XRP Price Prediction 2025: Can XRP Hit $3.60 and Beyond? Technical and Fundamental Analysis

- What's Driving XRP's Current Price Movement?

- How Are Whales and Institutions Affecting XRP?

- What Technical Patterns Suggest About XRP's Future?

- How Are Fundamental Developments Supporting XRP?

- What Are the Risks and Opportunities for XRP Investors?

- XRP Price Prediction: Frequently Asked Questions

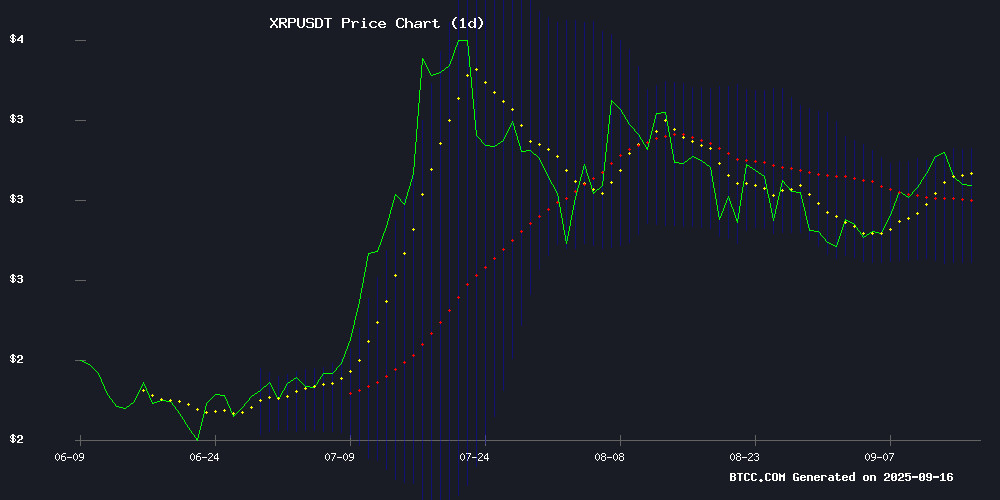

XRP is currently trading at $3.001, showing bullish momentum above its 20-day moving average while testing key resistance levels. This comprehensive analysis examines both technical indicators and fundamental developments that could propel XRP to $3.60 and potentially higher targets. We'll explore whale activity, institutional interest, ETF developments, and Ripple's ecosystem growth that are shaping XRP's price trajectory in September 2025.

What's Driving XRP's Current Price Movement?

XRP has been one of the standout performers in the crypto market this September, currently trading at $3.001 with clear bullish signals. The cryptocurrency recently surpassed Citigroup in market capitalization before retracing slightly, demonstrating its growing significance in global finance. According to TradingView data, XRP's technical setup shows it's positioned above its 20-day moving average of $2.9166, while testing the upper Bollinger Band resistance at $3.1352.

The MACD indicator presents an interesting picture - while still in negative territory at -0.0786, the histogram shows weakening bearish pressure at -0.0777. This suggests that despite recent profit-taking, the underlying momentum remains constructive. "We're seeing classic consolidation after a strong move," notes a BTCC market analyst. "The key will be whether XRP can convert this resistance into support."

Source: BTCC price charts

How Are Whales and Institutions Affecting XRP?

The past two weeks have seen significant whale activity, with approximately 160 million XRP (worth $486 million) moved off exchanges. On-chain data from Coinmarketcap shows addresses holding 1-10 million XRP reduced their balances after peaking earlier this month. This profit-taking behavior is typical during strong rallies but raises questions about short-term volatility.

Meanwhile, Coinbase's XRP reserves have plummeted by 90% since June, dropping from 780 million to just 99 million tokens. This dramatic outflow has fueled speculation about institutional accumulation, though no major player has claimed responsibility. "When you see this kind of drawdown from a major exchange, it often signals smart money positioning," observes crypto analyst Ali Martinez.

| Metric | Value | Significance |

|---|---|---|

| Whale Sell-off | 160M XRP ($486M) | Short-term bearish pressure |

| Coinbase Outflow | 90% reduction | Potential institutional buying |

| ETF Launch | REX-Osprey XRPR | Long-term bullish signal |

What Technical Patterns Suggest About XRP's Future?

