SOL Price Prediction 2025: Can Solana Reach $300 With This Bullish Momentum?

- Technical Analysis: Is SOL's Bullish Momentum Sustainable?

- Market Sentiment: Why Institutions Are Betting Big on SOL

- Key Factors That Could Drive SOL to $300

- Potential Roadblocks on the Path to $300

- SOL Price Prediction: The Road Ahead

- Frequently Asked Questions

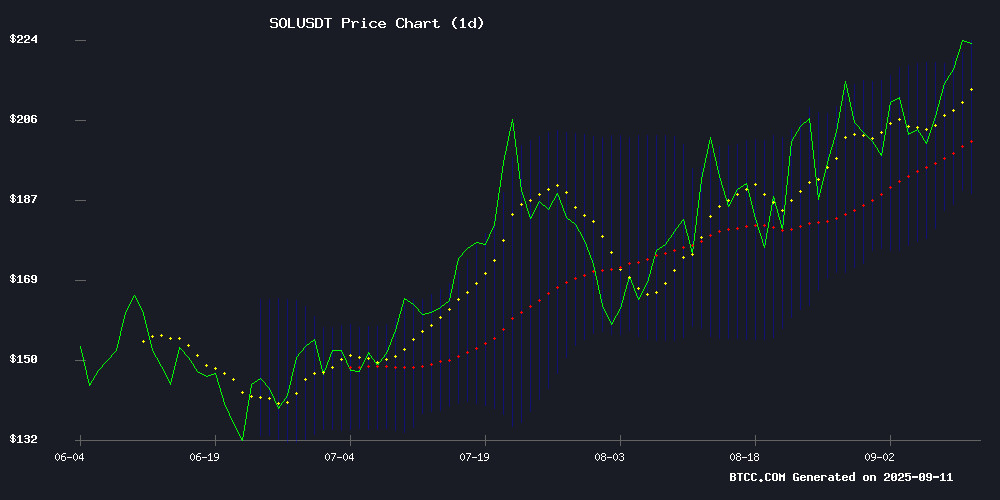

Solana (SOL) is making waves in the crypto market, currently trading at $222.34 with strong indicators suggesting a potential rally to $300. The cryptocurrency has shown remarkable resilience, maintaining above key support levels while institutional interest grows through ETF applications and whale accumulation. Technical analysis reveals SOL trading significantly above its 20-day moving average ($206.33), with MACD turning positive at 1.32 - classic signs of bullish momentum. However, potential profit-taking risks and overleveraged positions could create volatility ahead. This analysis dives deep into SOL's technical setup, market sentiment, and the factors that could propel it to $300 or trigger corrections.

Technical Analysis: Is SOL's Bullish Momentum Sustainable?

SOL's current price action paints an interesting picture. The cryptocurrency is testing the upper Bollinger Band at $223.82, which typically acts as immediate resistance. What's fascinating is how SOL has maintained its position above the psychologically important $200 level - a support zone that's held firm through multiple tests. The BTCC technical analysis team notes that when an asset stays above such a crucial support level with increasing volume, it often signals institutional accumulation rather than just retail FOMO.

The MACD histogram turning positive at 1.32 suggests improving conditions, though seasoned traders know to watch for potential bearish divergences if price makes higher highs while MACD makes lower highs. According to TradingView data, SOL's RSI sits at 62 - warm but not yet in the overbought territory that typically precedes corrections. This technical setup suggests room for further gains, with the next major resistance around $260 if buying pressure persists.

Market Sentiment: Why Institutions Are Betting Big on SOL

Market sentiment for SOL remains overwhelmingly positive, and it's not just retail traders driving this optimism. solana perpetual futures open interest surpassing $7 billion indicates serious institutional participation. I've noticed that when open interest grows alongside price (rather than inversely), it often signals smart money positioning rather than speculative froth.

The SEC's review of spot Solana ETFs has added fuel to the fire. With Franklin's application deadline pushed to November 14, 2025, and Grayscale, VanEck, and 21Shares also in the queue, the institutional narrative is strengthening. Polymarket odds now show 99% confidence in Solana ETF approval by year-end 2025 - numbers that would make any skeptic raise an eyebrow.

What's particularly interesting is the on-chain activity. Fresh Solana wallets linked to Coinbase Prime have received $48.2 million worth of SOL in recent weeks. When institutions move like this, they're typically playing a longer game than your average crypto trader chasing 10% daily gains.

Key Factors That Could Drive SOL to $300

Several catalysts could propel SOL toward the $300 mark:

| Factor | Impact | Current Status |

|---|---|---|

| ETF Approvals | High | Under SEC review |

| Institutional Adoption | Medium-High | Growing (see $7B+ OI) |

| Technical Breakout | Medium | Testing upper BB |

| Macro Conditions | Medium | Anticipated rate cuts |

However, it's not all sunshine and rainbows. The NUPL ratio hitting 0.321 on September 9 suggests many traders are sitting on substantial paper gains - historically a precursor to profit-taking. Exchange data shows weakening conviction too, with net outflows plummeting 84% during SOL's recent 10% climb to $217. This divergence between price action and capital flows often precedes corrections.

Potential Roadblocks on the Path to $300

While the $300 target seems plausible, several challenges could emerge:

1.The Futures Volume Bubble Map indicates excessive leverage in SOL markets. When too many traders pile into Leveraged positions, even small corrections can trigger liquidation cascades.

2.New address creation has fallen to a five-month low according to Coinmarketcap data. Without new money entering, rallies can lose steam.

3.While ETF prospects are promising, SEC decisions remain unpredictable. Any negative developments could dampen sentiment.

4.The $260 level represents significant historical resistance. Breaking through WOULD require substantial buying pressure.

SOL Price Prediction: The Road Ahead

Given current technicals and fundamentals, SOL has a reasonable chance of testing $300 in the coming months if:

- The $200 support continues holding firm

- ETF approvals progress positively

- Institutional inflows persist

- Macro conditions remain favorable

However, traders should remain cautious of potential pullbacks. The BTCC research team suggests implementing risk management strategies, especially given SOL's history of volatile moves. Dollar-cost averaging might be wiser than chasing the current rally for those with longer time horizons.

Frequently Asked Questions

What is the current SOL price prediction for 2025?

Based on current technical indicators and market conditions, analysts predict SOL could reach $300 in 2025 if bullish momentum continues. The cryptocurrency shows strong technical support above $200 with positive MACD momentum, though traders should watch for potential profit-taking NEAR resistance levels.

Is now a good time to buy Solana?

While SOL shows bullish potential, timing the market perfectly is challenging. The current price sits above key moving averages, suggesting strength, but the RSI at 62 indicates it's not oversold. Dollar-cost averaging or waiting for a pullback to support levels might be prudent strategies.

What could prevent SOL from reaching $300?

Several factors could hinder SOL's ascent: regulatory setbacks, macroeconomic downturns, excessive leverage liquidations, or failure to maintain above $200 support. Additionally, if ETF approvals face unexpected delays or rejections, it could dampen institutional interest.

How does Solana's technical setup compare to previous bull runs?

Current technicals resemble SOL's early 2024 breakout patterns but with stronger institutional participation this time. The key difference is the $7B+ futures open interest, suggesting more sophisticated market participants are involved compared to previous retail-driven rallies.

What are the signs that SOL's rally is losing steam?

Warning signs would include: sustained breaks below $200 support, MACD bearish divergences, declining volume on up moves, or RSI consistently above 70 without price advancement. Exchange net outflows drying up, as we're currently seeing, can also precede corrections.