Analyst Predicts Ethereum Surge to $22,000 as Key Market Factor Aligns

Ethereum's next bull run might just be waiting for one crucial puzzle piece to snap into place—and one analyst says when it does, prepare for a meteoric climb toward $22,000.

Breaking Down the Confluence

A perfect storm of technical, on-chain, and macroeconomic factors could send ETH soaring. We’re talking institutional inflows, protocol upgrades, and a shift in global liquidity conditions—all lining up like stars in a crypto-friendly sky.

Timing the Trigger

Markets move when catalysts converge. Reduced regulatory uncertainty, wider DeFi adoption, and yes—even a little old-school FOMO—could provide the final push. It’s not a question of if, but when.

Why $22K Isn’t a Fantasy

Ethereum’s utility backbone—smart contracts, NFTs, layer-2 scaling—isn’t just holding strong; it’s expanding. Real-world use cases are piling up, and so is investor confidence. Even traditional finance skeptics are starting to nibble—though they’ll probably still call it a 'speculative asset' right up until the ATH hits.

So keep your eyes on the charts and your wallets ready. When the pieces fall, they might just fall fast.

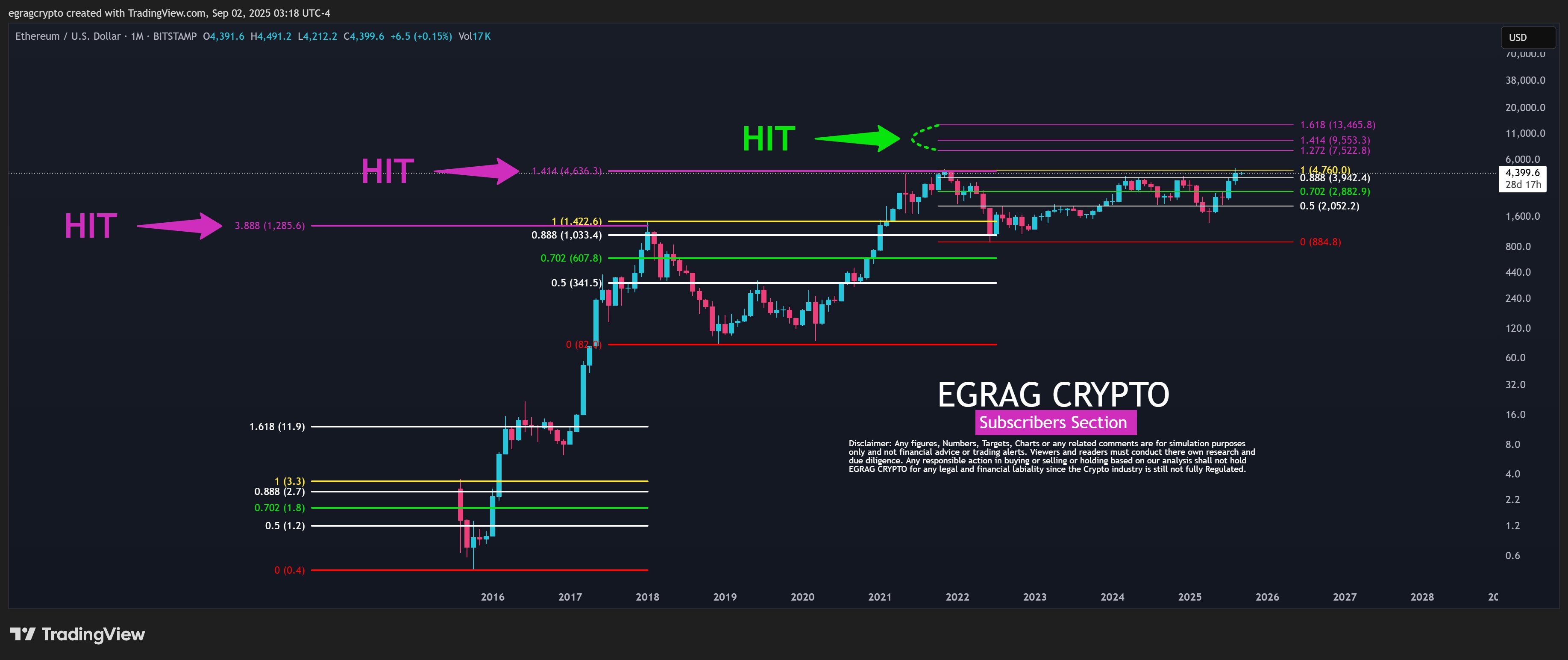

Ethereum Fib Hits | EGRAG Crypto

Specifically, during the first major rally from 2015 to January 2018, Ethereum topped out above the 3.888 Fibonacci extension ($1,285) when it reached a peak of $1,420. This marked the top of Cycle One.

Meanwhile, the second big run between 2018 and 2021 ended above the 1.414 Fibonacci extension ($4,266), with Ethereum soaring to a high of $4,868 by November 2021. This price set the Cycle Two high before the bear market hit.

During the bear market, the 2022 crash dragged Ethereum to a low near $880, which started Cycle Three. From there, the price built a recovery path through several Fibonacci retracement levels: $2,052 at the 0.5 level, $2,882 at 0.702, and $3,942 at 0.888.