The weekly chart reveals a potentially significant bullish flag pattern, with analyst Stedas identifying $3.60 as the critical resistance level. A decisive break above this point could open the door to much higher targets, including $6, $13, and even $23 by year-end based on historical pattern projections.

On shorter timeframes, the TD Sequential indicator recently flashed a buy signal on the 4-hour chart, suggesting downward pressure may be exhausting. This pattern has historically preceded uptrends in XRP's price action. "The setup looks primed for continuation," says Martinez, who maintains a $3.60 price target in the NEAR term.

Key levels to watch:

- Support: $2.9166 (20-day MA), $3.00 psychological level

- Resistance: $3.1352 (upper Bollinger Band), $3.30, $3.60

- Breakout Targets: $3.80, $4.49 Fibonacci extensions

How Are Fundamental Developments Supporting XRP?

The crypto landscape for XRP has transformed significantly in 2025. The imminent launch of the REX-Osprey XRP ETF (XRPR) marks a watershed moment - it's the first U.S. ETF offering direct XRP exposure with a unique hybrid structure combining spot holdings with traditional assets.

Ripple's ecosystem continues expanding, with the company committing $25 million in RLUSD stablecoins to support small businesses and veterans through partnerships with Accion Opportunity Fund and Hire Heroes USA. This follows a similar $25 million educational initiative earlier in the year, demonstrating Ripple's commitment to real-world blockchain utility beyond speculative trading.

These developments come amid XRP reclaiming its position among the top 100 global assets, briefly surpassing Citigroup's market cap and currently sitting above BlackRock and Sony. The cryptocurrency's $182 billion valuation reflects growing mainstream acceptance, though its volatility relative to traditional blue chips remains pronounced.

What Are the Risks and Opportunities for XRP Investors?

The current XRP landscape presents both compelling opportunities and notable risks. On the bullish side, the technical setup appears strong, institutional interest seems to be growing (evidenced by exchange outflows), and fundamental developments like the ETF launch provide structural support.

However, the whale sell-off and overbought conditions (Stoch RSI at 88.89) suggest potential near-term turbulence. The Federal Reserve's upcoming FOMC decision could also impact crypto markets broadly, though XRP has shown relative resilience during recent risk-off periods.

For investors considering positions, key factors to monitor include:

- ETF inflows once XRPR begins trading

- Whale wallet movements and exchange balances

- Ripple's ongoing ecosystem development

- Regulatory clarity (particularly regarding stablecoins)

- Broader crypto market sentiment

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

XRP Price Prediction: Frequently Asked Questions

What is the current XRP price prediction for 2025?

Analysts have varying targets for XRP in 2025, with near-term predictions around $3.60 based on technical patterns, and some longer-term projections reaching as high as $23 if bullish continuation patterns play out. The current price of $3.001 sits above key support levels, suggesting underlying strength.

Is XRP a good investment right now?

XRP presents an interesting risk/reward proposition at current levels. The technical setup appears favorable, and fundamental developments like the ETF launch provide support. However, investors should be aware of potential volatility from whale movements and broader market conditions.

What are the key resistance levels for XRP?

The immediate resistance to watch is the upper Bollinger Band at $3.1352, followed by $3.30 and the critical $3.60 level that analysts believe could trigger more significant upside if broken decisively.

Why did Coinbase's XRP reserves drop 90%?

The dramatic reduction in Coinbase's XRP holdings (from 780M to 99M) has fueled speculation about institutional accumulation, though no major entity has confirmed this activity. Such large exchange outflows often precede significant price movements.

When will the XRP ETF launch?

The REX-Osprey XRP ETF (XRPR) is scheduled to launch this week after previous delays. Its unique hybrid structure combining spot XRP with traditional assets makes it distinct from conventional crypto ETFs.

How does whale activity affect XRP's price?

Recent whale movements (160M XRP sold over two weeks) have created short-term downward pressure, but the simultaneous exchange outflows suggest more complex dynamics at play between different classes of large holders.

What makes XRP different from other cryptocurrencies?

XRP's primary differentiation comes from Ripple's focus on cross-border payments and financial institution adoption, along with greater regulatory clarity compared to many other digital assets following its legal battles with the SEC.