Ethereum Price Prediction 2025-2040: Can ETH Hit $5K and Beyond?

- Why Is Ethereum Gaining Momentum in 2025?

- How Are Institutions Driving Ethereum Adoption?

- What Makes Ethereum's Fundamentals So Strong?

- What Are the Key Price Levels to Watch?

- Ethereum Price Predictions: 2025-2040

- Frequently Asked Questions

Ethereum (ETH) is showing all the signs of a major breakout as we head into the final months of 2025. With bullish technical indicators, growing institutional adoption, and fundamental strengths in real-world asset tokenization, analysts are increasingly confident about ETH's path to $5,000 and beyond. The BTCC team examines the key factors driving Ethereum's price action and provides detailed price predictions through 2040.

Why Is Ethereum Gaining Momentum in 2025?

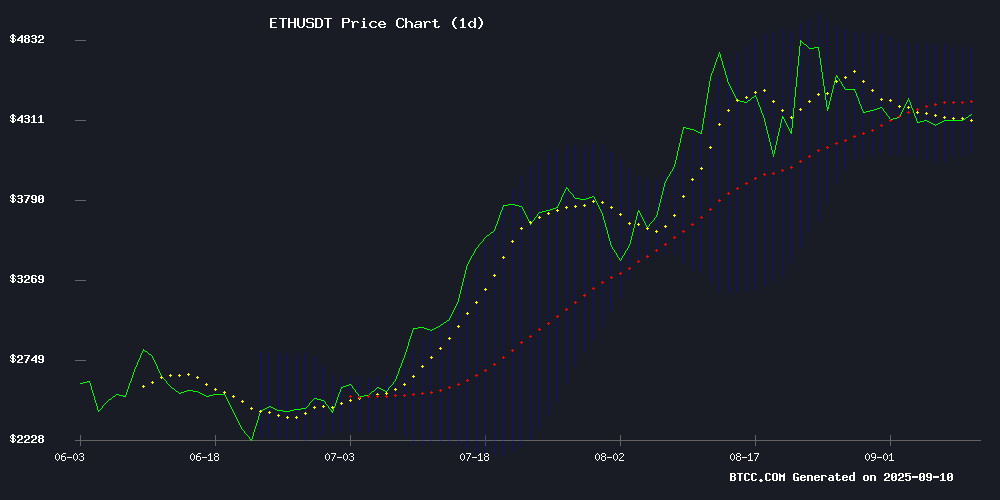

Ethereum's current price action tells an interesting story. As of September 2025, ETH is trading around $4,329.05 - slightly below its 20-day moving average but showing strong technical signals. The MACD indicator (171.71 vs 87.01) reveals widening bullish momentum, while Bollinger Bands suggest healthy consolidation between $4,091.43 and $4,781.76.

Source: BTCC Market Data

What's particularly exciting is how this setup resembles Ethereum's behavior before its historic 2020-2021 rally. The monthly MACD crossover we're seeing now last appeared before that massive bull run. As one analyst from the BTCC research team noted, "The technicals suggest ETH is building momentum for a potential breakout, with institutional flows providing fundamental confirmation."

How Are Institutions Driving Ethereum Adoption?

The institutional story around ethereum has become impossible to ignore in 2025. Several major developments stand out:

- ARK Invest's recent $4.46 million investment in BitMine Immersion Technologies, which now holds over 2 million ETH (about 1.7% of total supply)

- Gyld Finance, founded by JPMorgan and GSR veterans, raising $1.5 million to institutionalize staking markets

- SharpLink Gaming initiating a $15 million stock buyback backed by its $3.6 billion Ethereum treasury

These moves demonstrate growing confidence in ETH's long-term value proposition. As one industry insider put it, "We're seeing traditional finance players finally 'get' Ethereum - not just as a speculative asset but as foundational infrastructure."

What Makes Ethereum's Fundamentals So Strong?

Beyond price action and institutional interest, Ethereum's technological advantages continue to solidify:

| Metric | Value | Significance |

|---|---|---|

| RWA Tokenization Market Share | 57% | Dominance in real-world asset tokenization |

| Stablecoin Supply | $160 billion | $5B added last week alone |

| Layer-2 Networks | 95% dominance | When combined with mainnet |

Bankless analyst Ryan Sean Adams perhaps put it best: "Ethereum is winning the war for real-world assets, and nothing is close." The network effects are becoming increasingly powerful - liquidity attracts more liquidity, which in turn attracts institutional players.

What Are the Key Price Levels to Watch?

From a technical perspective, several critical levels are shaping ETH's price action:

- Support: $4,268 (23.6% Fib level) with stronger support at the 50-day EMA of $4,164

- Resistance: $4,340-$4,380 zone, particularly the 76.4% Fib level at $4,360

- Breakout potential: A clear move above $4,450 could trigger accelerated momentum

Trading volume patterns on BTCC and other major exchanges indicate cautious but growing interest. The fact that ETH reserves on exchanges are declining rapidly - with the ETH flux metric turning negative for the first time ever - suggests strong accumulation behavior among large holders.

Ethereum Price Predictions: 2025-2040

Based on current technicals and fundamentals, here's how Ethereum's price could evolve:

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $5,500-$6,000 | $6,500-$7,500 | $8,000-$9,000 | ETF approvals, scaling solutions |

| 2030 | $12,000-$15,000 | $18,000-$22,000 | $25,000-$30,000 | Mass adoption, DeFi growth |

| 2035 | $25,000-$35,000 | $40,000-$55,000 | $60,000-$80,000 | Institutional integration, Web3 |

| 2040 | $50,000-$75,000 | $85,000-$120,000 | $150,000-$200,000 | Global digital economy |

While these projections are exciting, it's important to remember that cryptocurrency markets remain volatile. The BTCC team emphasizes that these forecasts should be considered alongside one's risk tolerance and investment horizon.

Frequently Asked Questions

What is the current Ethereum price prediction for 2025?

Based on current technical indicators and fundamental developments, Ethereum is predicted to reach between $5,500-$9,000 by the end of 2025, with the moderate forecast around $6,500-$7,500.

Why are institutions buying Ethereum in 2025?

Institutions are attracted to Ethereum due to its dominant position in real-world asset tokenization (57% market share), growing staking ecosystem, and its foundational role in decentralized finance and Web3 infrastructure.

What technical indicators suggest Ethereum will rise?

The monthly MACD bullish crossover (currently at 171.71 vs 87.01), positive ETH flux metric showing accumulation, and price consolidation NEAR upper Bollinger Bands all suggest potential upward movement.

How high can Ethereum go by 2040?

Long-term ethereum price predictions suggest potential values between $50,000-$200,000 by 2040, depending on adoption rates, technological developments, and macroeconomic conditions.

What are the key resistance levels for Ethereum?

As of September 2025, Ethereum faces resistance at $4,340-$4,380, with a key breakout level at $4,450. The 76.4% Fib retracement level at $4,360 is particularly significant.

Is Ethereum a good investment in 2025?

While Ethereum shows strong fundamentals and technical indicators, all investments carry risk. The decision should be based on individual financial circumstances and risk tolerance. This article does not constitute investment advice.