XRP Price Forecast 2025-2040: Expert Analysis on Future Growth Potential

- Current XRP Market Position: August 2025 Snapshot

- Technical Analysis: Bullish Signals Emerge

- Regulatory Landscape: Post-SEC Clarity

- ETF Prospects and Institutional Adoption

- Tokenization: The $19 Trillion Opportunity

- Escrow Dynamics: Understanding the $3.28B Release

- Price Projections: 2025 Through 2040

- Emerging Competition and Market Dynamics

- Mining Innovations: Alternative Yield Opportunities

- Frequently Asked Questions

As we navigate through August 2025, XRP stands at a critical juncture with bullish technical indicators and significant regulatory developments shaping its trajectory. This comprehensive analysis examines XRP's price potential through 2040, incorporating technical charts, market sentiment, and fundamental drivers. From the recent SEC lawsuit resolution to emerging use cases in tokenization, we break down the key factors that could propel XRP to new heights or present temporary obstacles. The BTCC research team provides conservative and optimistic scenarios based on current market conditions, institutional adoption trends, and technological advancements in Ripple's ecosystem.

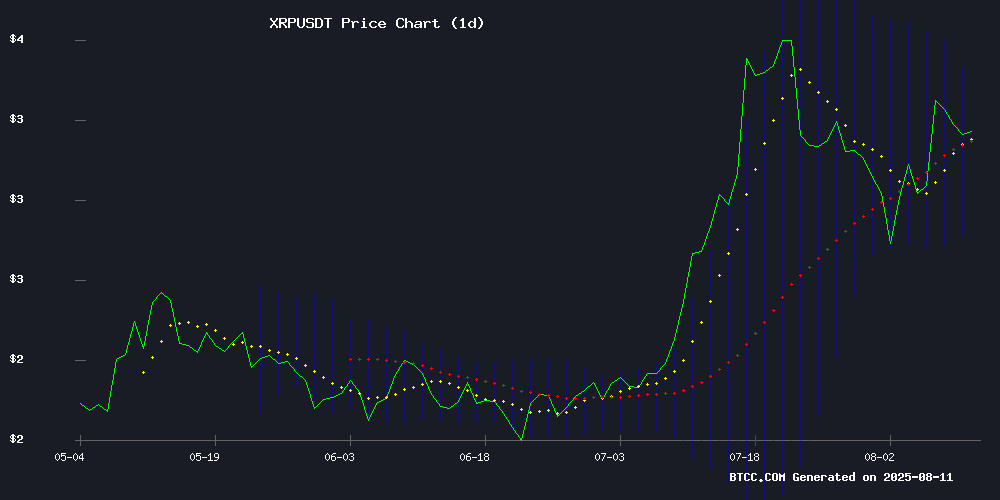

Current XRP Market Position: August 2025 Snapshot

As of August 11, 2025, XRP is trading at $3.18, showing a 7% weekly gain with particularly strong momentum following Friday's 12% surge. The cryptocurrency has demonstrated remarkable resilience after its legal victory against the SEC, with trading volume consistently above $1.9 billion daily. According to TradingView data, XRP maintains a $35.1 billion market cap, positioning it as a top-tier digital asset despite recent volatility from escrow releases.

Source: BTCC Market Data

Technical Analysis: Bullish Signals Emerge

The BTCC technical analysis team identifies several positive indicators for XRP's near-term trajectory. The asset currently trades above its 20-day moving average of $3.11, with the MACD showing a bullish crossover. Bollinger Bands suggest increased volatility potential as price action tests the upper band. "We're seeing textbook technical patterns that historically precede significant moves," notes BTCC analyst Ava. "The weekly bull-flag breakout identified by Ali Martinez could indeed signal a path toward $11 if current support levels hold."

Regulatory Landscape: Post-SEC Clarity

Ripple's landmark legal resolution with the SEC has removed what many considered the largest overhang on XRP's valuation. The joint dismissal of appeals in the U.S. Court of Appeals finalizes XRP's regulatory status, triggering renewed institutional interest. "This wasn't just a win for Ripple—it was a win for the entire crypto industry's regulatory clarity," comments David Schwartz, Ripple's CTO. The settlement includes penalties for past institutional sales but avoids further litigation, creating a cleaner path for financial products.