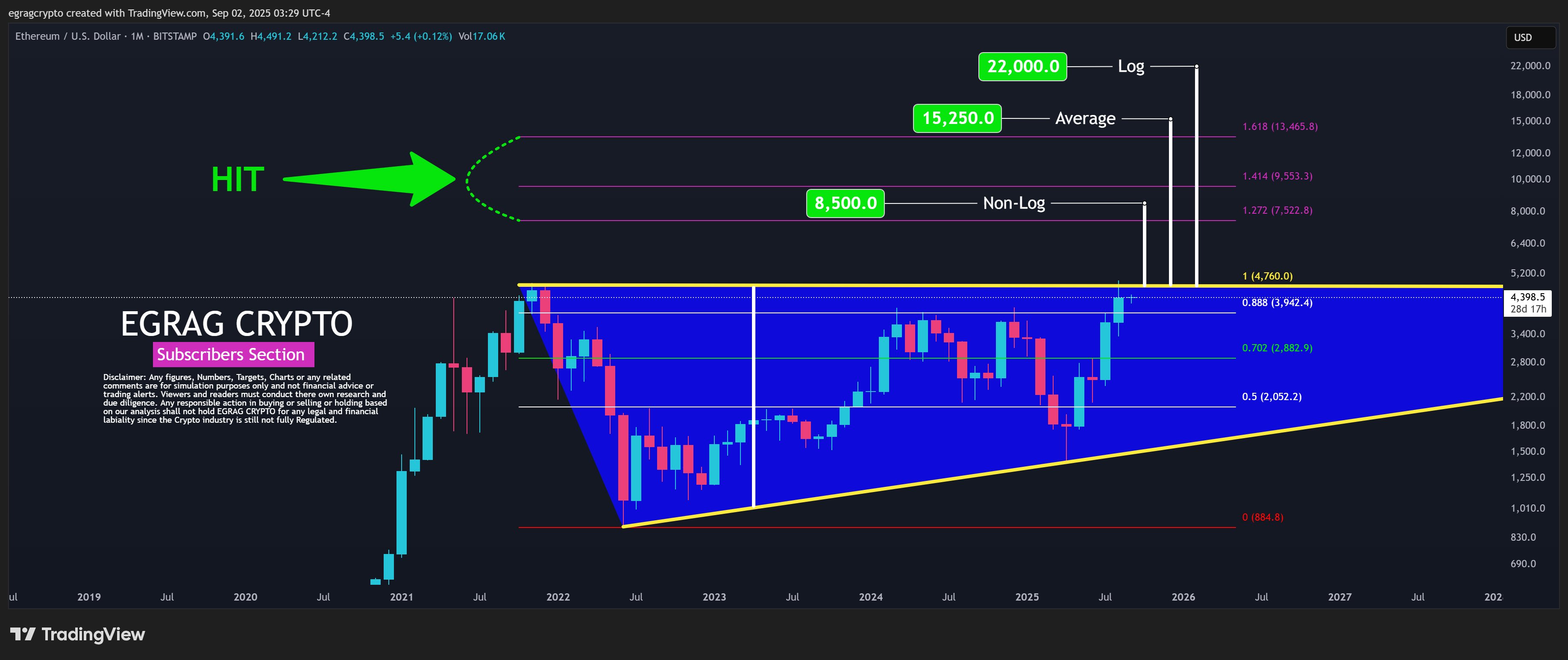

The Confluence Factor: ETH Needs to Break the Ascending Triangle

Notably, the 1.0 extension at $4,760 now acts as the major horizontal resistance line and the top boundary of the ascending triangle. With its price now at $4,378, Ethereum trades just below this level, holding steady after reclaiming those key retracement zones one by one.

Meanwhile, another EGRAG chart focused on the ascending triangle, which stretches from the 2022 low through higher lows in 2023, 2024, and 2025. The top of the triangle sits at $4,760. This forms the breakout point EGRAG calls the confluence factor.

Ethereum Fib Hits | EGRAG Crypto

Specifically, during the first major rally from 2015 to January 2018, Ethereum topped out above the 3.888 Fibonacci extension ($1,285) when it reached a peak of $1,420. This marked the top of Cycle One.

Meanwhile, the second big run between 2018 and 2021 ended above the 1.414 Fibonacci extension ($4,266), with Ethereum soaring to a high of $4,868 by November 2021. This price set the Cycle Two high before the bear market hit.

During the bear market, the 2022 crash dragged Ethereum to a low near $880, which started Cycle Three. From there, the price built a recovery path through several Fibonacci retracement levels: $2,052 at the 0.5 level, $2,882 at 0.702, and $3,942 at 0.888.

The Confluence Factor: ETH Needs to Break the Ascending Triangle

Notably, the 1.0 extension at $4,760 now acts as the major horizontal resistance line and the top boundary of the ascending triangle. With its price now at $4,378, Ethereum trades just below this level, holding steady after reclaiming those key retracement zones one by one.

Meanwhile, another EGRAG chart focused on the ascending triangle, which stretches from the 2022 low through higher lows in 2023, 2024, and 2025. The top of the triangle sits at $4,760. This forms the breakout point EGRAG calls the confluence factor.