CME Group & Tesla Earnings Loom: Bitcoin Price Impact Incoming?

Two market giants are about to drop financial bombshells that could send crypto markets reeling.

CME's Institutional Pulse

When the world's largest derivatives exchange speaks, Bitcoin listens. CME Group's earnings report isn't just numbers—it's a temperature check on institutional crypto appetite. Their Bitcoin futures volumes often predict where smart money flows next.

Tesla's Crypto Gambit

Remember when Elon's electric empire bought $1.5 billion in Bitcoin? The market surged 20% overnight. Now with Tesla's earnings imminent, traders are watching for any mention of their crypto treasury—still sitting at around $184 million despite selling 75% during the 2022 crash.

The Domino Effect

Positive earnings from either player could trigger a risk-on rally. Negative results might send crypto tumbling alongside traditional markets. Either way, volatility is coming—because when traditional finance heavyweights move, crypto feels the tremors.

Wall Street still treats Bitcoin like a speculative toy while quietly building positions. The hypocrisy would be amusing if it weren't so profitable.

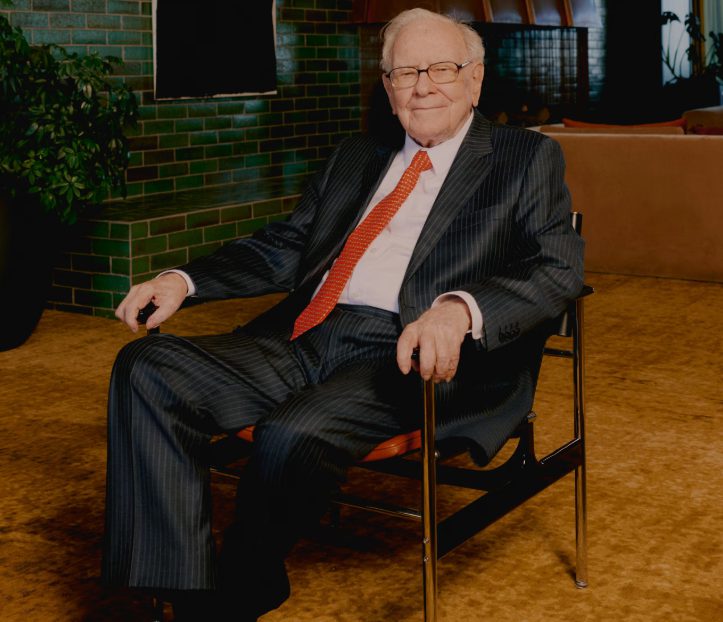

Top Buffett Dividend Picks Backed by Berkshire and Greg Abel’s Strategy

1. Chevron Corporation Leads With Energy Sector Strength

stands as Berkshire Hathaway’s third-largest holding right now and offers a 4.40% dividend yield. As an integrated energy giant, Chevron benefits from what has been described by analysts asin the oil sector. The company’s diversified operations across exploration, refining, and even marketing create multiple revenue streams that remain stable during economic stress.

Energy stocks like Chevron are being viewed as effective hedges against inflation, which makes them essential recession resistant stocks in any portfolio that’s focused on high yield investments.

2. Coca-Cola and Kraft Heinz Dominate Consumer Essentials

Thewith its 2.91% yield, actually represents the ultimate consumer staples play among Buffett dividend stocks. The beverage giant has raised dividends for 62 consecutive years, demonstrating consistency that aligns with the Greg Abel succession planning at Berkshire.

3. Kraft Heinz Delivers Premium Yield Through Essential Food Products

delivers the highest yield at 6.27% among these four holdings in the Berkshire Hathaway portfolio. As a producer of essential food products, the company benefits from non-discretionary demand that persists regardless of economic conditions. Brands like Kraft, Heinz, and also Oscar Mayer maintain pricing power along with customer loyalty across market cycles.

4. Kroger Provides Grocery Sector Stability

rounds out these picks with a 1.90% yield at the time of writing. Operating in what’s considered the most recession-proof sector—grocery retail—Kroger sees consistent traffic regardless of economic conditions. The company’s scale and private label expansion support margin improvement while maintaining competitive pricing.

These four Buffett dividend stocks are a good example of the defensive nature that makes them useful as recession resistant stocks in times of uncertainty, which is a combination of the necessary business models in addition to the reputable dividend track record that has been sustained even in the past declines. The high yield investments, which are provided by these companies are under scrutiny as the larger Berkshire Hathaway portfolio strategy.