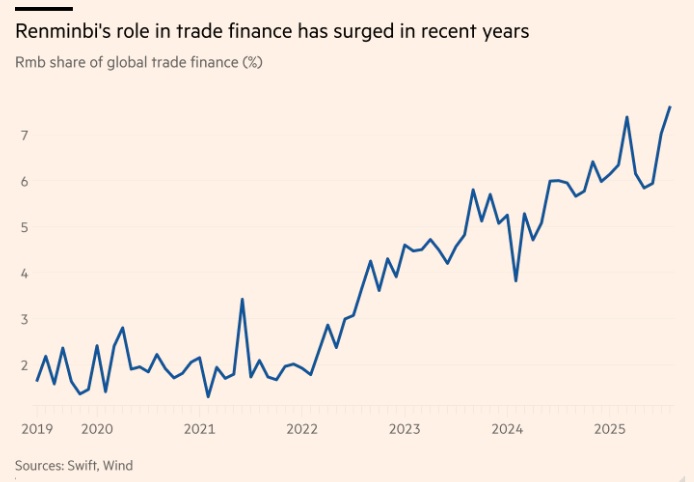

BRICS De-Dollarization Accelerates: Chinese Yuan Lending Surges $480 Billion

The dollar's dominance faces its biggest challenge yet as BRICS nations pivot hard toward the yuan.

The Great Currency Shift

Forget subtle policy changes—this is full-scale financial realignment. BRICS economies are dumping dollar-denominated deals at unprecedented rates, replacing them with Chinese yuan transactions that just crossed the $480 billion mark in lending volume.

Yuan's Ascent Goes Mainstream

What started as political posturing has evolved into concrete financial infrastructure. Cross-border payment systems are being rebuilt, trade settlements are shifting in real-time, and reserve allocations are getting rewritten across multiple central banks.

The New Financial Architecture

This isn't just currency swapping—it's building parallel financial ecosystems. Think SWIFT alternatives, yuan-clearing networks, and commodity pricing that bypasses traditional dollar benchmarks. The move creates self-contained economic blocs that operate outside Western banking channels.

Global Implications Unfold

Watch commodity markets particularly closely. Oil, metals, and agricultural trades are increasingly settling in yuan, creating ripple effects through pricing structures and liquidity patterns worldwide. The dollar's exorbitant privilege? Looking slightly less exorbitant these days.

Of course, Wall Street analysts will call this 'currency diversification' while quietly updating their crisis playbooks—because nothing says financial stability like moving $480 billion away from the world's reserve currency overnight.

Source: SWIFT, Wind

Source: SWIFT, Wind

Exporters and importers in China are now using the Chinese yuan in settlements, the highest since December 2020. The MOVE supports the BRICS de-dollarization agenda and funds the Chinese yuan in the global markets.said Adam Wolfe, Emerging Markets Economist at Absolute Strategy Research in London, to the Financial Times.

BRICS De-Dollarization: Chinese Yuan Makes It To the Top

The Bank for International Settlements (BIS) weighed in on the development, estimating that lending WOULD rise by another $373 billion. It credited the sanctions on Russia as the turning point for BRICS to kick-start the de-dollarization agenda and prioritize local currencies.

the BIS said. This strengthened BRICS de-dollarization as the Chinese yuan took center stage.

BRICS is also making other countries believe in de-dollarization while promoting local currencies. China, especially, is convincing other nations that using the US dollar for all cross-border transactions is a disadvantage. Chinese officials believe thatsaid Bert Hoffman, Professor at the National University of Singapore’s East Asian Institute.