Bitcoin Price Prediction 2025: Technical Consolidation Meets Bullish Fundamentals - Will BTC Hit $100K?

- Where Is Bitcoin's Price Headed in 2025?

- What Are the Key Technical Levels to Watch?

- Why Are Institutional Developments So Bullish?

- What Are the Major Fundamental Catalysts?

- Who's Making Big Moves in the Bitcoin Market?

- What Are the Expert Predictions for Bitcoin's Price?

- Frequently Asked Questions

Bitcoin is currently trading at $90,606 after a period of technical consolidation below the critical 20-day moving average at $92,696. While short-term indicators show bearish momentum, the cryptocurrency remains within a healthy Bollinger Band range ($81,003-$104,389) with strong institutional support. Major developments including Nasdaq's proposed 40-fold increase in Bitcoin ETF options and Wall Street's shift to perpetual contracts create a fundamentally bullish backdrop. Analysts suggest Bitcoin could challenge $100,000 by year-end, with BitMEX founder Arthur Hayes maintaining his $250,000 prediction for 2025.

Where Is Bitcoin's Price Headed in 2025?

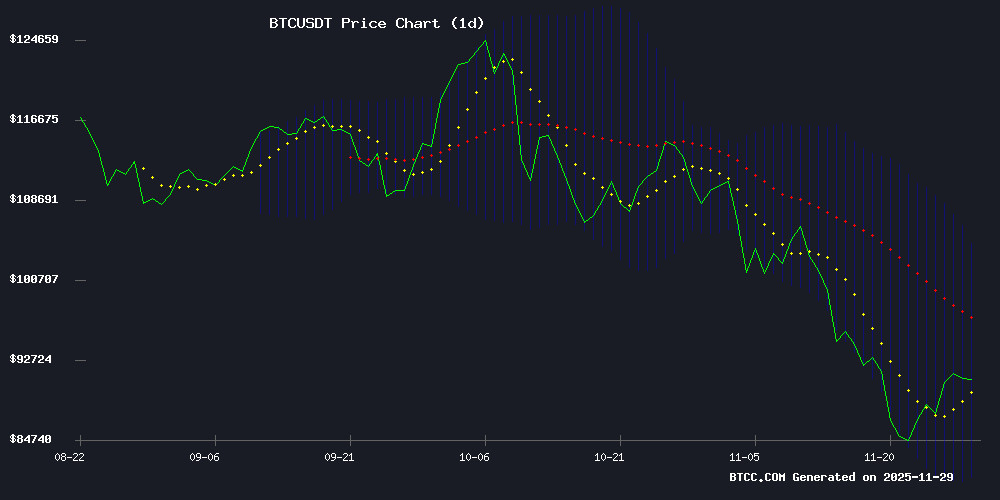

As of November 29, 2025, bitcoin (BTC) presents a fascinating technical picture. The cryptocurrency is currently trading at $90,606.33, positioned just below the psychologically important 20-day moving average of $92,696.38. This positioning suggests we're seeing a classic consolidation phase after the volatility of recent months.

The MACD reading of -885.84 confirms short-term bearish momentum, but don't let that fool you - the Bollinger Bands tell a more nuanced story. With the current price comfortably within the $81,003.16 to $104,389.61 range and sitting closer to the middle band, this looks more like healthy consolidation than a bearish reversal.

Source: BTCC Trading Platform

What Are the Key Technical Levels to Watch?

From my experience tracking crypto markets, these are the critical levels traders should monitor:

| Indicator | Value | Significance |

|---|---|---|

| Current Price | $90,606 | Consolidation phase |

| 20-Day MA | $92,696 | Immediate resistance |

| Bollinger Upper | $104,390 | Near-term target |

| MACD | -885.84 | Short-term bearish |

The BTCC team notes, "The technical setup shows Bitcoin is in a consolidation phase after recent volatility. The key resistance lies at the 20-day MA around $92,700, while support holds strong near $81,000."

Why Are Institutional Developments So Bullish?

Let me break down why Wall Street's recent moves are such a big deal. Nasdaq's proposal to increase Bitcoin ETF options trading limits from 25,000 to 1,000,000 contracts represents a 40-fold expansion - that's not just incremental growth, it's a seismic shift in institutional access.

Meanwhile, the derivatives market is undergoing its biggest transformation in a decade. Singapore Exchange (SGX) and CBOE Global Markets plan to launch perpetual-style products by late 2025, following Coinbase's retail version introduced earlier this year. As someone who's watched crypto derivatives evolve since the BitMEX days, I can tell you this is huge - perpetual contracts are becoming the preferred instrument for serious traders.

What Are the Major Fundamental Catalysts?

Several fundamental factors are converging to support Bitcoin's price:

- Institutional Adoption: BlackRock's iShares Bitcoin Trust (IBIT) has surpassed $20 billion in inflows, though much was tied to basis trades.

- Regulatory Developments: Japan's potential tax reforms could significantly boost domestic crypto adoption.

- Market Structure: The October leverage washout, while painful, created healthier conditions for the next leg up.

- Macro Factors: Fed rate cut speculation and potential political developments are creating favorable conditions.

Who's Making Big Moves in the Bitcoin Market?

Elon Musk's SpaceX made waves by transferring 1,163 BTC (worth ~$105 million) to a new wallet. While some feared a sell-off, the absence of direct exchange links suggests this is more likely portfolio management. Remember when Tesla bought Bitcoin back in 2021? This feels different - more strategic than reactionary.

On the institutional side, we're seeing whales make interesting moves. Binance recorded $7.5 billion in Bitcoin deposits over the past 30 days - the highest ever in a calendar year. While this could signal selling pressure, it might also represent sophisticated position management ahead of expected volatility.

What Are the Expert Predictions for Bitcoin's Price?

BitMEX founder Arthur Hayes remains steadfast in his $250,000 bitcoin price target for 2025, citing ETF inflows and expanding USD liquidity. Meanwhile, Kalshi traders are pricing in a 60% chance of Bitcoin hitting $100,000 by December.

The BTCC team offers a measured perspective: "The combination of technical consolidation and strong fundamental catalysts creates a compelling case for Bitcoin to challenge the $100,000 level before year-end, with potential for further gains in 2026."

Frequently Asked Questions

What is Bitcoin's current price and technical position?

As of November 29, 2025, Bitcoin is trading at $90,606.33, below the 20-day moving average of $92,696.38 but within the Bollinger Band range of $81,003.16 to $104,389.61, indicating consolidation.

What are the key resistance and support levels?

The immediate resistance is at the 20-day MA ($92,696), with strong support at $81,000. The upper Bollinger Band at $104,389 represents the near-term upside target.

What institutional developments support Bitcoin's price?

Major catalysts include Nasdaq's proposed 40-fold increase in Bitcoin ETF options limits, Wall Street's shift to perpetual contracts, and BlackRock's IBIT surpassing $20 billion in inflows.

What are experts predicting for Bitcoin's price?

BitMEX founder Arthur Hayes maintains a $250,000 target for 2025, while traders price in a 60% chance of Bitcoin reaching $100,000 by December 2025.

What risks should Bitcoin investors consider?

Key risks include whale movements to exchanges, potential regulatory changes, and macroeconomic factors like Fed policy decisions. This article does not constitute investment advice.