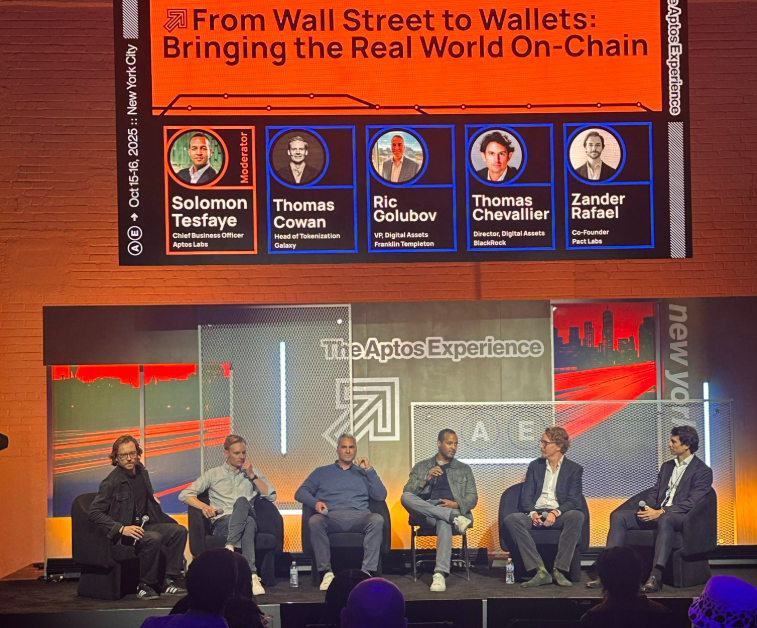

Wall Street’s Tokenization Revolution Accelerates as BlackRock, Franklin Templeton, and Galaxy Go All-In on On-Chain Assets

Traditional finance giants are finally waking up to what crypto natives knew years ago—tokenization changes everything.

The Institutional Onslaught

BlackRock's digital asset division joins Franklin Templeton's blockchain initiatives and Galaxy's institutional infrastructure in a coordinated push toward tokenized real-world assets. They're not just dipping toes anymore—they're diving headfirst into the blockchain pool.

Why Now? Liquidity Never Sleeps

24/7 markets don't care about Wall Street's traditional hours. Tokenization unlocks global liquidity pools that traditional finance can only dream about. Fractional ownership? Check. Instant settlement? Double check. The old guard is finally realizing efficiency actually matters.

The Compliance Tightrope

Regulatory hurdles remain the elephant in the room. But when institutions this size move, regulators tend to follow rather than lead. Watch for the usual dance—slow-walking innovation while claiming to protect investors from, well, themselves.

Traditional finance's embrace of tokenization feels suspiciously like your grandfather finally learning to text—clunky at first, but inevitable once everyone else is doing it. The real question isn't if they'll succeed, but whether they'll manage to charge their usual 2% fees for the privilege.