31,968 BTC Suddenly on the Move: Dormant 3-5 Year-Old Bitcoin Wallets Wake Up – Here’s What History Says About Price Impact

Sleeping giants are stirring. Nearly 32,000 BTC—untouched for 3-5 years—just changed hands. When long-dormant coins shake off the dust, markets tend to notice.

The HODLer Exodus

These veterans bought near the 2020-2022 price floor. Their sudden activity suggests either strategic repositioning or profit-taking—either way, liquidity just got a jolt.

Historical Precedents

Past awakenings saw 15-30% volatility within 30 days. Sometimes it’s a local top signal; other times, fuel for the next leg up. (Cue the ‘this time it’s different’ chorus from permabulls and permabears.)

Timing the Tides

The moves coincide with August’s typical low-liquidity slumber—when even modest flows can warp prices. Perfect storm or nothingburger? Watch order books, not Twitter hot takes.

Bonus jab: If Wall Street treated supply shocks this way, the SEC would’ve banned gravity by now.

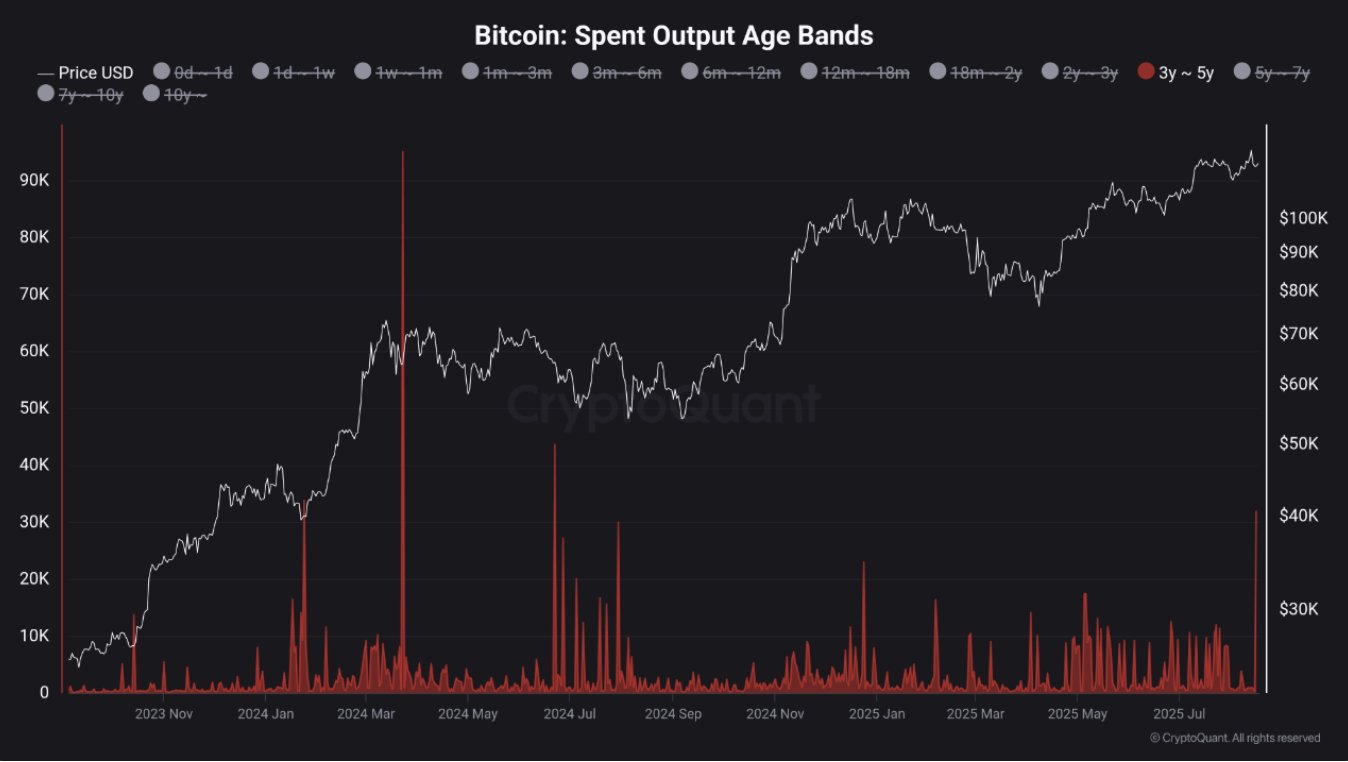

Bitcoin Spent Output Age Bands/CryptoQuant

Notably, such movement often suggests increasing selling pressure among HODLers. Maartunn also aligns with this sentiment, further highlighting that such shifts make a key turning point in the market trend.

Historical Moves and Impact on bitcoin Price

For context, the research shared that whales aged 3 to 5 years moved 33,803 BTC on 24 January 2024, marking Bitcoin’s bottom. BTC traded close to $40,000 at the time and has never retested the price level since then.

A similar move occurred on 23 March 2024, where this address bracket moved 95,090 BTC. This marked a local top for Bitcoin as it dropped from a new all-time high of $73,700 attained a few days earlier.

On 22 June 2024, 43,641 BTC moved from these long-term holders, which added further selling pressure to the market following a consolidatory run. A similar shift happened on 30 July 2024, with a 29,994 BTC move marking a local top.

Additionally, they transferred 23,012 BTC on 24 December 2024 after Bitcoin’s initial rally to six-figure values, which also marked a local top. As a result, he emphasized that the market would make a move after the August 16 development.

Market Takes a Downward Turn

Meanwhile, the market has taken a downward turn since the whale transactions, correcting 3% from a high of $118,624 to its current price of $115,053. This further adds to the distance between BTC and its new all-time high of $124,457.

