XRP Tumbles 5% as Canary Capital Prepares to Launch First-Ever Spot ETF

XRP takes a hit just as Wall Street gets ready to play.

The cryptocurrency dropped 5% ahead of Canary Capital's groundbreaking spot ETF launch—because nothing says 'adoption' like a pre-emptive sell-off. Traders clearly aren't waiting for the suits to finish their paperwork.

Here's what's happening:

1. The ETF Effect (Backwards Edition): Usually, crypto pumps on ETF news. Not today. XRP's dip suggests traders are front-running institutional demand—or just cashing in early.

2. The Canary in the Coal Mine: If this ETF flops, it'll be a bad omen for other altcoin funds. But if it soars? Suddenly every hedge fund will 'believe' in Ripple again.

3. The Real Test: Watch volume post-launch. If inflows can't reverse this drop, even Wall Street's magic touch might not save XRP from its regulatory hangover.

Funny how crypto's 'institutional future' still dances to retail's short-term whims. Maybe ETFs just give bankers a new way to lose money like the rest of us.

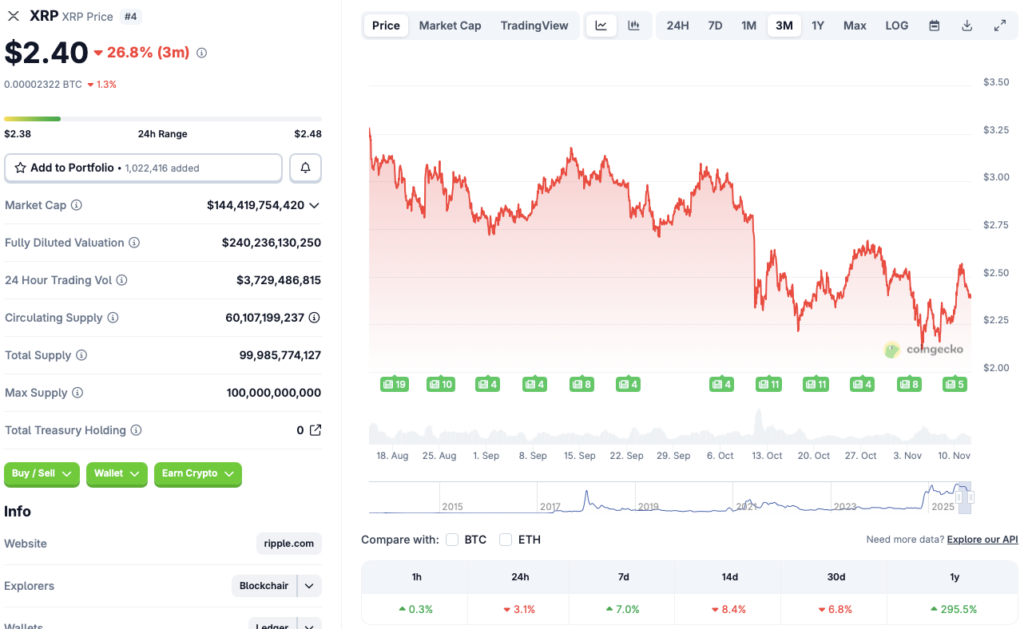

According to CoinGecko, XRP was down more than 5% earlier today in the 24-hour chart, but has slightly recovered and is currently down by 3.1% in the same time frame. The asset is also down by 8.4% in the 14-day charts and 6.8% over the previous month. Despite the sharp dips, XRP has rallied by 7% over the last week and 295.5% since November 2024. Let’s discuss if XRP will rebound over the coming days.

Will XRP Rally After The ETF Launch?

Crypto-based ETF products made their US debut in early 2024, with the launch of several Bitcoin (BTC) and ethereum (ETH) ETFs. Both assets had very contrasting behaviors after their respective ETF launches. While Bitcoin (BTC) hit multiple all-time highs throughout 2024 and well into 2025, Ethereum (ETH) did not see much movement in the first year of its ETF launch. Instead, it took almost one year for ETH to hit a new peak. Which pattern XRP will follow is yet to be seen.

XRP has had quite a bullish year in 2025. Ripple settled its lawsuit with the SEC, and XRP is getting its first ETF launch. Both developments could lead to a massive surge in investor sentiment. We could see a massive influx of institutional money over the coming weeks. Moreover, the Federal Reserve recently slashed interest rates by an additional 25 basis points. The list of bullish developments could greatly aid XRP to hit a new all-time high very soon.