XRP just pulled off a derivatives market coup—racing to $1 billion in open interest faster than any asset in CME history. Traders are loading up on contracts while crypto Twitter braces for what one analyst calls 'the most hated rally you'll ever see.'

The Institutional Stampede

CME's open interest milestone isn't just a number—it's a statement. Institutions are positioning for something big, bypassing retail sentiment entirely. The surge suggests smart money sees value where others see controversy.

Love It or Hate It—XRP Moves Anyway

Market pundits note the peculiar disconnect: soaring derivatives activity clashes with lingering skepticism from SEC battles. Yet the charts don't care about feelings. XRP's momentum builds while traditional finance pundits—still debating whether crypto is 'real'—miss another boat.

Get ready. This rally might just leave the haters—and the hedgies—in the dust.

CME Group Crypto Futures Milestones

XRP Becomes Fastest to Hit $1B OI on CME

Interestingly, the

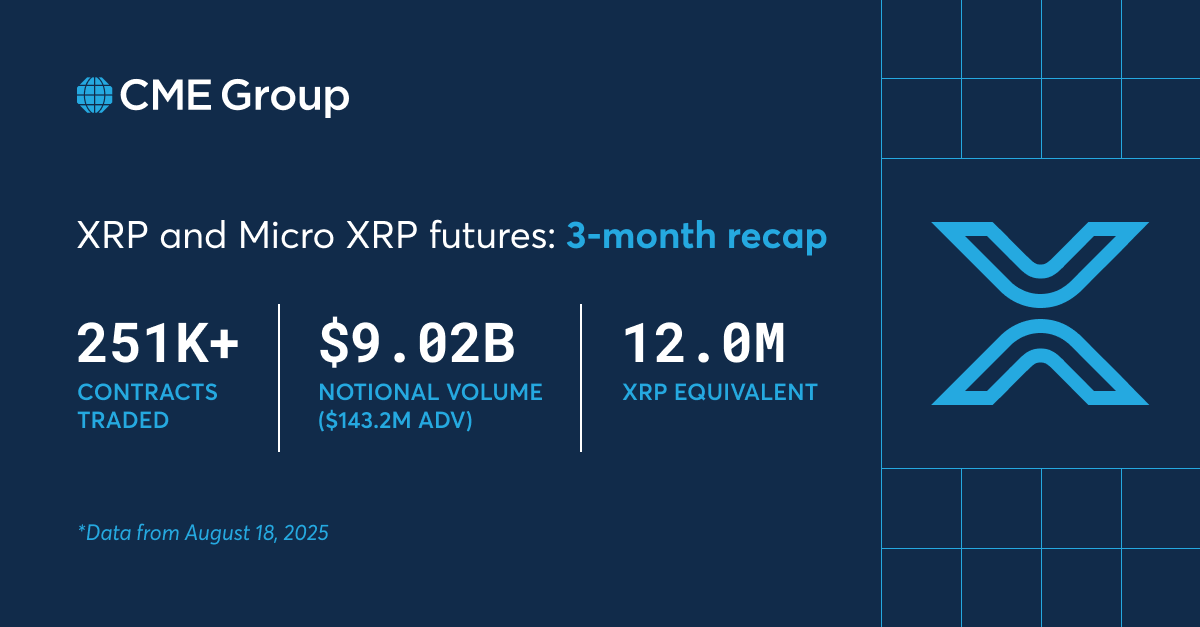

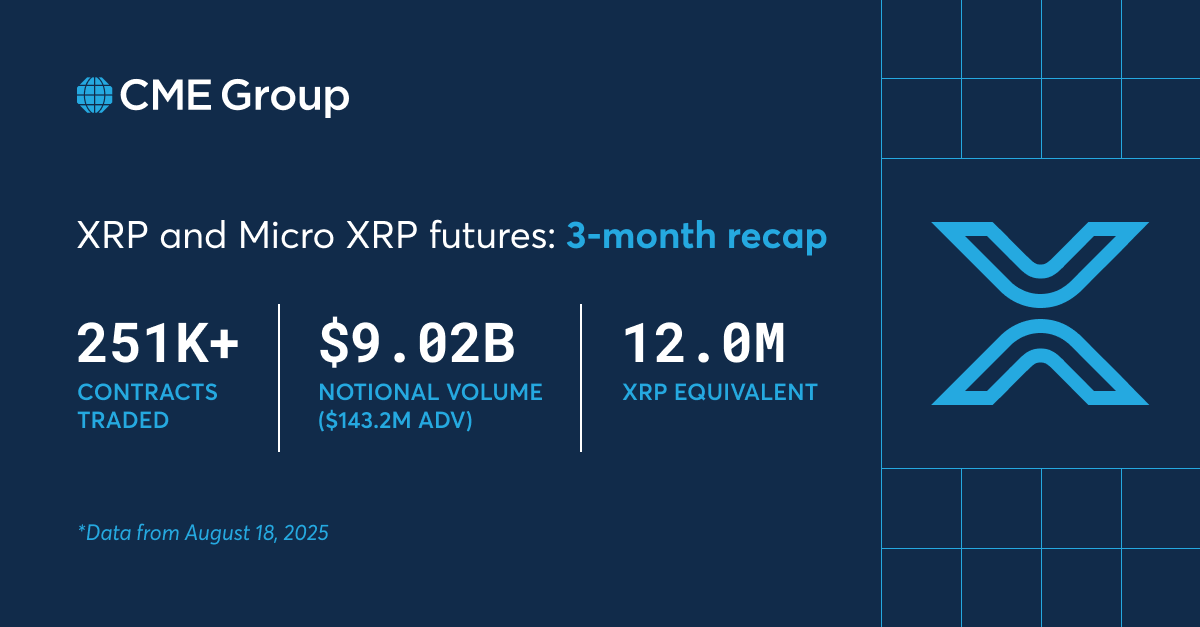

XRP futures contracts hit this mark in just over three months after their launch on May 19, 2025, showing how quickly interest in XRP is building across both institutional and retail markets.

Also, CME reported that since the XRP futures launch, traders have moved 251,000 contracts with a combined notional volume of $9.02 billion. The contracts average $143 million in daily trading, with a one-day record of $235 million set in July.

XRP Futures on CME Group

For context, CME offers two versions of the product: a standard contract of 50,000 XRP and a micro contract of 2,500 XRP, both cash-settled against the CME CF XRP-Dollar Reference Rate.

The rapid growth of these futures shows rising liquidity and tighter spreads, conditions that often lead to stronger institutional participation. Many analysts also believe this success strengthens the case for a U.S. spot XRP exchange-traded fund.

Traders on Polymarket now give XRP an 82% chance of winning ETF approval before the end of 2025. The SEC has scheduled October as the decision date for several applications, including those from Canary Capital, WisdomTree, and Grayscale. These issuers have already amended their filings in preparation.

XRP About to See the Most Hated Rally in Crypto

