Bitcoin vs Gold: The Ultimate Dollar Hedge Showdown

The dollar's decline sparks the age-old debate: traditional gold or digital bitcoin?

The Digital Gold Revolution

Bitcoin surges as the modern safe haven, bypassing traditional banking systems while gold struggles to match its digital counterpart's performance.

Market Dynamics Shift

Institutional adoption accelerates bitcoin's hedge status, cutting through conventional investment wisdom and challenging gold's centuries-old dominance.

The Verdict Emerges

While gold maintains its physical allure, bitcoin's borderless, decentralized nature positions it as the superior hedge in our increasingly digital economy—proving once again that sometimes the best investments come with a side of blockchain rather than a safety deposit box.

Gold or Bitcoin: Better Hedge Against Inflation?

Gold has been rallying lately, claiming spectacular price highs throughout the year. The metal has been carving its own price trajectory, with analysts predicting how gold can easily hit the $5000 mark by 2026.

Gold slowly but steadily grinding higher allowing miners to catch up. I believe, the next impulsive wave could take gold to $5k with little effort… pic.twitter.com/I6UYz08BJ1

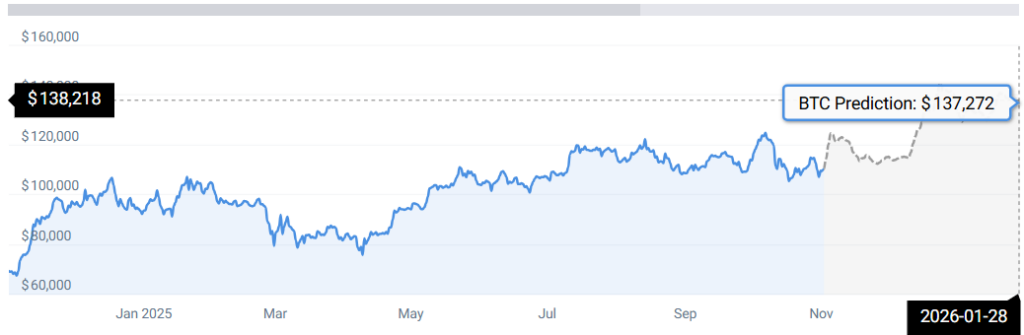

— Rashad Hajiyev (@hajiyev_rashad) October 31, 2025Bitcoin, on the other hand, has also been soaring steadily in the process. With the slow US economic growth and trade tariffs spurring volatility across, bitcoin has gradually been gaining steady momentum, eyeing new price highs worth $137K as predicted by technical platforms.

“

Which Is A Better Inflation Prospect?

According to ChatGPT, gold is touted as a stable short-term inflation hedge, with low volatility and central bank demand as primary sources of support.

The AI, on the other hand, backs Bitcoin as the best hedge for long-term investment prospects. The platform praises Bitcoin for its scarcity, noting that increased tokenization momentum could ultimately help BTC rise in popularity in the NEAR future.