Bitcoin 2020-2021 Mega Rally Repeat Incoming? Flash Crash Echoes Spark Bullish Déjà Vu

History doesn't repeat but it often rhymes—and Bitcoin's recent flash crash is playing a familiar tune from the last bull cycle.

The Ghost of Cycles Past

Remember 2020's March crash? Bitcoin plunged 50% in 24 hours—the kind of bloodbath that makes traditional investors reach for their smelling salts. Then came the mother of all rebounds: a 1,500% surge that minted millionaires and left Wall Street dinosaurs scratching their heads.

Pattern Recognition On Steroids

Same script, different actors. Institutional money now flows where only degens dared tread. BlackRock's Bitcoin ETF makes the 2020 Grayscale rally look like amateur hour. The plumbing's better too—exchanges don't buckle under pressure like they used to (mostly).

The Cynic's Corner

Sure, Wall Street's 'adoption' means they'll find new ways to charge 2% fees for crypto exposure—some things never change. But this time, the smart money's betting the house on digital gold while Main Street still thinks NFTs are monkey pictures.

Bottom line: volatility isn't a bug—it's the feature that separates diamond hands from paper portfolios. The last flash crash was a buying opportunity disguised as catastrophe. This one? Feels like history's greatest hits album just dropped track two.

TSMC stock price intraday chart showing surge – Source: CNBC

TSMC stock price intraday chart showing surge – Source: CNBC

AI Boom Powers Massive TSMC Stock Rally After TSM Earnings Beat

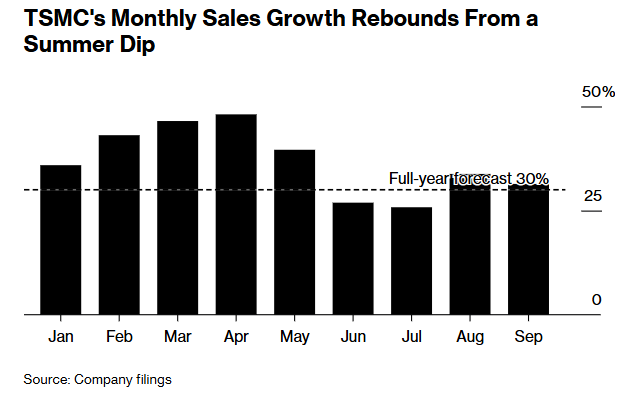

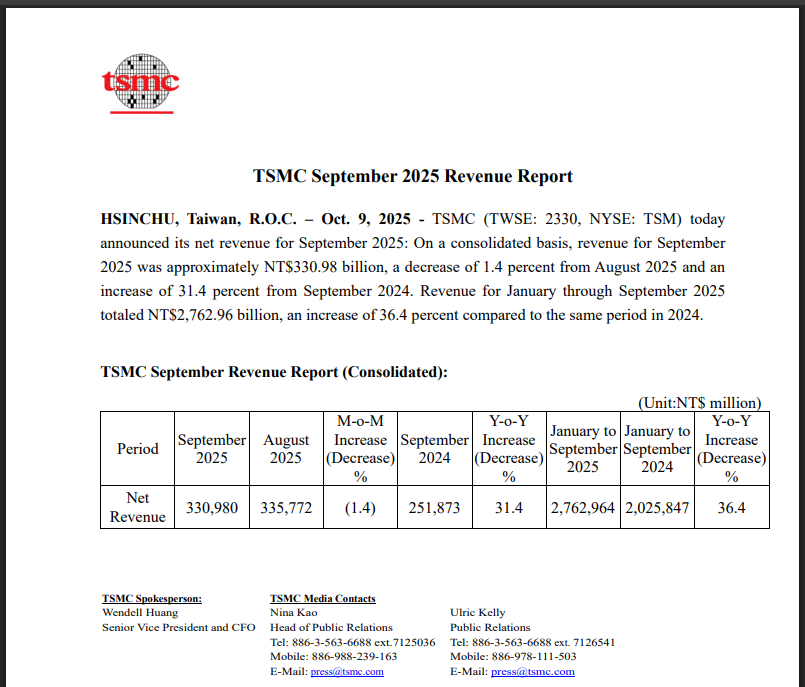

September quarter revenue was NT$759.69, an increase of 36.5 percent over the same period of the previous year. TSMC was also enjoying a high demand of both 3-nanometer and 5-nanometer chips that were used in artificial intelligence applications. The September 2025 revenue was NT$330.98 billion and this was 31.4 percent higher than September 2024.

CEO C.C. Wei also said that:

“Recent developments in AI market continue to be very positive. Thus, our conviction in the AI mega trend is strengthening.”

Strong Results Drive Optimistic Outlook

The stock gained as TSMC raised its 2025 revenue growth forecast to the mid-30% range. The company also increased capital expenditure to $40 billion for capacity expansion. High-performance computing, which includes AI chips along with 5G applications, was responsible for 57% of revenues in the quarter.

Gross margin was expanded to 57.8%, up from 54.3% in the prior year. CFO Wendell Huang provided fourth-quarter guidance of $32.2 billion to $33.4 billion in revenue, even as the company continues ramping up overseas operations.

Wei also said:

“The explosive growth in token volume demonstrated increasing consumer AI model adoption, meaning more computation is needed.”

TSM earnings demonstrated the company’s dominance in advanced chip manufacturing at the time of writing. Wei also addressed some market concerns:

“If the China market is not available, I still think the AI growth will be very positive. I have confidence in my customers.”