Brazil’s Braza Bank Shatters Records: $1B Stablecoin Payments Processed on XRP Ledger

Brazil's financial landscape just got a blockchain-powered jolt—Braza Bank has processed a staggering $1 billion in stablecoin transactions using the XRP Ledger.

RIPPLE EFFECTS IN BANKING

The move signals a massive shift toward decentralized settlement infrastructure—cutting out traditional intermediaries and slashing transaction times from days to seconds. No more waiting for SWIFT confirmations or paying outrageous wire fees.

STABLECOINS STEAL THE SPOTLIGHT

Using dollar-pegged digital assets, Braza Bank bypasses currency volatility while maintaining regulatory compliance. The $1 billion milestone proves institutions aren't just testing waters—they're diving headfirst into crypto liquidity pools.

Legacy bankers might still argue about 'volatility' while missing the biggest transfer of wealth since the internet—some things never change.

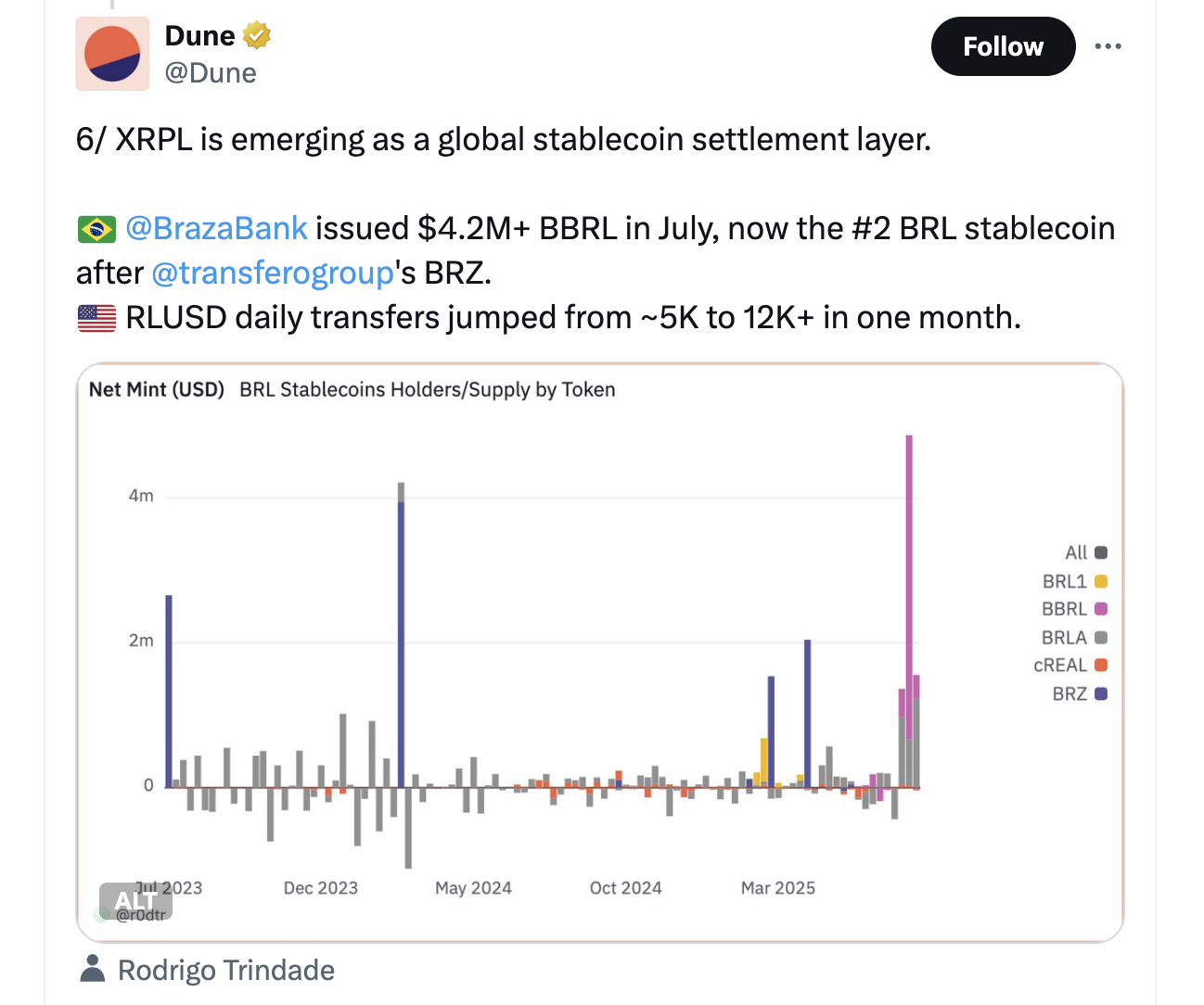

$4.2 million BBRL Minted on XRP Ledger

Notably, the bank reported a balance sheet of more than $500 million as of 2024 and ranks sixth in Brazil’s interbank market.

Euro Stablecoin on the Horizon

Meanwhile, Judges also revealed that Braza has a "line of sight" to a euro-denominated stablecoin, which he believes could achieve similar transaction volumes soon. This suggests the bank is preparing to expand its offering beyond the Brazilian Real and U.S. Dollar.

Such a move WOULD position Braza to manage BRL, USD, and EUR stablecoins simultaneously on the XRPL. This will establish a robust on-chain infrastructure for global currency flows.

Ripple’s Role in Brazil’s Stablecoin Push

Ripple executives have emphasized the XRPL’s role in enabling compliant, reliable, and efficient tokenization at scale. According to Ripple’s LATAM Managing Director Silvio Pegado, the ledger’s features are designed to support regulated financial institutions like Braza as they move billions across borders.

The partnership forms part of an effort to modernize Brazil’s financial system. Braza is also participating in the Brazilian Central Bank’s DREX project, which explores integrating blockchain with traditional banking infrastructure.

Braza Bank’s Outlook for 2025 and Beyond

Notably, Braza CEO Marcelo Sacomori has projected that USDB could capture 30% of Brazil’s USD-pegged stablecoin market by 2026. Sacomori believes stablecoins will dominate global foreign exchange within five years, with Braza positioning itself to lead the transition.

$4.2 million BBRL Minted on XRP Ledger

Notably, the bank reported a balance sheet of more than $500 million as of 2024 and ranks sixth in Brazil’s interbank market.

Euro Stablecoin on the Horizon

Meanwhile, Judges also revealed that Braza has a "line of sight" to a euro-denominated stablecoin, which he believes could achieve similar transaction volumes soon. This suggests the bank is preparing to expand its offering beyond the Brazilian Real and U.S. Dollar.

Such a move WOULD position Braza to manage BRL, USD, and EUR stablecoins simultaneously on the XRPL. This will establish a robust on-chain infrastructure for global currency flows.

Ripple’s Role in Brazil’s Stablecoin Push

Ripple executives have emphasized the XRPL’s role in enabling compliant, reliable, and efficient tokenization at scale. According to Ripple’s LATAM Managing Director Silvio Pegado, the ledger’s features are designed to support regulated financial institutions like Braza as they move billions across borders.

The partnership forms part of an effort to modernize Brazil’s financial system. Braza is also participating in the Brazilian Central Bank’s DREX project, which explores integrating blockchain with traditional banking infrastructure.

Braza Bank’s Outlook for 2025 and Beyond

Notably, Braza CEO Marcelo Sacomori has projected that USDB could capture 30% of Brazil’s USD-pegged stablecoin market by 2026. Sacomori believes stablecoins will dominate global foreign exchange within five years, with Braza positioning itself to lead the transition.