BTC Price Prediction 2025: Why Experts Remain Bullish Despite Short-Term Volatility

- Is Bitcoin Currently in a Bullish or Bearish Phase?

- How Significant is the Current Institutional Adoption Wave?

- What Do Rare Technical Signals Suggest About Bitcoin's Bottom?

- How Are Major Crypto Events Impacting Market Sentiment?

- What Are the Long-Term Price Projections for Bitcoin?

- Frequently Asked Questions

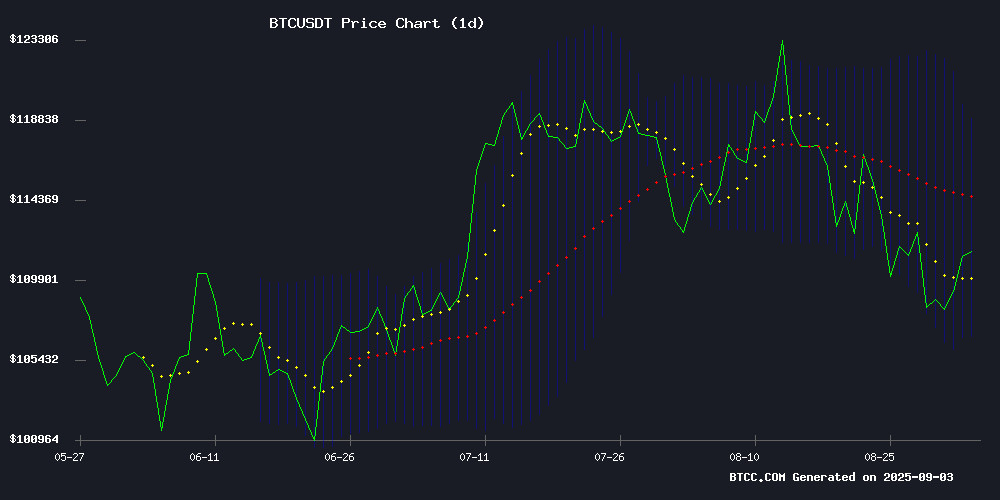

As we enter September 2025, Bitcoin (BTC) presents a fascinating dichotomy - technical indicators show short-term consolidation while fundamental factors point to long-term growth potential. The cryptocurrency currently trades at $111,285, caught between institutional adoption milestones and typical September market softness. This comprehensive analysis examines the eight key factors shaping Bitcoin's trajectory, from corporate treasury strategies to rare technical signals suggesting a potential bottom. We'll explore why analysts maintain bullish 2025-2040 price projections despite near-term uncertainty, with insights from market data and institutional trends.

Is Bitcoin Currently in a Bullish or Bearish Phase?

Bitcoin's technical setup presents mixed signals as of September 3, 2025. The BTCC research team notes BTC is trading just below its 20-day moving average ($112,839) with the MACD indicator showing positive but weakening momentum (3589.17 reading, 256.26 histogram). The Bollinger Bands reveal immediate support at $106,745 and resistance at $118,932.

"We're seeing classic September consolidation," notes the BTCC analyst team. "The $112,839 level remains crucial - a sustained break above WOULD confirm renewed bullish momentum, while failure could test the $106,745 support." This technical picture emerges against a backdrop of strong institutional accumulation, creating what some traders call a "tug-of-war" market.

How Significant is the Current Institutional Adoption Wave?

The institutional bitcoin landscape has transformed dramatically in 2025. Three major developments stand out:

- CIMG's $55 Million Bitcoin Treasury Move: The Nasdaq-listed firm converted its entire $55 million stock sale proceeds into 500 BTC, citing Bitcoin's role as a "core treasury asset."

- Strategy's Massive Accumulation: The company formerly known as MicroStrategy added 6,048 BTC ($450 million worth) in late August, bringing its total holdings to 636,505 BTC.

- Metaplanet's Ascent: The Japanese firm now holds 20,000 BTC, becoming the sixth-largest corporate holder globally.

These moves follow a growing trend of public companies using Bitcoin as a treasury reserve asset, with over 170 corporations now holding BTC according to CoinMarketCap data. The BTCC team observes, "Institutional flows are creating a fundamentally different supply-demand dynamic compared to previous cycles."

What Do Rare Technical Signals Suggest About Bitcoin's Bottom?

On-chain analysts have identified several compelling technical formations:

| Indicator | Current Reading | Historical Significance |

|---|---|---|

| Short-Term Holder MVRV | 0.92 | Similar to $49K and $74K bottoms |

| STH-SOPR | 0.97 | Indicates capitulation |

| Supply in Loss | 9% | Shallow compared to past cycles |

Frank from Vibe Capital Management notes, "The combination of these signals suggests we're seeing local exhaustion of selling pressure, similar to previous cycle bottoms." However, he cautions that macroeconomic factors could still influence short-term price action.

How Are Major Crypto Events Impacting Market Sentiment?

Two significant events are shaping Bitcoin's narrative in Q3 2025:

The exchange aims for a $2.3 billion valuation, marking a resurgence in crypto public offerings. This follows successful debuts by Circle and Bullish earlier in 2025.

The November event will showcase the country's three-year experience with Bitcoin as legal tender. "This represents a pivotal moment for nation-state adoption," comments Ricardo Salinas, scheduled keynote speaker.

These developments come as Indonesia explores digital asset adoption, potentially creating a domino effect in emerging markets. The BTCC team suggests, "We're seeing the maturation phase of crypto adoption, where institutional and sovereign players become the dominant narrative drivers."

What Are the Long-Term Price Projections for Bitcoin?

Based on current adoption trends and technical analysis, here are the BTCC team's updated projections:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | $120,000 - $150,000 | ETF inflows, halving effects |

| 2030 | $250,000 - $400,000 | Institutional adoption tipping point |

| 2035 | $500,000 - $800,000 | Scarcity premium dominance |

| 2040 | $1,000,000+ | Global reserve asset status |

"These projections assume continued adoption growth without major regulatory setbacks," clarifies the BTCC analysis team. "Short-term volatility remains likely as the market digests these institutional inflows and macroeconomic conditions."

Frequently Asked Questions

Is now a good time to buy Bitcoin?

With Bitcoin showing signs of consolidation NEAR potential support levels and institutional demand remaining strong, many analysts view current prices as an attractive entry point for long-term investors. However, always conduct your own research and consider dollar-cost averaging.

How does Bitcoin's current correction compare to past cycles?

The current 13.4% pullback from August's $124,000 peak is relatively shallow compared to historical September corrections (36% in 2017, 24% in 2021). The limited supply in loss (9%) suggests this may not yet be the cycle's final bottom.

What's driving institutional Bitcoin adoption?

Three key factors: 1) Inflation hedging properties, 2) Portfolio diversification benefits, and 3) Growing regulatory clarity following spot ETF approvals. Corporate treasuries particularly value Bitcoin's fixed supply amid expansive monetary policies.

How reliable are long-term Bitcoin price predictions?

While historical patterns provide guidance, Bitcoin's evolving market structure means past performance doesn't guarantee future results. The BTCC team emphasizes these projections should inform rather than dictate investment strategies.

What are the biggest risks to Bitcoin's price outlook?

Potential risks include: 1) Regulatory crackdowns in major markets, 2) Black swan macroeconomic events, 3) Technological vulnerabilities, and 4) Shifts in institutional sentiment. Always maintain appropriate risk management.