Canary Capital Shakes Up Crypto Markets with Trump Coin ETF Filing in Delaware

Wall Street meets meme politics as Canary Capital drops a regulatory bombshell—the first Trump-themed cryptocurrency ETF just hit Delaware's registration books.

Political tokens go mainstream

Love him or hate him, Trump's brand now gets institutional treatment. The filing signals hedge funds are dead serious about monetizing polarization—even if it means wrapping it in a blockchain bow.

Delaware's crypto gold rush

The First State cements its status as America's onshore tax haven for digital assets. Expect every meme coin with a Twitter following to queue up at Wilmington's courthouse by Monday.

Just when you thought 2025 couldn't get weirder, finance proves satire is dead. The ultimate hedge? Probably not. But for fund managers chasing retail dollars, it's the perfect cocktail of hype and regulatory arbitrage—shaken, not stirred.

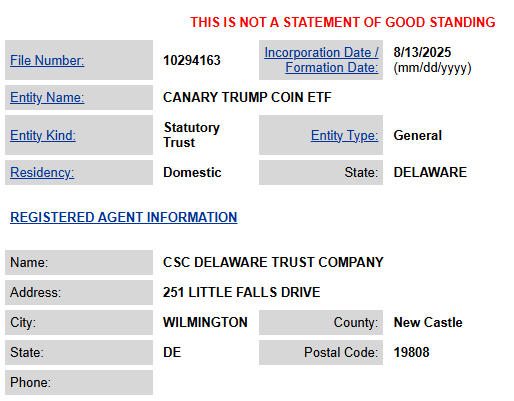

Canary Capital Trump Coin Registration in Delaware

He deduced this from the filing, highlighting that Canary registered the entity name as a statutory trust. Earlier filings, like the Tuttle 2x ETF for both the Trump and Melania coins, were under the Investment Company Act of 1940 (40 Act).

Meanwhile, if Canary Capital files for a Trump Coin ETF as the Delaware registration suggests, it would join the long altcoin ETF waitlist. It would also accompany a combined effort from the Osprey Funds and REX Shares to file the REX-Osprey Trump ETF as a fund offering spot exposure to the token. Notably, the latter submitted its application with the US SEC on January 21.

Bold Prospect Of a Memecoin ETF

Under the formal US SEC regime, the prospects of a memecoin ETF were seemingly impossible, considering the tightened regulatory landscape. However, with Trump’s election and a change in power in the Commission, altcoin ETFs, especially meme-based funds, have had a fighting chance.

Moreover, the US SEC does not see meme coins as securities, a sentiment that would further ease their approval. The agency’s Division of Corporate Finance made this disclosure in February, classifying them as collectibles.

Leading the line are the Dogecoin ETFs, which have seen prominent asset managers like Bitwise, Grayscale, and 21Shares file for. Bitwise recently amended its application to include in-kind creation and redemption, a feature now seen in the Bitcoin and Ethereum spot ETFs.

Meanwhile, there is also a BONK ETF filing, but none yet for shiba inu and Pepe. Nonetheless, the Shiba Inu ecosystem team remains optimistic that asset managers will look its way soon.

Canary Capital Trump Coin Registration in Delaware

He deduced this from the filing, highlighting that Canary registered the entity name as a statutory trust. Earlier filings, like the Tuttle 2x ETF for both the Trump and Melania coins, were under the Investment Company Act of 1940 (40 Act).

Meanwhile, if Canary Capital files for a Trump Coin ETF as the Delaware registration suggests, it would join the long altcoin ETF waitlist. It would also accompany a combined effort from the Osprey Funds and REX Shares to file the REX-Osprey Trump ETF as a fund offering spot exposure to the token. Notably, the latter submitted its application with the US SEC on January 21.

Bold Prospect Of a Memecoin ETF

Under the formal US SEC regime, the prospects of a memecoin ETF were seemingly impossible, considering the tightened regulatory landscape. However, with Trump’s election and a change in power in the Commission, altcoin ETFs, especially meme-based funds, have had a fighting chance.

Moreover, the US SEC does not see meme coins as securities, a sentiment that would further ease their approval. The agency’s Division of Corporate Finance made this disclosure in February, classifying them as collectibles.

Leading the line are the Dogecoin ETFs, which have seen prominent asset managers like Bitwise, Grayscale, and 21Shares file for. Bitwise recently amended its application to include in-kind creation and redemption, a feature now seen in the Bitcoin and Ethereum spot ETFs.

Meanwhile, there is also a BONK ETF filing, but none yet for shiba inu and Pepe. Nonetheless, the Shiba Inu ecosystem team remains optimistic that asset managers will look its way soon.