Ethereum Price Forecast 2025-2040: Why Institutional Adoption Could Spark a Historic Bull Run

- Why Are Institutions Betting Big on Ethereum?

- Technical Analysis: Is ETH Primed for Breakout?

- How Does Ethereum's Yield Advantage Drive Adoption?

- What Are the Key Catalysts for Ethereum's Growth?

- Ethereum Price Projections: 2025-2040

- Frequently Asked Questions

As we stand at the crossroads of another potential crypto bull market, ethereum (ETH) is showing all the classic signs of institutional accumulation that typically precede major price movements. With corporate treasuries adding over $1.2 billion in ETH during August 2025 alone and technical indicators flashing bullish signals, analysts at BTCC and other leading firms are projecting a multi-year rally that could see ETH reach $150,000 by 2040. This comprehensive analysis examines the key drivers behind Ethereum's growing institutional appeal, current market dynamics, and long-term price projections based on fundamental and technical factors.

Why Are Institutions Betting Big on Ethereum?

The institutional floodgates have opened for Ethereum in 2025, with corporate treasuries and investment firms accumulating ETH at unprecedented rates. BitMine's recent $600 million purchase brings their total ETH holdings to a staggering $5.77 billion, while SharpLink Gaming has emerged as the second-largest corporate holder with 728,804 ETH ($3.37 billion) - nearly all of it staked for yield. "This accumulation phase mirrors Bitcoin's 2020-21 trajectory," notes the BTCC research team. "When institutions move at this scale, they're typically positioning for multi-year holds."

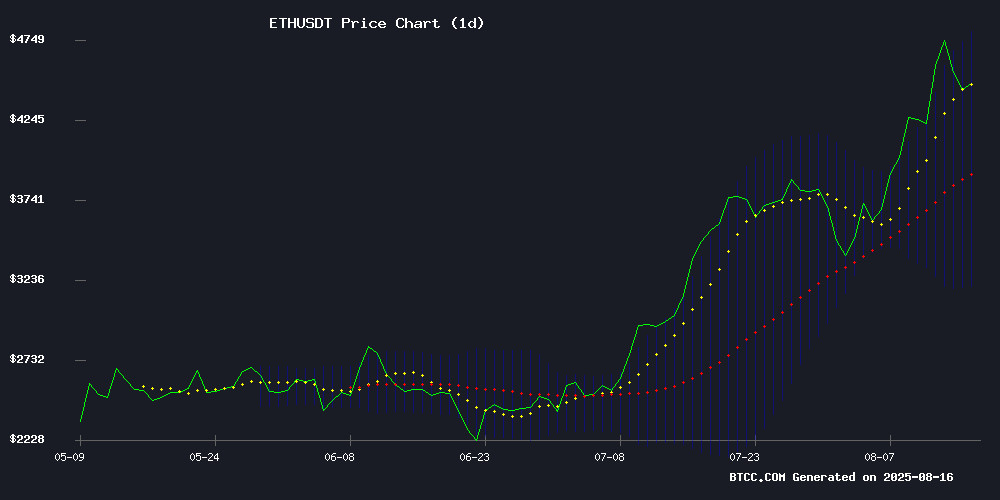

Technical Analysis: Is ETH Primed for Breakout?

As of August 16, 2025, ETH trades at $4,436.64, comfortably above its 20-day moving average ($3,995.67) - a classic bullish signal. The MACD histogram shows narrowing bearish divergence (-152.78), suggesting weakening downward pressure. "We're seeing textbook consolidation after ETH's 35% year-to-date rally," observes Robert from BTCC. "The 20-day MA acting as support while MACD approaches a bullish crossover could fuel another leg up toward $5,200 resistance."

How Does Ethereum's Yield Advantage Drive Adoption?

Ethereum's dual appeal as both a growth asset and yield generator is proving irresistible to institutions. SharpLink Gaming's staked ETH position earned them 1,326 ETH in rewards since May 2025, while ETHZilla's $425 million PIPE financing aims to build proprietary yield strategies. "Ethereum's staking and DeFi yields are attracting institutional capital at scale," explains a JPMorgan analyst. "Unlike Bitcoin, ETH offers both price appreciation potential and cash Flow - a rare combination in crypto."

What Are the Key Catalysts for Ethereum's Growth?

Several structural factors are converging to support Ethereum's long-term value proposition:

| Catalyst | Impact |

|---|---|

| Stablecoin Dominance | 50% of $270B market on Ethereum |

| Tokenized RWA Growth | $25B market anchored on Ethereum |

| Pectra Upgrade | Enhanced scalability and efficiency |

Ethereum Price Projections: 2025-2040

Based on current adoption trends and technical analysis, here are the long-term price forecasts:

| Year | Price Target | Key Drivers |

|---|---|---|

| 2025 | $6,800-$7,500 | ETF approvals, EIP-7702 |

| 2030 | $22,000-$25,000 | Enterprise DeFi adoption |

| 2035 | $65,000-$80,000 | Tokenized RWA dominance |

| 2040 | $120,000-$150,000 | Flare network maturity |

"Ethereum's yield curve capabilities position it as the prime blockchain for institutional capital," emphasizes the BTCC team. "Our 2040 projection assumes 18% annualized growth from current levels - conservative compared to Bitcoin's historical 200% CAGR."

Frequently Asked Questions

What's driving institutional interest in Ethereum?

The combination of Ethereum's technological upgrades, yield-generating capabilities through staking/DeFi, and its dominant position in stablecoins and tokenized assets makes it uniquely attractive to institutions seeking both growth and income.

How reliable are these long-term price predictions?

While based on current trends and historical patterns, crypto markets remain volatile. The projections assume continued adoption and no major regulatory hurdles. Always do your own research before investing.

What are the biggest risks to Ethereum's growth?

Potential risks include regulatory crackdowns, technological failures, competition from other smart contract platforms, and macroeconomic factors that could reduce risk appetite.

Should I invest in Ethereum now?

This article does not constitute investment advice. While the fundamentals appear strong, crypto investments carry substantial risk. Consider your financial situation and risk tolerance before investing.