Notably, speaking on the recent CME OI feat, crypto commentator Zach Rector said XRP could soon trigger what he called the most disliked rally in the crypto sector due to its long history of polarizing views. His take shows a belief that XRP could surge despite heavy skepticism from parts of the industry.

https://twitter.com/ZachRector7/status/1960136835428196384

Meanwhile, market data shared by analyst CryptoInsightUK suggests such a rally might be imminent. He explained that XRP/USD continues to hold firm on the daily chart, with the relative strength index steady around 40. The analyst added that a few days of solid price action could confirm bullish momentum.

XRPUSDT Chart | CryptoInsightUK

Also, on the XRP/BTC pair, he identified a bullish crossover on the daily RSI and stressed that XRP has held its ground even during recent sell-offs. He emphasized that XRP now sits at a level that has acted as resistance for six years, suggesting a breakout could happen if momentum builds.

XRPBTC Chart CryptoInsightUK

Looking at XRP/ETH, CryptoInsightUK highlighted that XRP has bounced multiple times from a multi-year resistance level that has flipped into support. He admitted that XRP is not yet in a clear uptrend but argued that it is beginning to stand apart from the wider crypto market.

XRPETH Chart | CryptoInsightUK

At press time, XRP trades at $2.9, down 0.87% in the last 24 hours. According to data from Coinglass, global XRP futures open interest remains strong at more than $7 billion despite a 4.23% drop in the past 24 hours.

CME Group Crypto Futures Milestones

XRP Becomes Fastest to Hit $1B OI on CME

Interestingly, the XRP futures contracts hit this mark in just over three months after their launch on May 19, 2025, showing how quickly interest in XRP is building across both institutional and retail markets.

Also, CME reported that since the XRP futures launch, traders have moved 251,000 contracts with a combined notional volume of $9.02 billion. The contracts average $143 million in daily trading, with a one-day record of $235 million set in July.

CME Group Crypto Futures Milestones

XRP Becomes Fastest to Hit $1B OI on CME

Interestingly, the XRP futures contracts hit this mark in just over three months after their launch on May 19, 2025, showing how quickly interest in XRP is building across both institutional and retail markets.

Also, CME reported that since the XRP futures launch, traders have moved 251,000 contracts with a combined notional volume of $9.02 billion. The contracts average $143 million in daily trading, with a one-day record of $235 million set in July.