Fed Divided Over December Rate Cut: What It Means for Crypto’s Next Move

The Federal Reserve's internal debate on interest rates is heating up—and crypto markets are watching like hawks. Will traditional finance's indecision become decentralized finance's opportunity?

Here's the breakdown:

• Rate Cut Rumble: Fed officials can't agree on December's monetary policy, creating prime volatility conditions

• Crypto's Hedge Play: Bitcoin and altcoins historically thrive during monetary policy uncertainty

• Liquidity Watch: TradFi paralysis could drive more capital into digital assets (because nothing says 'prudent investment' like gambling on internet money)

The takeaway? While economists argue over basis points, crypto's already pricing in the chaos—proving once again that blockchain moves faster than the suits on Capitol Hill.

Will The Crypto Market Rally If The Federal Reserve Cuts Rates Again?

Many anticipated the crypto market to rebound after the October interest rate cut. However, the market did not respond to the 25 basis point rate reduction. Most assets saw prices consolidate, while many faced corrections. The market correction could have been due to Powell’s bearish speech. It may have also been due to the weak macroeconomic environment and global trade uncertainty.

Another interest rate cut from the Federal Reserve may just trigger a market-wide turnaround. Interest rate reductions are generally considered bullish for the crypto market as they allow investors to put their money in risky assets, as borrowing becomes easier. While interest rate cuts often lead to rallies, the October rate reduction seems to have been an anomaly. Moreover, October has historically been a bullish month for the crypto market.

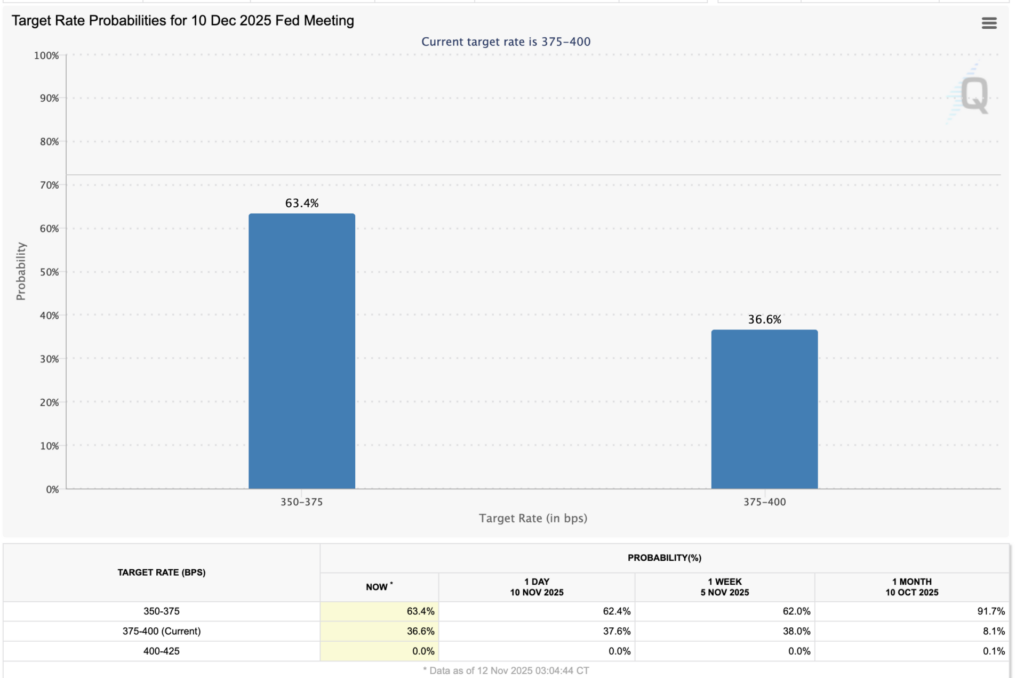

While another rate cut could do the trick for the crypto market, it is still uncertain if the Federal Reserve will actually announce another rate cut in 2025. According to CME FedWatch, there is a 63.4% chance that the Federal Reserve will reduce rates by another 25 basis points in December, while there is a 36.6% chance that rates will remain unchanged.