Crypto Market Crash: Is This Just the Calm Before an Even Bigger Storm?

Markets tumble as fear spreads through digital asset corridors

The Perfect Storm Brewing

Another 15% drop overnight sends shivers through crypto portfolios worldwide. Bitcoin's slide below critical support levels triggers mass liquidations while altcoins bleed out in spectacular fashion. Trading volumes spike 40% as panic sets in.

Whale Movements Signal Trouble

Major holders shift $2.8 billion to cold storage—either preparing for deeper discounts or bracing for impact. Exchange outflows hit yearly highs as institutional players join the retail exodus. The smart money isn't sticking around to find out what happens next.

Regulatory Headwinds Strengthen

Three separate government agencies announce fresh crackdowns on stablecoin operations. Banking partners pull back support, creating liquidity crunches across decentralized finance platforms. The traditional finance crowd watches from the sidelines with that familiar 'I told you so' smirk.

Technical Breakdown Accelerates

Every major support level shattered like glass. The fear and greed index plunges to extreme fear territory as leveraged positions get wiped out faster than you can say 'margin call.' Chart analysts point to patterns eerily similar to previous catastrophic collapses.

What's Next: Recovery or Ruin?

The real question isn't whether this storm will pass—it's whether your portfolio survives the cleanup. History shows these moments create generational buying opportunities... or financial graves. Choose wisely, because in crypto, the difference between genius and idiot often comes down to timing and, let's be honest, pure luck.

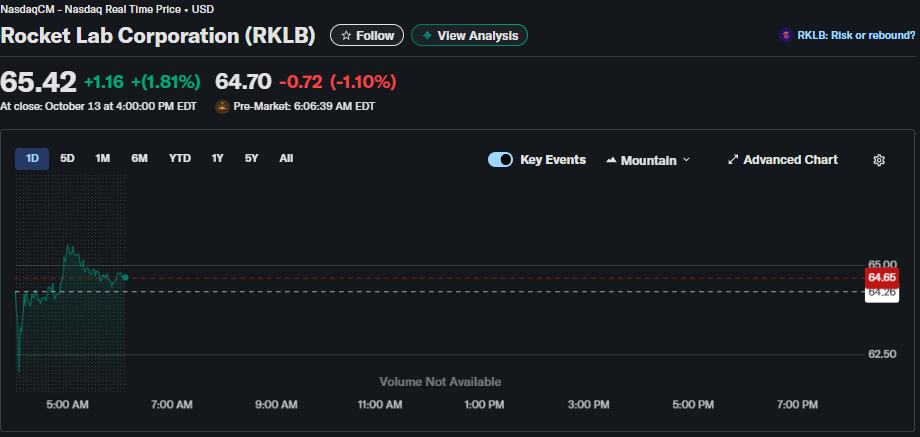

Rocket Lab Stock Surges With Morgan Stanley Price Target Amid SpaceX Comparison

Morgan Stanley Upgrades RKLB With $68 Target

Morgan Stanley analyst Adam Jonas established the RKLB $68 target, calling Rocket Lab stockavailable to public investors. The SpaceX comparison demonstrated that Rocket Lab is a player in the market of launching products and services and that vertically pushing the values of its business model resembles the way in which SpaceX operates.

Adam Jonas had this to say:

“Rocket Lab is the closest thing to a SpaceX proxy available to public market investors.”

Its RKLB price target of $68 is a considerable premium over its assets, and the Morgan Stanley price target will be pegged on the Rocket Lab development of the Neutron rocket and its growing launch program. The optimistic outlook on Rocket Lab shares indicates the increased trust in the commercial space business and the competitive position within the company.

