Market Dip Intensifies: Will Bitcoin Plunge Below $100,000 Threshold?

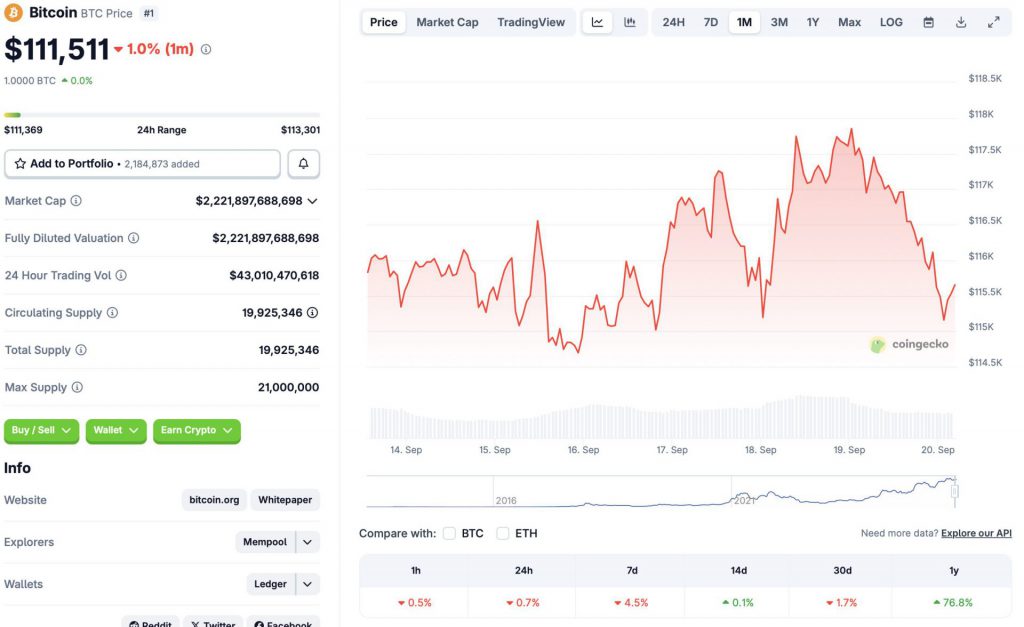

Bitcoin teeters on the edge as the crypto market extends its downward spiral. The $100,000 psychological barrier now faces its toughest test since the asset's last major correction.

The Perfect Storm Gathers

Market forces converge to create unprecedented pressure on digital assets. Institutional investors pull back while retail traders scramble for exits—classic panic behavior that makes traditional finance guys pat themselves on the back for sticking with bonds.

Technical Breakdown Accelerates

Key support levels crumble as selling volume spikes. The charts show patterns reminiscent of previous major corrections, though this time with higher stakes given Bitcoin's current market dominance.

Industry Reactions Split

Crypto veterans double down on 'buy the dip' mantras while regulators quietly sharpen their knives. Meanwhile, Wall Street analysts suddenly remember all the reasons they never understood blockchain technology in the first place.

The coming days will determine whether this is a healthy correction or the start of something more serious. One thing's certain: the crypto market never does anything quietly—whether crashing or climbing.

Source: CoinGecko

Source: CoinGecko

Why Is The Crypto Market Falling?

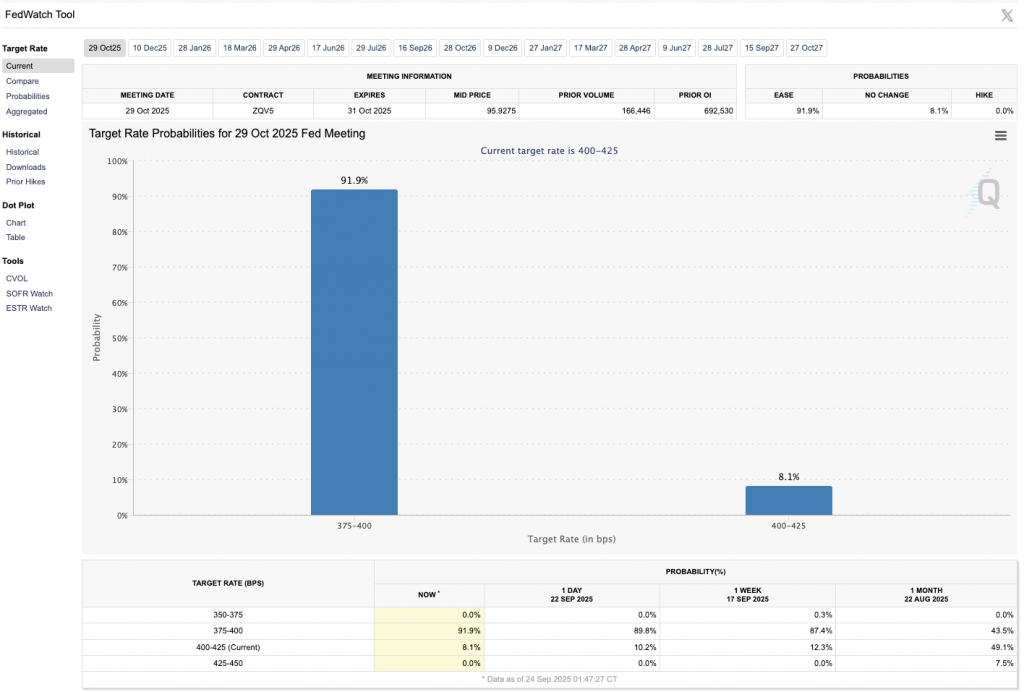

Bitcoin’s (BTC) downturn comes despite an interest rate cut earlier this month. The Federal Reserve slashed interest rates by 25 basis points, leading to a brief market rally, before this week’s correction. Federal Reserve Chair Jerome Powell delivered a speech yesterday, where he stated that weakness in the labor market is outweighing concerns about stubborn inflation. The development prompted the Fed to cut interest rates.

Powell further stated, “”

The uncertain path may have led to a dip in investor sentiment. Bitcoin (BTC) and the larger crypto market may have succumbed to the Fed’s slightly restrictive stance.

Will Bitcoin Fall Below $100,000?

According to CoinGlass data, the crypto market faced $292.30 million worth of liquidations in the last 24 hours. If the liquidations continue, Bitcoin (BTC) could continue its downward trajectory.

Bitcoin (BTC) has some support at the $112,000 price level. BTC’s price may consolidate around current levels for the time being. If BTC dips below $110,000, it WOULD face substantial risks of falling to $100,000.

There is a chance that bitcoin (BTC) will recover over the coming weeks. The CME FedWatch tool hints at a 91/9% chance of an interest rate cut in October. Another interest rate cut could trigger a market-wide rally. Such a development could push Bitcoin’s (BTC) price to a new all-time high.