Canary Capital’s Bold Move: Files for Revolutionary Solana ETF with Game-Changing SOL Staking Feature

Wall Street meets Web3 as traditional finance takes its biggest leap yet into crypto's future.

The Staking Revolution Hits Main Street

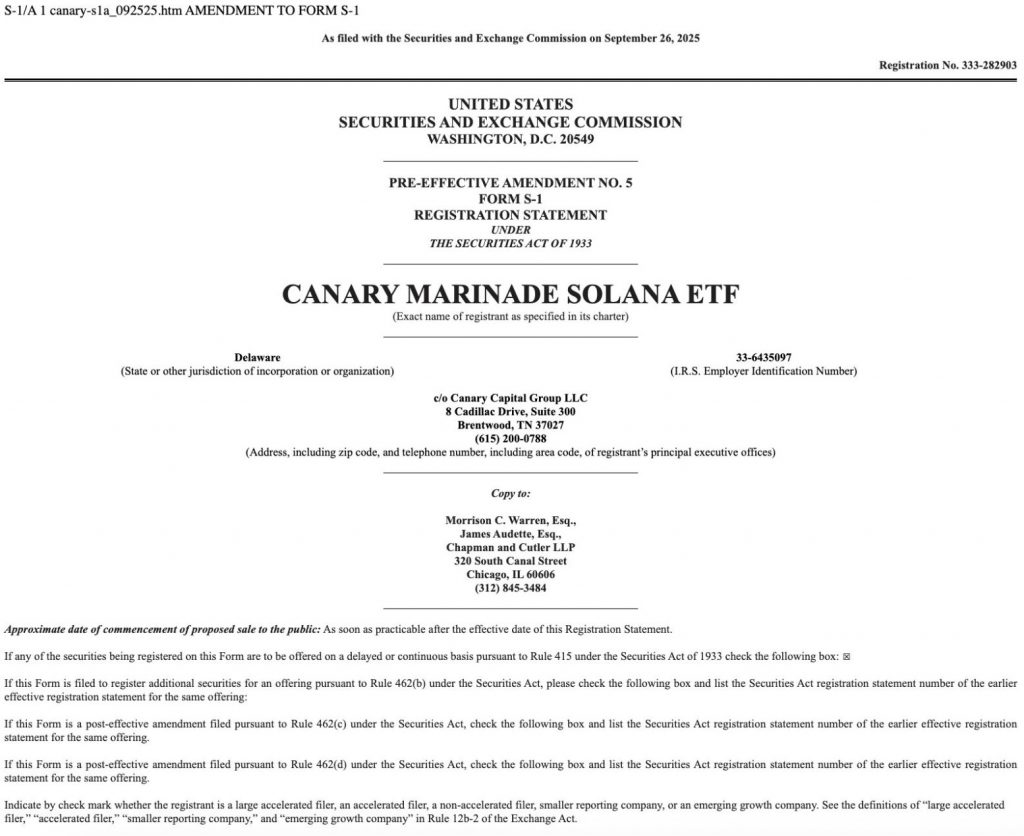

Canary Capital just dropped a regulatory bombshell that could reshape how ordinary investors access crypto yields. Their newly filed Solana ETF doesn't just track SOL's price—it actually stakes the underlying assets to generate passive income.

Why This Changes Everything

Traditional finance finally acknowledges what crypto natives knew for years: digital assets can work while they sleep. The filing bypasses conventional ETF structures by incorporating native blockchain functionality directly into the product design.

The Regulatory Gauntlet

SEC approval remains the elephant in the room—regulators historically treat staking like a four-letter word. Canary's move forces the conversation about whether old frameworks can handle new technology.

Wall Street's latest 'innovation'? Discovering that money can actually earn money—something crypto traders figured out back in the Obama administration.

Source: SEC

Source: SEC

Will The SEC Approve a Solana ETH in 2025?

Cryptocurrency-based ETFs have been in the spotlight over the last year. The US SEC made history in 2024 by approving 11 spot Bitcoin ETFs and 8 spot ethereum ETFs. ETF inflows have led to both assets hitting new all-time highs in 2025. A Solana (SOL) ETF becoming a reality may be just a matter of time.

The US SEC recently adopted new rules for listing cryptocurrency ETFs. Previously, each crypto ETF had to go through a lengthy and complex approval process. Under the new system, exchanges like the NYSE, Nasdaq, and Cboe can now list crypto ETFs more quickly. The move sheds light on the SEC’s pro-crypto stance.

There is a very high chance that the SEC will approve at least one Solana (SOL) ETF sometime this year. If not in 2025, there is a chance that the financial watchdog will green-light a spot SOL ETF in early 2026.

There is a possibility that Solana (SOL) will see increased institutional interest if an ETF is approved. Institutional money is key in driving an asset’s price. SOL could easily hit a new all-time high if it follows Bitcoin’s (BTC) trajectory after a potential ETF launch.

So far, the SEC has yet to pass judgment on the Solana (SOL) ETF applications. How things pan out for the asset is yet to be seen.