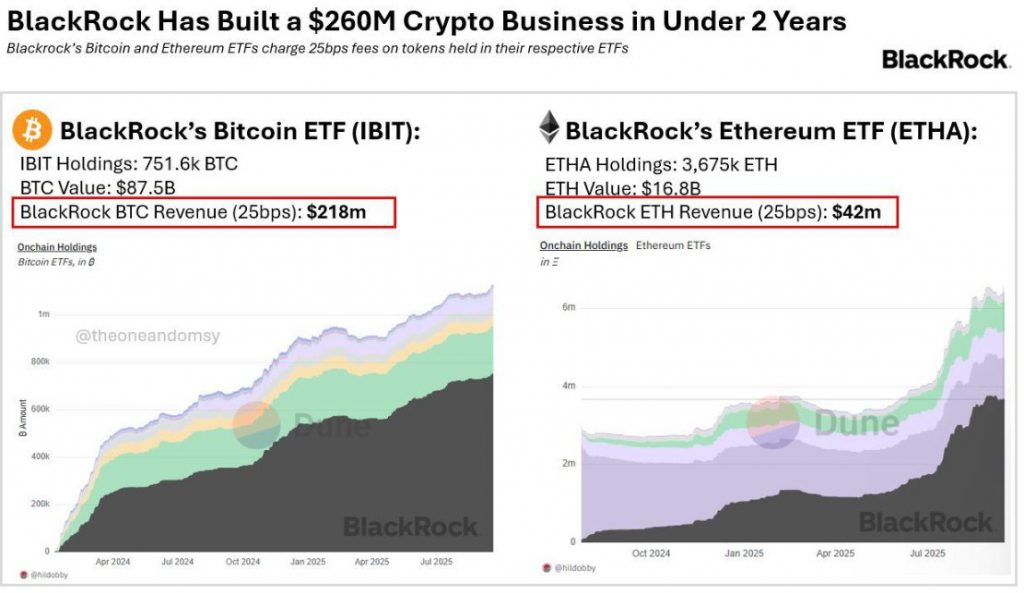

BlackRock Rakes in $260 Million Annually from Bitcoin & Ethereum ETFs

Wall Street's quiet crypto coup just hit paydirt.

The Fee Machine Churns

BlackRock's digital asset division quietly became a revenue powerhouse while traditional finance scoffed at crypto. The firm's Bitcoin and Ethereum ETF products now generate a staggering $260 million in annual income—proving institutional adoption isn't just real, it's profitable.

Mainstream Money Flows

Investors flock to regulated crypto exposure like never before. The ETFs bypass technical hurdles that kept pension funds and retirement accounts on the sidelines. Now grandma's IRA buys digital gold alongside Treasury bonds.

Legacy finance still calls it a speculative bubble—between counting their own ETF management fees, of course.

In less than 2 ye,ars their Bitcoin and ethereum ETFs are generating over $260M in annual revenue.

That’s a quarter-billion-dollar business, built almost overnight. For comparison, many… pic.twitter.com/NuhZnlMMAS — Leon Waidmann

![]()

BlackRock Bitcoin & Ethereum ETFs Drive $260M Annual Revenue

The data shows how BlackRock’s crypto ETF strategy has been creating unprecedented revenue generation. BlackRock ETF revenue reaches $218 million from BTC products alone, while the BlackRock Ethereum ETF contributes an additional $42 million annually. This BlackRock crypto ETF success demonstrates the massive institutional appetite for regulated cryptocurrency exposure that has been growing.

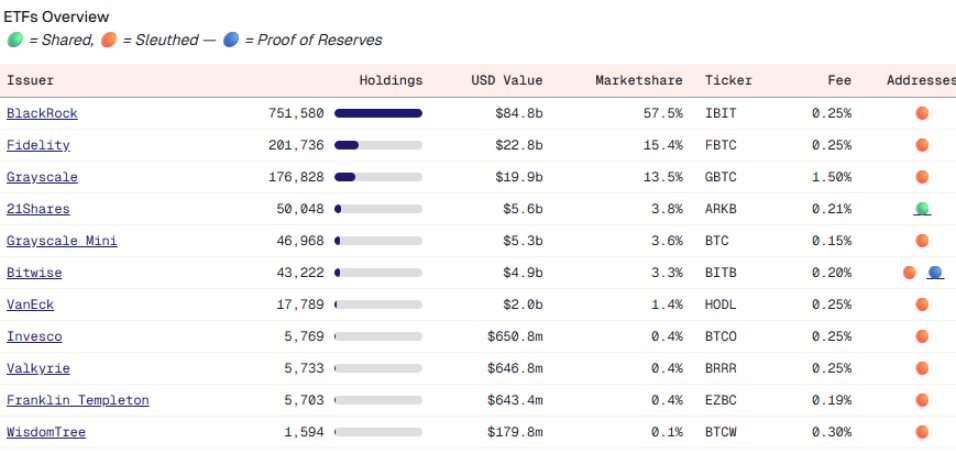

Market Dominance Through Strategic BlackRock Bitcoin ETF Leadership

BlackRock Bitcoin ETF commands an impressive 57.5% market share of U.S. spot Bitcoin ETFs, significantly outperforming competitors even at this point. The fund’s BlackRock ETF AUM exceeds $85 billion across both cryptocurrency products, with the Bitcoin ETF pulling in over $60 billion since launch.

The Ethereum ETF by BlackRock has also acquired significant assets with an addition of 13 billion dollars even though the Ethereum ETF was launched many months later than the bitcoin counterpart. This crypto ETF performance of BlackRock demonstrates the potential of the company to gain market share within a short period of time and stay in leading positions of various crypto assets.

Revenue Milestone Marks Turning Point

Leon Waidmann from the Onchain Foundation also had this to say about the achievement:

“The $260 million revenue milestone underscores a turning point for traditional finance.”

The BlackRock ETF AUM success story demonstrates how digital assets have been moved from speculative investments into mainstream finance. BlackRock’s BTC ETF and Ethereum offerings now represent Core business lines that also rival fintech startup revenues built over decades.

The firm’s exploration of tokenized ETFs suggests BlackRock Bitcoin ETF innovations will continue driving institutional adoption going forward. This BlackRock crypto ETF leadership sets benchmarks for pension funds, insurers, along with sovereign wealth funds entering cryptocurrency markets right now.