XRP Profit-Taking Volume Soars to $375M, Marking Highest Since December Rally Peak

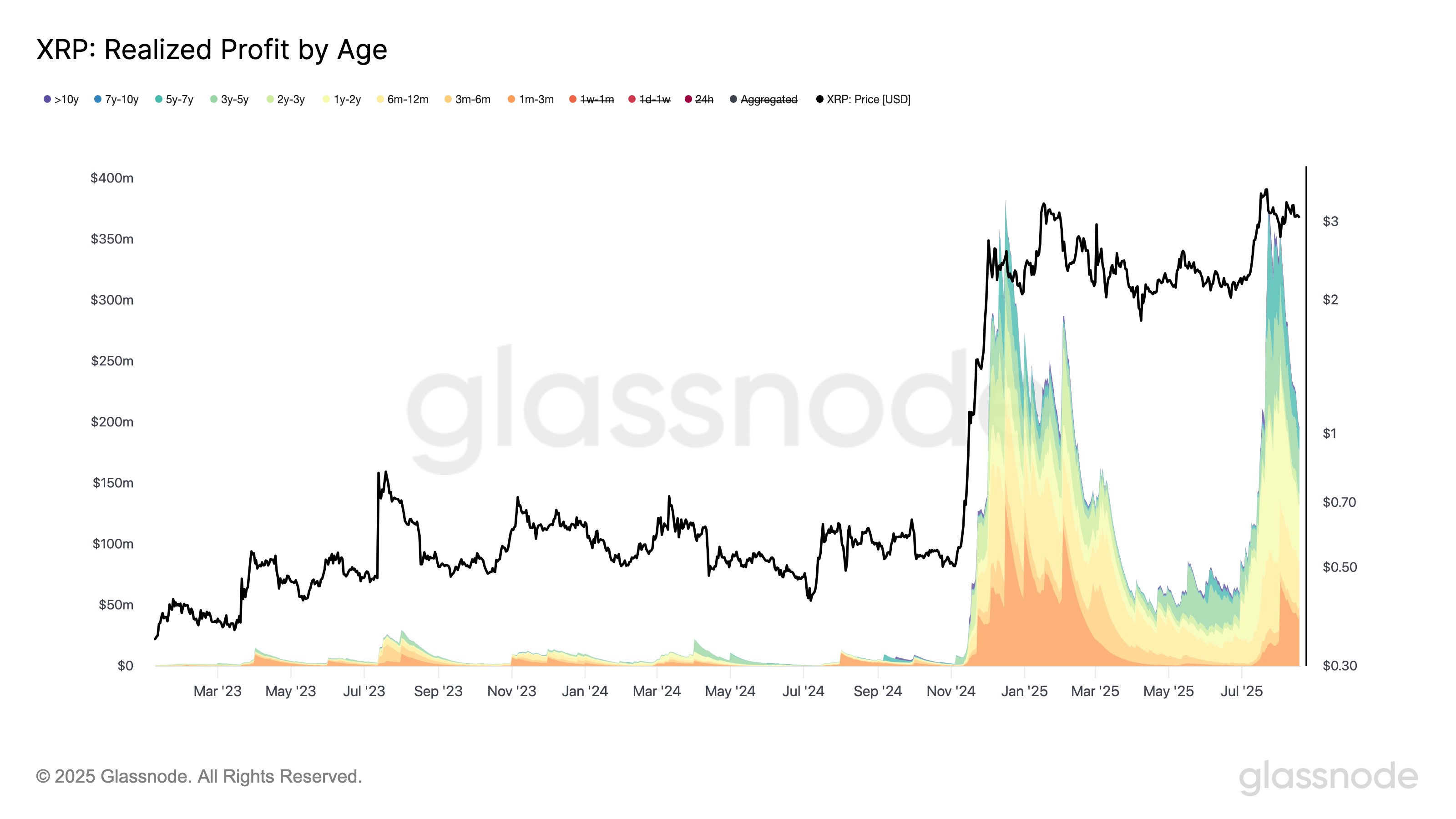

XRP investors just cashed out big—$375 million big—in the largest profit-taking spree since last December's explosive rally.

The Sell Signal That's Shaking Markets

That massive liquidation volume screams one thing: traders are locking in gains while the getting's good. The December 2024 rally clearly left enough meat on the bone for this feeding frenzy.

Timing the Top or Missing the Next Leg Up?

Profit-taking at these levels either signals smart money exiting near peaks or nervous hands underestimating XRP's next potential surge. Because nothing says 'crypto markets' like selling right before the next 50% pump—classic trader psychology meets FOMO economics.

When retail takes profits, whales are usually accumulating. Just another day in the casino—sorry, 'digital asset ecosystem.'

XRP Profit-Taking Volume | Glassnode

This large distribution event occurred amid the panic that ensued as a result of the broader market crash on July 23, which saw XRP collapse by a massive 10.34% in a single day. This marked its highest intraday drop in three months. Following this slump, investors panicked and began taking profit, leading to the $375 million XRP profit-taking volume the next day, on July 24.

According to Glassnode, this marked XRP's largest profit-taking volume this year, and mirrored the extent of the distribution observed by the market during the December 2024 rally. For context, XRP soared nearly 290% from November to December 2024, retesting the $3 mark and leading to a similar heightened profit-taking event.

