16 Major Banks Unite to Launch EDP, Targeting ECB’s Digital Euro by 2028

Sixteen banking giants just dropped a blockchain bombshell—forming a European Digital Payments coalition to build the ECB's digital euro infrastructure.

The Banking Alliance Awakens

Forget slow-moving central bank pilots. This consortium cuts through bureaucratic red tape, pooling resources to hit the European Central Bank's 2028 deadline. They're not waiting for permission—they're building the rails.

Infrastructure Over Ideology

These institutions finally recognized something crypto natives knew for years: digital currency infrastructure can't be an afterthought. The EDP initiative bypasses theoretical debates, focusing on scalable settlement layers that could handle everything from micropayments to cross-border transfers.

The Timeline Pressure Cooker

Three years might seem generous—until you consider the regulatory hurdles and technical integration required. The 2028 target forces rapid iteration, mirroring private sector development cycles rather than typical central bank timelines.

Of course, watching traditional banks scramble to build what Satoshi solved decades ago does bring a certain irony—nothing motivates innovation like the threat of irrelevance.

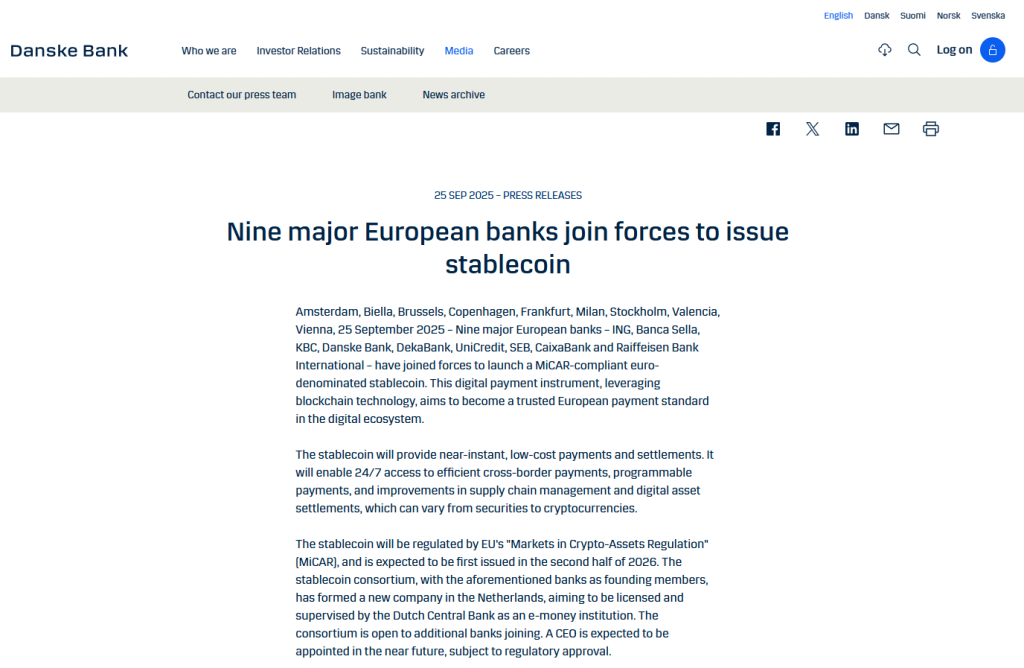

Nine major European banks joining forces to issue stablecoin – Sourc: danskebank.com

Nine major European banks joining forces to issue stablecoin – Sourc: danskebank.com

Euro Stablecoin Initiative Paves Road for ECB Digital Euro Future

The EDP consortium includes some big names like ING, Banca Sella, KBC, Danske Bank, and also DekaBank, UniCredit, SEB, CaixaBank, along with Raiffeisen Bank International. This European bank stablecoin will be MiCAR-compliant and actually aims to become a trusted European payment standard in the digital ecosystem.

Digital Euro Development Through Private Innovation

At the time of writing, this private sector euro stablecoin initiative boosts digital euro development. The EDP consortium has actually formed a new company in the Netherlands, and they’re seeking licensing from the Dutch Central Bank as an e-money institution. The EU aims to fully implement the digital euro by 2028, which is a notably ambitious target.

Technical Features and Timeline

The European bank stablecoin will provide near-instant, low-cost payments and settlements with 24/7 access to efficient cross-border payments right now. The EDP consortium plans first issuance in the second half of 2026, which supports the broader euro stablecoin initiative timeline.

This euro stablecoin project provides the necessary infrastructure that will then be used in the implementation of the digital euro at the ECB later on and in fact, it shows how the EDP consortium is transiting the traditional banking to the digital currency innovation.