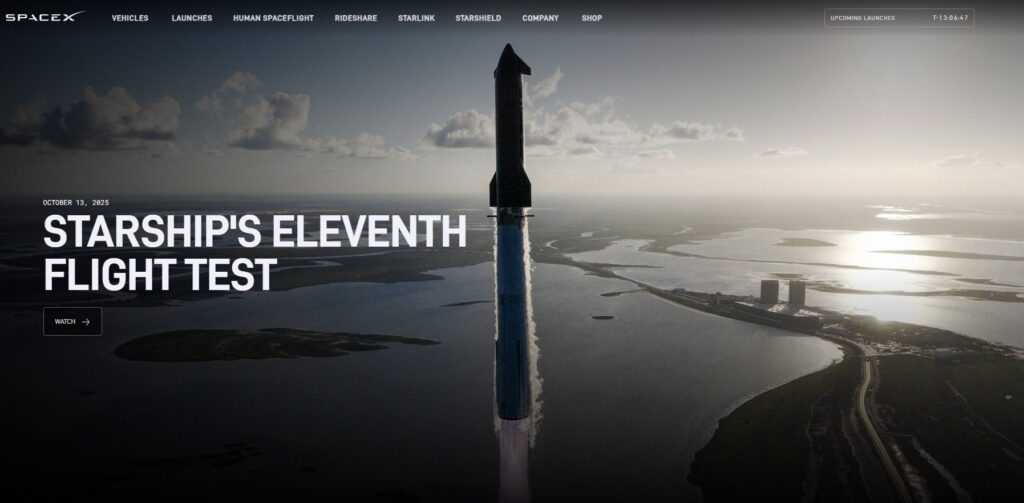

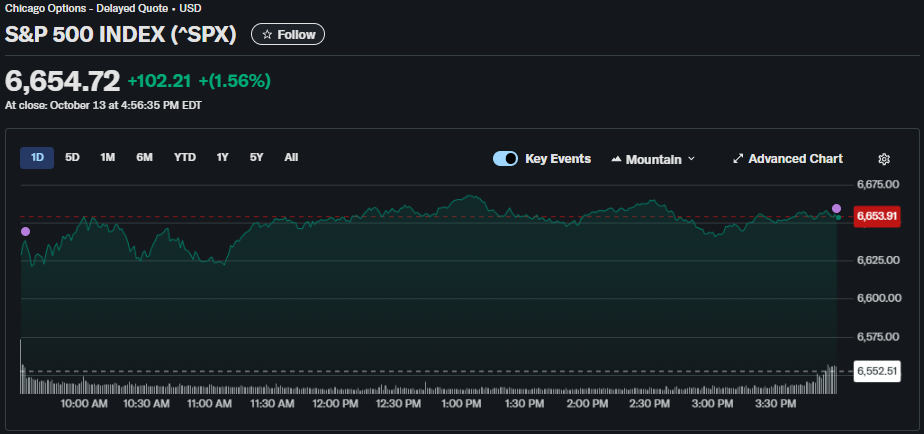

SpaceX Starship Test Drives Space Stock Rally

Another successful demonstration of the eleventh SpaceX Starship flight on October 13, 2025, elevated the mood in the space stock markets such as Rocket Lab stock. The test was a seminal milestone to the reusable rocket program.

Great work by the @SpaceX team https://t.co/75Wei3wMrS

— Elon Musk (@elonmusk) October 14, 2025SpaceX stated:

“Splashdown confirmed! Congratulations to the entire SpaceX team on an exciting eleventh flight test of Starship!”

Elon Musk also commented on the achievement:

“Great work by the @SpaceX team”

The successful Starship test boosted investor confidence in commercial space projects, and the momentum transferred to other space-related firms. The Morgan Stanley price target of Rocket Lab shares followed this industry-wide exuberance as analysts observe increasing opportunities throughout the industry.

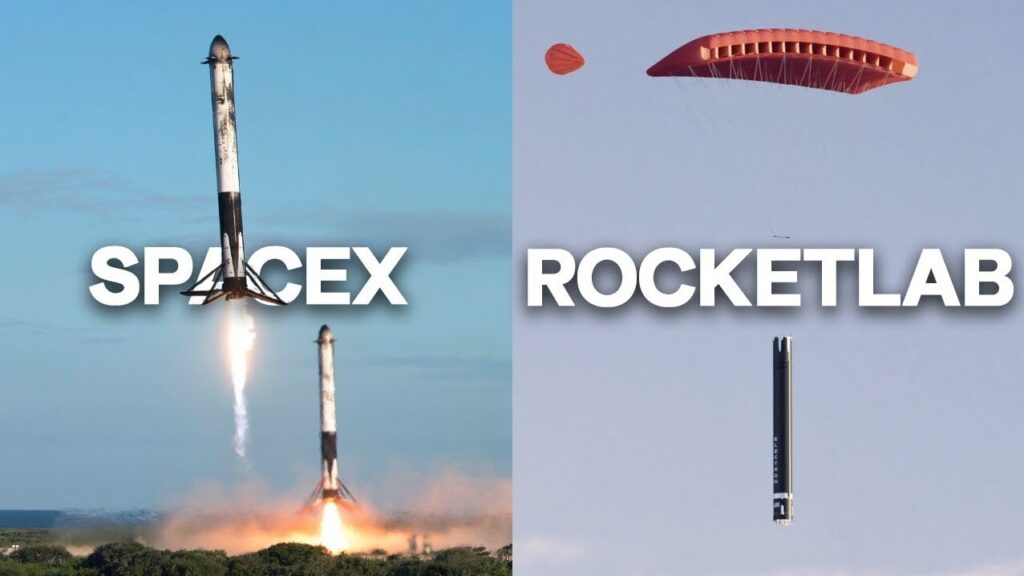

Rocket Lab vs SpaceX: Different Scales, Shared Vision

The debate between Rocket Lab and SpaceX has heightened among investors despite the fact that the firms operate in different markets. The stock of Rocket Lab enjoys the fact that it has concentrated on small to medium-sized payloads with its Electron rocket, and it is developing Neutron, a larger vehicle. The reason why the SpaceX comparison is possible is due to the fact that both companies placed importance on reusable rocket technology and vertical integration.

The Morgan Stanley RKLB $68 is a target that also recognizes the distinction of Rocket Lab as a publicly-traded pure-space company. Rocket Lab stock has been packaged as a convenient entry point to an investment in the commercial space economy, with SpaceX remaining privately owned. This positioning is also backed by the Morgan Stanley’s price target, where analysts have seen the recent Starship success as confirmation of the potential of the entire industry.