Notably, Bitcoin has been on a downtrend since the high last week, currently trading 7.5% away from there. Today’s correction has spiked liquidation to $576 million in the past 24 hours, as market observers point to overleveraging.

Notwithstanding, some still insist the mid and long-term trajectory for Bitcoin remains positive. For instance, Canary Capital CEO Steven McClurg claimed that there is a 50% chance that Bitcoin will hit $150,000 this year.

Bitcoin Spent Output Age Bands/CryptoQuant

Notably, such movement often suggests increasing selling pressure among HODLers. Maartunn also aligns with this sentiment, further highlighting that such shifts make a key turning point in the market trend.

Historical Moves and Impact on bitcoin Price

For context, the research shared that whales aged 3 to 5 years moved 33,803 BTC on 24 January 2024, marking Bitcoin’s bottom. BTC traded close to $40,000 at the time and has never retested the price level since then.

A similar move occurred on 23 March 2024, where this address bracket moved 95,090 BTC. This marked a local top for Bitcoin as it dropped from a new all-time high of $73,700 attained a few days earlier.

On 22 June 2024, 43,641 BTC moved from these long-term holders, which added further selling pressure to the market following a consolidatory run. A similar shift happened on 30 July 2024, with a 29,994 BTC move marking a local top.

Additionally, they transferred 23,012 BTC on 24 December 2024 after Bitcoin’s initial rally to six-figure values, which also marked a local top. As a result, he emphasized that the market would make a move after the August 16 development.

Market Takes a Downward Turn

Meanwhile, the market has taken a downward turn since the whale transactions, correcting 3% from a high of $118,624 to its current price of $115,053. This further adds to the distance between BTC and its new all-time high of $124,457.

Notably, Bitcoin has been on a downtrend since the high last week, currently trading 7.5% away from there. Today’s correction has spiked liquidation to $576 million in the past 24 hours, as market observers point to overleveraging.

Notwithstanding, some still insist the mid and long-term trajectory for Bitcoin remains positive. For instance, Canary Capital CEO Steven McClurg claimed that there is a 50% chance that Bitcoin will hit $150,000 this year.