Meanwhile, after the latest July 24 volume, XRP held strong for a few days before going into a death spiral that led to a 13.2% collapse by Aug. 2. XRP has since recovered from this drop, but Glassnode's recent analysis suggests the most recent crash below $3 could also be a direct product of such profit-taking trades.

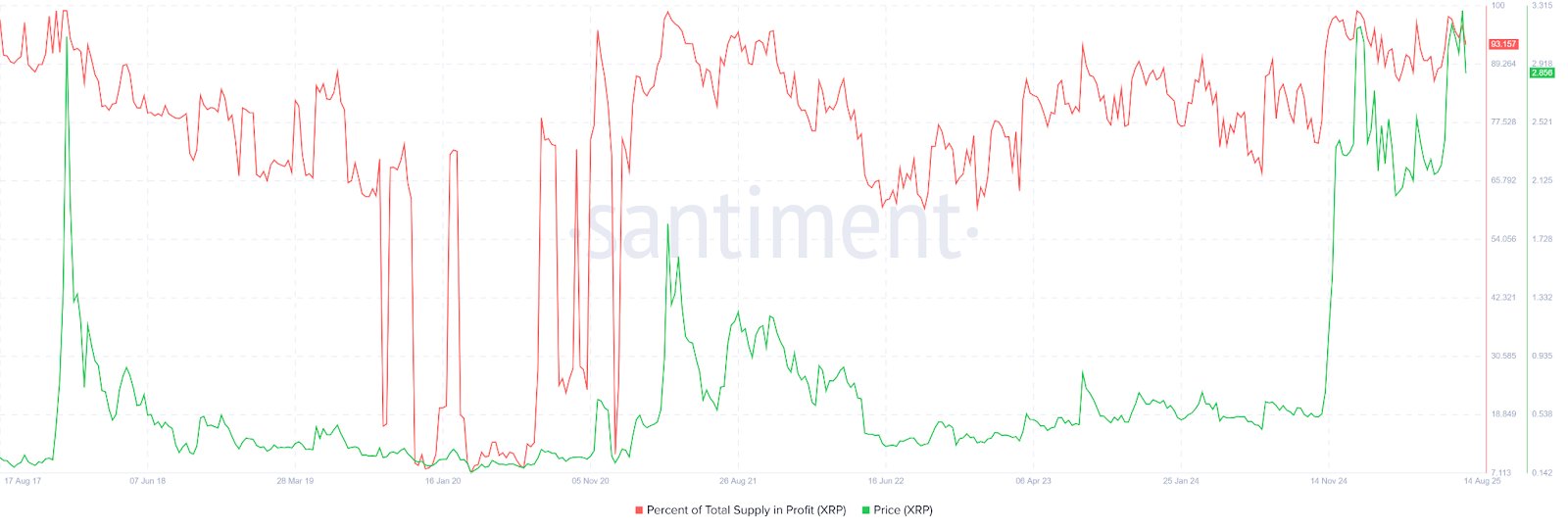

XRP Address Profitability Remains High

Interestingly, a previous report from The crypto Basic confirmed that Glassnode data also revealed a rise in XRP address profitability above 90%. Specifically, as XRP held above $3, addresses seeing gains on their holdings surged to 94%.

Citing this data, market commentator Winny suggested at the time that this could lead to heightened XRP profit-taking volume. This trend has since materialized, contributing to the recent crash below $3 for XRP. However, XRP has shown more resilience than in previous instances of profit-taking trades due to multiple bullish factors.

Meanwhile, despite the recent pullback, trader Xaif Crypto confirmed today that 93% of XRP addresses are still in profit, citing Santiment data. Notably, since July, address profitability has averaged 90%. While this is a positive sign, it also shows that there could still be increased XRP profit-taking volumes going forward.

XRP Profit-Taking Volume | Glassnode

This large distribution event occurred amid the panic that ensued as a result of the broader market crash on July 23, which saw XRP collapse by a massive 10.34% in a single day. This marked its highest intraday drop in three months. Following this slump, investors panicked and began taking profit, leading to the $375 million XRP profit-taking volume the next day, on July 24.

According to Glassnode, this marked XRP's largest profit-taking volume this year, and mirrored the extent of the distribution observed by the market during the December 2024 rally. For context, XRP soared nearly 290% from November to December 2024, retesting the $3 mark and leading to a similar heightened profit-taking event.

Meanwhile, after the latest July 24 volume, XRP held strong for a few days before going into a death spiral that led to a 13.2% collapse by Aug. 2. XRP has since recovered from this drop, but Glassnode's recent analysis suggests the most recent crash below $3 could also be a direct product of such profit-taking trades.

XRP Address Profitability Remains High

Interestingly, a previous report from The crypto Basic confirmed that Glassnode data also revealed a rise in XRP address profitability above 90%. Specifically, as XRP held above $3, addresses seeing gains on their holdings surged to 94%.

Citing this data, market commentator Winny suggested at the time that this could lead to heightened XRP profit-taking volume. This trend has since materialized, contributing to the recent crash below $3 for XRP. However, XRP has shown more resilience than in previous instances of profit-taking trades due to multiple bullish factors.

Meanwhile, despite the recent pullback, trader Xaif Crypto confirmed today that 93% of XRP addresses are still in profit, citing Santiment data. Notably, since July, address profitability has averaged 90%. While this is a positive sign, it also shows that there could still be increased XRP profit-taking volumes going forward.