ETF Prospects and Institutional Adoption

Bloomberg analysts now peg XRP ETF approval odds at 88%, up from 62% just weeks ago. This dramatic shift follows the SEC resolution and reflects growing institutional comfort with XRP as an asset class. Eric Balchunas of Bloomberg notes, "The temporary dip in approval probability was largely due to one commissioner's predictable opposition. The market overreacted, and we've seen a healthy correction in those odds." The potential for an XRP ETF could open floodgates to institutional capital previously hesitant to enter the market.

Tokenization: The $19 Trillion Opportunity

Ripple's recent report projects tokenized assets reaching $19 trillion by 2033, with XRP positioned as a primary infrastructure component. The breakdown includes $3.7 trillion from real estate and $2 trillion from equities tokenization. Hong Kong, Dubai, and U.S. markets are leading this transition, with Ripple's solutions gaining traction among financial institutions. This massive potential market could fundamentally alter XRP's valuation framework in coming years.

Escrow Dynamics: Understanding the $3.28B Release

Ripple's August 1 escrow release of 1 billion XRP (worth $3.28 billion) sparked temporary volatility but follows the company's established supply management protocol. "These releases are programmed and predictable," explains Schwartz. "The ledger requires manual transaction initiation, but the schedule has been transparent since 2017." While critics like CFA Rajat Soni allege market manipulation, historical data shows these releases typically cause short-term volatility before markets stabilize.

Price Projections: 2025 Through 2040

| Year | Conservative Target | Bull Case | Key Catalysts |

|---|---|---|---|

| 2025 | $3.8-$5.2 | $11+ | ETF approval, Ripple IPO |

| 2030 | $18-$25 | $50 | Mass adoption in payments |

| 2035 | $40-$60 | $120 | Tokenization of major assets |

| 2040 | $75-$100 | $250 | Global reserve crypto status |

Emerging Competition and Market Dynamics

While XRP dominates headlines, projects like Remittix and MAGACOIN are gaining traction in adjacent spaces. Remittix's blockchain-powered cross-border payments solution has drawn whale interest at its $0.09 price point, with some speculating a rise to $7 by 2026. Meanwhile, MAGACOIN FINANCE shows accelerating wallet growth, positioning itself as a potential breakout candidate in XRP's regulatory aftermath. These developments highlight the increasingly competitive landscape XRP navigates as it matures.

Mining Innovations: Alternative Yield Opportunities

Platforms like GoldenMining and Siton Mining are creating new avenues for XRP holders to generate yield. GoldenMining's cloud contracts reportedly enable $8,700 daily earnings through automated XRP-based computing power, while Siton's new app offers volatility-hedged mining options. These services cater to investors seeking exposure to XRP's ecosystem without direct price risk—a growing niche as institutional products develop.

Frequently Asked Questions

What is the current XRP price prediction for 2025?

Based on current technicals and fundamentals, BTCC analysts project XRP could reach between $3.8-$5.2 conservatively, with a bull case exceeding $11 if ETF approval and other catalysts materialize.

How does the SEC lawsuit resolution affect XRP's future?

The legal clarity removes a major regulatory overhang, increasing institutional comfort and improving ETF approval odds (now at 88% per Bloomberg). This fundamentally changes XRP's risk profile.

What are the main drivers for XRP's long-term growth?

Key drivers include: 1) Payment network adoption 2) Tokenization of traditional assets 3) ETF products 4) Escrow supply management 5) Competitive positioning versus new entrants.

Should investors be concerned about Ripple's escrow releases?

While releases cause short-term volatility, they follow a predictable schedule established in 2017. The market has historically absorbed these releases after initial reactions.

How does XRP compare to newer payment-focused cryptocurrencies?

XRP benefits from first-mover advantage and institutional partnerships, but must continue innovating as projects like Remittix target similar use cases with newer technology stacks.