JP Morgan Spots Golden Opportunity as Rate Cut Sends Dollar Tumbling

Wall Street's banking giant just flipped bullish as monetary policy shifts create fresh openings.

Dollar's Decline Opens Floodgates

JP Morgan analysts are circling like sharks after the Federal Reserve's latest rate cut weakened the US dollar's dominance. The currency slide creates perfect conditions for alternative assets to gain traction.

Cryptocurrency Markets Poised for Breakout

Digital assets typically thrive when traditional currencies stumble. Bitcoin and Ethereum already showing strength as institutional money seeks hedges against fiat weakness.

Traditional Finance Plays Catch-Up

While JP Morgan's sudden optimism feels like déjà vu—bankers always discover opportunities right after they've materialized—the timing suggests major players are finally understanding what crypto natives knew years ago: decentralized finance doesn't wait for permission.

Investing Beyond the US With JP Morgan Rate Cut Forecast Insights

The Fed’s decision came with some details that really matter right now. Most officials are penciling in one to two more cuts this year, and there was actually one person who disagreed – Stephen Miran, who wanted a bigger 50-basis-point cut instead. The projections also point to stronger growth, slightly lower unemployment, and a bit more inflation ahead.

Markets really liked the news. After a quiet start, things picked up momentum and the S&P 500 pushed to new highs – its 26th record high this year. Small companies also hit new highs for the first time since 2021.

JP Morgan Rate Cut Forecast: Rate Cuts During Economic Slowdown Create Global Opportunities

This rate cut is happening during a slowdown, not a full recession, which usually helps global investments perform better. Corporate profit margins are NEAR their highest levels in history right now, and companies are feeling more optimistic about the next six to 12 months.

Federico Cuevas, who works as a Global Investment Strategist at JP Morgan, had this to say:

When the US dollar gets weaker, investments in other countries often do just as well or even better than US investments during these rate-cutting periods.

Why International Markets Look Attractive

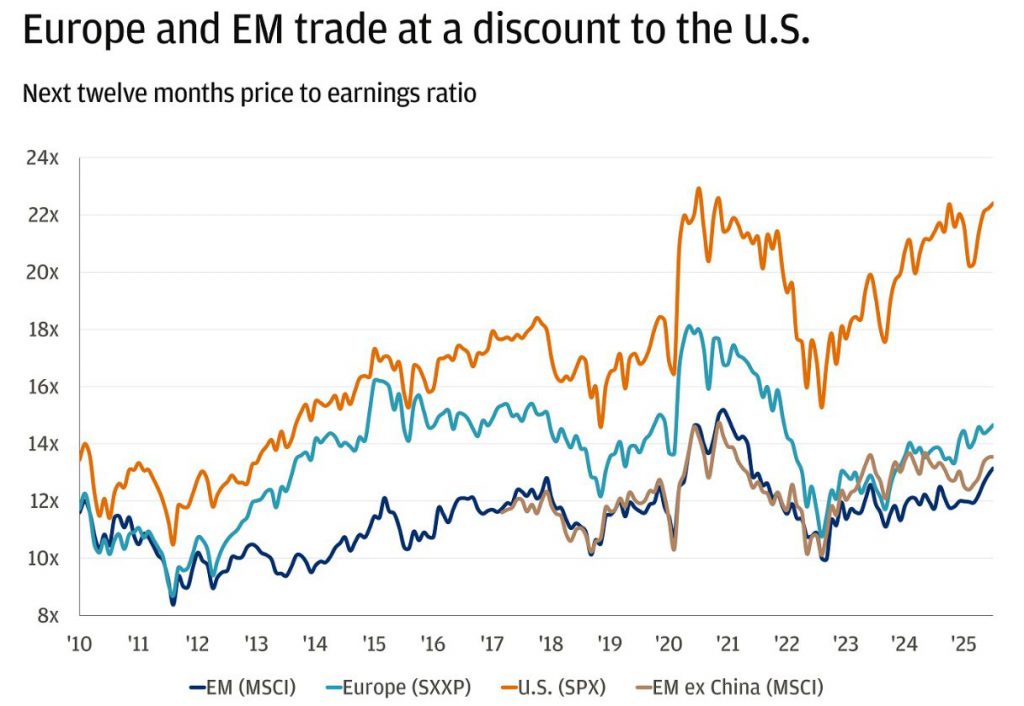

Three things are making JP Morgan focus on international opportunities. US stock prices are pretty high right now – the S&P 500 is trading at about 22.5 times what companies are expected to earn over the next year. That’s similar to levels we saw back in the late 1990s and 2000. European and emerging markets are trading at around 15 times earnings, which means they’re about 40% cheaper.

The US market is also really concentrated. The top 10 biggest stocks make up about 40% of the S&P 500 and 35% of all earnings. This makes spreading investments across different countries more important for reducing risk.

JP Morgan Rate Cut Expectations & How Regional Opportunities Are Opening Up

Europe is showing steady improvement with inflation getting close to 2% and the European Central Bank moving to a neutral position. The main European stock index has gained about 10% this year in local currency terms, or 22% when measured in US dollars. Germany has committed 500 billion euros in public support along with 631 billion euros in planned corporate investments.

Emerging markets represent a huge portion of the global economy – 86% of the world’s people, 59% of global economic output, and 44% of exports. The main emerging markets index has climbed about 25% this year, benefiting from easier Fed policy and a weaker dollar.

Taiwan looks particularly strong with its central bank raising growth forecasts to 4.6% for 2025. Exports hit a record $58.5 billion in August, up 34% from last year. South Korea’s chip exports also reached all-time monthly highs at $15.1 billion, jumping 27% year-over-year.

Getting Started With International Investments

A good starting point is putting about 15% of a stock and bond portfolio into international markets. This approach helped protect JP Morgan’s investment portfolios during the market pullback that happened in April.

China presents a mixed picture right now. The overall economy is still weak, with deflation running at -0.4%, but exports are holding up well and contributing most to economic growth this year.

JP Morgan’s strategy encourages looking for opportunities both in the US and internationally as the Fed’s policy changes create better conditions for spreading investments across global markets.