gets another vote of confidence—this time from a billionaire who won't touch the sell button.

The 'Never Sell' Thesis

Forget trading—this whale treats TSLA like a rare collectible. Growth? Sure. Volatility? Bring it on. Dividends? Who cares when you're betting on the auto industry's extinction event.

Wall Street Rolls Its Eyes

Analysts mutter about valuation metrics while scrambling to update their price targets (again). Meanwhile, retail traders pile in, fueled by memes and a distrust of traditional finance—ironic, given Tesla's S&P 500 crown.

One thing's clear: In a market obsessed with short-term gains, this playbook only works if you've got diamond hands—and a bank account that can weather 40% drawdowns before breakfast.

Source: Sky News

Source: Sky News

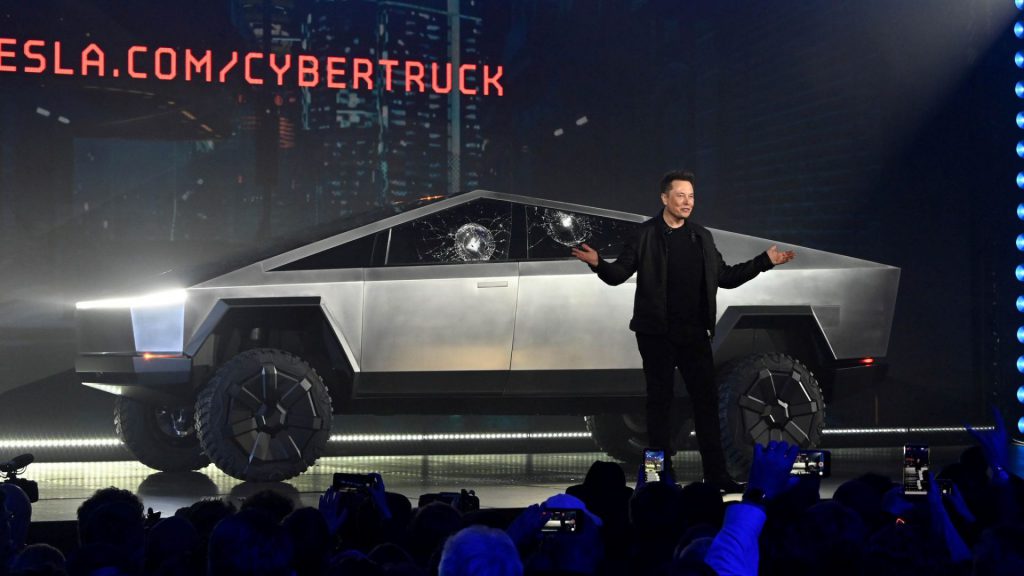

Shares in Tesla (TSLA) stock continue to decline following the approval of Elon Musk’s $1T bonus payment plan last week. At the Tesla shareholder meeting, Elon Musk was granted his $1T pay package that will pay out as Tesla achieves several sales targets in the coming years.

Despite the recent 5% dip this past week, analysts like Wedbush’s Dan Ives remain bullish on Tesla shares, and he believes the automaker’s AI future is where investors should be looking. “In my opinion, it’s going to be the most important chapter ever in Tesla’s story,” Ives said from the Yahoo Finance Invest event in New York. Ives has called the passage of Musk’s pay package a “bright green light” for Tesla’s AI and autonomous tech plans, and has an Outperform rating on the stock and a Street-high $600 price target.

”You have to have the understanding of what Musk and Tesla are trying to do here,” Ives added. “They’re building out the AI future, autonomous. I mean, they’re going to own 80% of the autonomous landscape, in my opinion, over the next decade.”